Let's face it, without change, there can be no opportunity. As traders and investors, we need to see change in order to make money.

One potential opportunity in 2014 could be gold. In 2013, gold suffered what was perhaps its worst performance as an asset in decades, losing over 25% of its value for the year. This was the first time that gold had a year-to-year loss that I can remember. So in 2014, the question has to be, what's going on with gold and is it going to redeem itself?

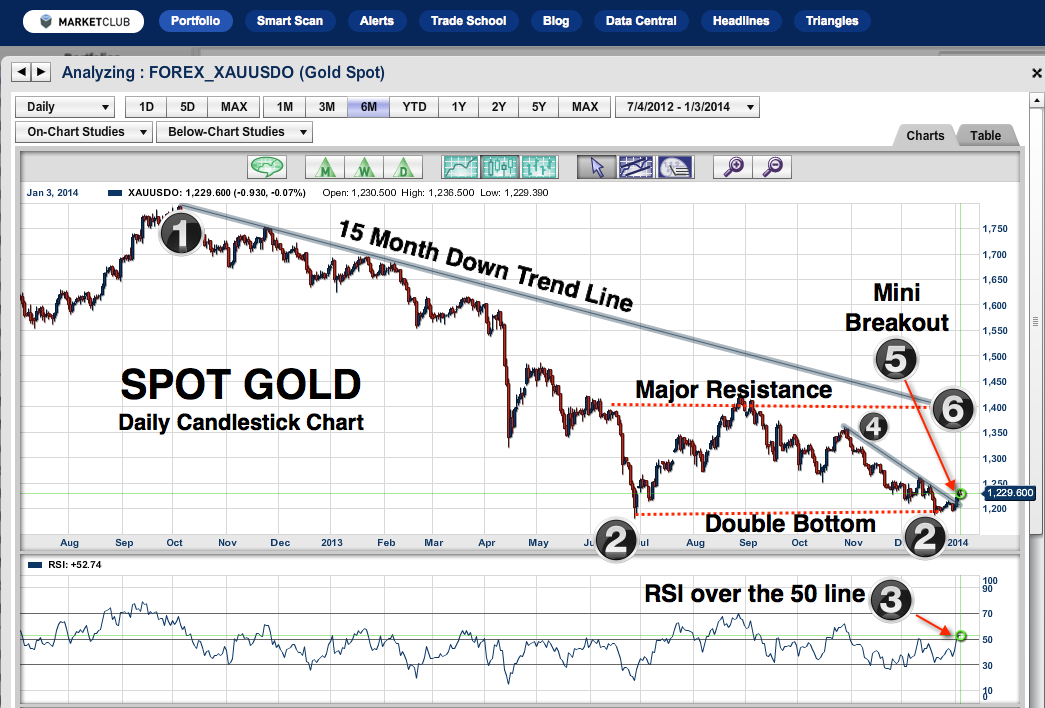

Looking at the chart which begins in July of 2012, you can see that gold hit its high and then basically for the next 15 months moved consecutively lower. This high is not the all-time high that was seen in August of 2011 at $1904, but the most significant high for our chart work.

The 15-month trend line (1) is the overriding technical aspect for this market in my opinion. The second most important element to this chart is the potential of a double bottom (2), which comes in around the $1,185 level.

1. 15-month downtrend line

2. Double bottom

3. RSI indicator above 50

4. 2-month downtrend line

5. Mini breakout

6. Major resistance at $1,400

On (3), the RSI line moved over 50, indicating that the trend could now be moving higher. Please be aware that this is different from the Trade Triangle technology, which remains neutral to negative.

On (4) I see a mini trend line which has been broken, indicating that a mini uptrend is in place at (5).

Number (6) indicates where major resistance is for gold at the $1,400 level. This area could also be a potential “pivot point” for a double bottom (2) that was formed in July and December 2013. Should that be the case, once the $1,400 level is broken on the upside, a strong argument can be made that gold could move up to the $1,600 level based on the pivot point swing. This level coincides nicely with a Fibonacci retracement of $1,568, not shown on this chart.

