Each week longleaftrading.com will be providing us with a commodity chart of the week as analyzed by a member of their team. We hope that you enjoy and learn from this new feature.

The copper market is very sensitive to both Chinese growth statistics and US Housing numbers. Both groups have been trending in the right direction for months and that has given the copper trade a boost. Last week's US housing numbers missed, blunting a nice move off of support the prior week. It was reported last week that China's manufacturing activity in January grew at the fastest pace in two years, according to the preliminary HSBC China Manufacturing purchasing managers' index, which rose to 51.9 in January from 51.5 in December. This growth trend bodes well for China's 2013 economic outlook and it is in line with the comments from the IMF made the prior week, with respect to projected growth in China.

The fundamental forces at had set a nice backdrop for copper, but as we all know that does not amount to much if the market is not providing a way to enter a trade with a strong risk/reward profile. The technical developments in copper appear to be orderly and I will be looking to come into the copper this week based on the strong technical picture.

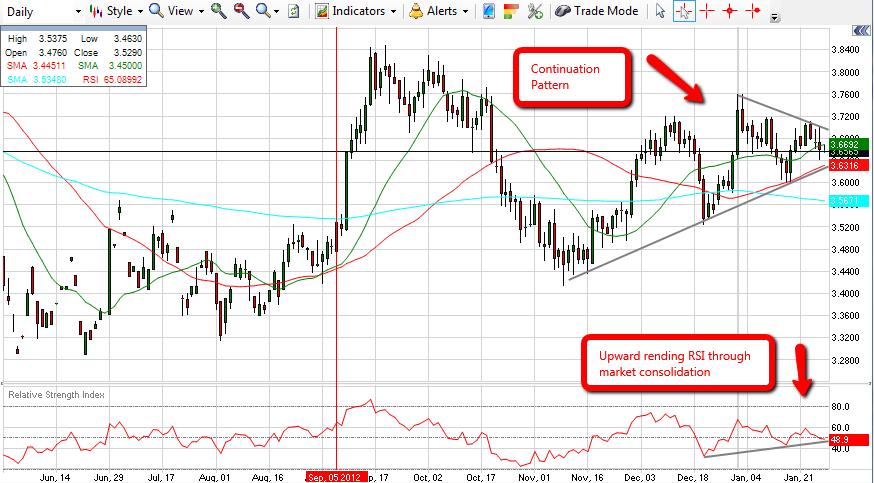

As you can see from the chart above, copper has been consolidating in an upward sloping pennant. The range that keeps the market bound right now is between 3.63-3.70. I would view a close over the 3.70 mark as bullish as would want to be involved at that point. The 50 day moving average has also been supportive to the market and as long as those levels hold, my bias remains to the upside.

Good luck this week traders! As always, feel free to call or email me directly with any questions or comments regarding this article and chart. I can be reached at (866) 325-9873 or by email at [email protected]. I will be happy to hear from you.

Thank you for your interest,

Timothy Evans

Chief Market Strategist

Phone: (866) 325-9873

www.longleaftrading.com

There is a substantial risk of loss in trading futures and options. Past performance is not indicative of future results. The information and data contained in this article was obtained from sources considered reliable. Their accuracy or completeness is not guaranteed.