The Trade Triangle technology will also need to kick in and confirm that the trend is indeed on the upside. I want to watch very carefully in the days and weeks ahead to see if the weekly Trade Triangle kicks in. The weekly Trade Triangle is the one that's used for the trend in gold. I do not expect the monthly to kick in for some time, so the trend may be somewhat erratic until that happens.

The potential for gold to rebound is fairly strong with Janet Yellen as the new Fed chairman. Her job as the new Fed Chair is to get out of this crazy experiment that the Fed began four years ago with quantitative easing. The only way I can see this happening is basically the return of inflation which will be good for gold and perhaps, not so good for equities.

Conjuncture aside, I will of course always go with the tried and true, market-proven Trade Triangle technology.

Here's to a very successful 2014 for all of our members, traders and friends.

All the best,

Adam Hewison

President, INO.com

Co-Creator, MarketClub

Adam, I was hoping you would make some comment to re-consider the outlook for gold prices in 2014.

I think the fundamental, at least for this gold price decline, is the shift in financial interest in the markets from futures to derivatives during the last year that made all of the difference. Banks are trading derivatives options which close a week before precious metals options expiry. Much of the financial interest in gold has gone over to this type of trading.

That means they essentially can corner the financial interest in a market by being both long and short through a derivative contract based on the black-scholes option pricing model on which they all trade. Futures traders, by contrast, will be obviously biased short and long, depending on their view of price momentum in either direction, rather than leveraged risk.

I think we should be prepared for a risk reversal, since the short interest carries such weight and momentum, and a premium for being short in the derivatives market comes down. Futures traders not cognizant of derivative formulations will probably be overwhelmingly short at this point. I also happen to think it's quite the reverse for the main indexes.

I think also that the value is in the producing asset, which are the mines.

To explain this derivative, I would use a 'volatility smile' description, which is outlined in grey:

http://scharts.co/193dEYD (sorry to use stockcharts, man!)

My prediction is gold to $1280, then to $1000, another rally, then down to $700, +/- $100. The mines had better learn how to make money below $1000. Its gonna stay there for 10 years.

Andy

Andy,

Appreciate your ideas and thoughtful input on our blog page.

Many Thanks,

Adam

Adam Hewison

President, INO.com

Co-Founder of MarketClub.com

http://club.ino.com/members/blog/ab

I understand that Fort Knox has joined the fractional reserve banking system - it only contains a fraction of the reserves it's supposed to have.

No one except the keepers and some very well connected insiders, Dimon and Blankfein come to mind, knows exactly how much unencumbered gold truly remains at Fort Knox. The powers behind the FED refuse to allow any independent audit. Furthermore repeated requests from some vocal politicians have been rebuffed to keep this secret from the public ear. The theory is that the physical movements of bullion from West to East which allegedly exceed total yearly world production have been so large that they could only have come from the Central Banks. However many questions remain, particularly with the gold leasing programs through the bullion banks. The FED and the Treasury which claim to want to increase transparency of their actions and intentions are being surprisingly opaque on the subject of their gold reserves. The following link deals with the subject.

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/1/3_Forget_IMFs_Tax_On_Savings%2C_This_Will_Truly_Destroy_Savers.html

Manfred,

I like your thinking. Thanks for sharing with everyone.

Many Thanks,

Adam

Adam Hewison

President, INO.com

Co-Founder of MarketClub.com

http://club.ino.com/members/blog/ab

maxmike,

Thanks for contributing to the conversation, much appreciated.

Many Thanks,

Adam

Adam Hewison

President, INO.com

Co-Founder of MarketClub.com

http://club.ino.com/members/blog/ab

A fascinating discussion! Meanwhile, my question remains: what should I do with the physical gold I'm holding in Zurich?

Hans Cristian Andersens "the Emperors new clothes" tells us a valuable lesson. When the little boy turns up saying: He has no clothes on. Then the game is over!

Michael,

I have always like the Hans Cristian Andersens "the Emperors new clothes" story.

Appreciate your suggestions and thoughtful input on our blog page.

Many Thanks,

Adam

Adam Hewison

President, INO.com

Co-Founder of MarketClub.com

http://club.ino.com/members/blog/ab

The massive level of Global debt has reached the point of no return that IMHO can only end in default. Debt default can take different paths but the most likely scenarios are: (A) Non-payment which ultimately leads to deflation due to the resulting destruction of capital or (B) Repayment in devalued currency via massive currency printing which ultimately leads to inflation. All major Central Banks (US, ECB, China and Japan have clearly chosen alternative B. I don’t profess to have the answer but warn anyone who bets on deflation that they are fighting the collective FEDS of all major economies. Throwing a monkey wrench into the matter to make matters more interesting, we could also get some deflation first which would be so unpalatable to the central banks that their reaction to stop any deflationary trends would be to really open the printing presses into overdrive ultimately leading to hyper-inflation.

Three points to ponder.

1. None of the central banks are printing money. They are all issuing credit. Huge credit. But very little of that credit is making its way into the real economy, otherwise the real economies would be booming. Notice any booms lately?

2. EVERY hyper-inflation got started with excessive printing of paper currency. I challenge you to find one hyper-inflation that got going based on digital currency alone, or credit.

3. The price of gold. Went up for 10 years to an all-time high in late 2011. Then it started to fall, and as far as we know it has not reached bottom. What might the fall in the price of the ultimate currency hedge be telling us?

Andy

! Central Banks do not and are not issuing credit. They print money. They are buying paper issued by treasuries, banks and other issuers such as mortgage lenders with digital book entries created out of thin air. Welcome to the modern printing press.

2. Digital currency entries are a new phenomenon that did not exist previously and therefore could not have caused inflation. For practical purposes there is absolutely no difference between digital or pater currencies. What do you think is in your bank account???.

3. The current episode reminds me a lot of the early 1970’s when gold rose from $35 to $200, then dropped to $100 in the mid 70’s and then broke $800 at the end of the decade. History will not necessarily repeat, but it may well rhyme.

4. Long term the value or purchasing power of gold does not fluctuate very much with minor exceptions during periods of direct government intervention. Since the creation of the FED in 1913 the value or purchasing power of the US Dollar has dropped more than 95%. Eventually all paper currencies will drop to their intrinsic value which is zero.

I agree with you an all points. I will add the following:

The Federal Reserve is BOTH printing money and increasing credit, as evidenced by its own reports.

A copy of a small portion from the latest one follows from http://www.federalreserve.gov/releases/h6/Current/:

Federal Reserve Money Stock Measures - [Report] H.6

Release Date: January 2, 2014

$Billions

Date Seasonally adjusted Not seasonally adjusted

M1 M2 M1 M2

Dec. 2011 2,161.2 9,639.4 2,207.7 9,692.3

Nov. 2013 2,610.9 10,933.5 2,610.2 10,936.8

Percent change at seasonally adjusted annual rates M1 M2

3 Months from Aug. 2013 TO Nov. 2013 8.9 6.1

6 Months from May 2013 TO Nov. 2013 5.9 7 0

12 Months from Nov. 2012 TO Nov. 2013 8.4 6.1

And a few numbers from: http://usdebtclock.org/ @ 3:54 PM 1/4/2014

US TOTAL DEBT: 60.7297 TRILLION

US NATIONAL DEBT: 17.313 TRILLION

US FEDERAL SPENDING: 3.481 TRILLION

US GDP: 16.041 TRILLION

What usually happens when you owe plus spend a lot more than you earn?

Sooner or later, the two huge elephants in the room being ignored by The Fed and the paper lovers:

DEBT and CURRENCY DEBASEMENT, are going to stomp around and squash everything.

Looking at the numbers above and considering that they are increasing rapidly, it seems to me that the FUNADAMENTALS for gold are IMPROVING with time, NOT getting worse. So what is the problem with gold? It is MENTAL, NOT FUNDAMENTAL!

Carlos,

That’s great information,thanks for sharing this info with everyone.

Appreciate your suggestions and thoughtful input on our members only blog page.

Many Thanks,

Adam

Adam Hewison

President, INO.com

Co-Founder of MarketClub.com

http://club.ino.com/members/blog/ab

Prediction - gold to $1300 then down to $1100 by April 2014

I'm confused by this statement:

"Her job as the new Fed Chair is to get out of this crazy experiment that the Fed began four years ago with quantitative easing. The only way I can see this happening is basically the return of inflation which will be good for gold and perhaps, not so good for equities."

Especially the bit about inflation. Where is this inflation supposed to come from? For four years the FED has been trying to stimulate inflation with zero success. What makes you think Janet is going to be any more successful? And if she tries to get out of the crazy experiment that began four years ago all we will get out of it is deflation.

For four years all I've heard from the gold bugs is how QE is going to be inflationary, thus gold will go up. Did so in the first couple of years, until the market realized that whatever the FEd was doing, it wasn't stimulating inflation.

The FED has been fighting deflation for the last four or five years. Its a useless exercise as that is what the economy wants, with the record debt load at the end of a long growth cycle. The sooner deflation is allowed to happen the sooner we can restart economic growth.

That does not bode well for gold.

Andy

I am always confused when people state that deflation is inevitable. Public debt and spending are at all time highs, trillions per year. Tapering is a drop in the spending bucket... inflation is everywhere you look in terms of family groceries, utilities, insurance, energy costs, where is the deflation coming from?

Deflation shows up as the elimination of credit. Our whole economy is credit based, and for it to grow we have to borrow and spend. The FED knows this so they have been trying for years to expand the credit, hoping the banks will loan it out. No such thing has happened. When the process goes in reverse you will get deflation.

As Bernanke puts it: "Deflation is in almost all cases a side effect of a collapse of aggregate demand--a drop in spending so severe that producers must cut prices on an ongoing basis in order to find buyers."

So no deflation yet, but its waiting in the wings as over indebted consumers run into the increasing costs of debt service, higher insurance payments, declining support payments (unemployment compensation) and other factors to cause their aggregate spending to actually fall.

Throw in a possible decline in the markets and you have a recipe for deflation.

Andy

Great explanation! The prevailing "wisdom" is that the Fed is God. If we get to the point where the markets lose all faith in Fed monetary policy, God help us. Interesting to imagine that faith would be lost, borrowing would cease, but yet people would still trust the US Dollar. Definitely a good topic to ponder. Thanks.

If the purpose of printing money is to stimulate the economy, why doesn't the Fed make its lending lending money to the banks conditional upon them in turn lending it to consumers and the wider economy?

Rafi,

Could not have said it any better, thank you for sharing your ideas on this blog.

Many Thanks,

Adam

Adam Hewison

President, INO.com

Co-Founder of MarketClub.com

http://club.ino.com/members/blog/ab

The FED isn't trying to "loan" money to the banks so they loan it out to us. The FED thinks that if interest rates go low enough then everyone will rush out and borrow and spend, with wild abandon. All the FED controls is short term rates, almost nobody borrows at short term rates for long term consumption or production.

So the FED buys treasuries and other bonds to try and suppress long term rates, thinking as they go down, borrowing goes up.

That's not working very well. In fact, its not working at all. The money just remains on the balance sheet of the FED, the government gets funds to do what it wants to do, but the economy does nothing.

One could ask why we aren't rushing into the banks to borrow and spend? Well, sales suck, business people aren't stupid, they aren't going to expand production if sales suck. On the other side, income sucks, so consumers aren't going to borrow and spend when they are maxed out already.

The BIG elephant is DEBT. Everyone has too much, and the cost of servicing that debt inhibits growth, no matter how low the rates go.

In the meantime.....Boomers are retiring, spending even less as they near retirement and actually retire, and they also start spending down their savings, assuming they have any. Anyone over 50 pretty much has spent the maximum they are going to spend every year on raising the family, after 50 that spending begins to wind down, falling off a cliff when they quit working and retire.

There is NOTHING anyone can do about this. 80 million BB's are going to cut spending and sell assets to pay for retirement. Nothing the FED or anyone else can do to stop this tsunami from hitting our economy.

Andy

Andy,

We trade on the technicals and our Trade TRiangle technology. The charts never lie - they always point the trend in the end.

Appreciate your suggestions and thoughtful input on our blog page.

Many Thanks,

Adam

Adam Hewison

President, INO.com

Co-Founder of MarketClub.com

http://club.ino.com/members/blog/ab