The last month or so has been an interesting one for Bitcoin (BITCOIN:BITSTAMPUSD) believers. No doubt you have heard about the collapse of Mt.Gox, the largest Bitcoin exchange in the world and the missing millions.

If the collapse of the Mt.Gox exchange was not enough, Newsweek announced to the world that they have tracked down the mystery man who they claim invented Bitcoin. The gentleman’s name is Satoshi Nakamoto and it has long been assumed to be the pseudonym for the man (or woman) who created Bitcoin. Satoshi Nakamoto subsequently denied that he was the brains behind Bitcoin, so the mystery continues, or does it? You would think with a major Bitcoin exchange collapsing, all the controversy and lost funds, Bitcoin would have collapsed to zero, as everyone rushes to cash out their virtual currency.

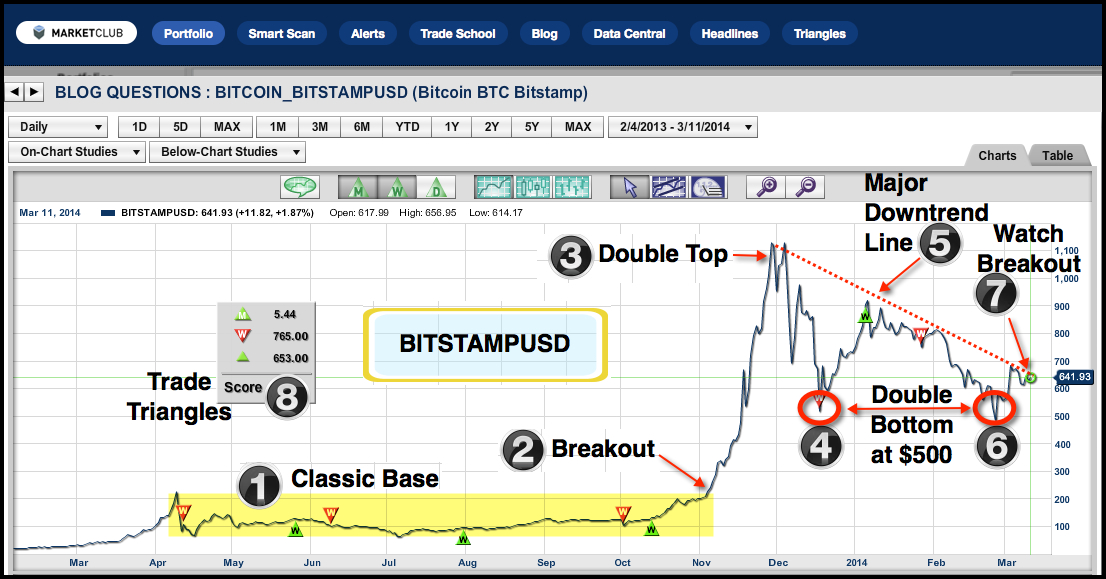

But oh no, the opposite appears to be happening when you view the recent Bitcoin (BITCOIN:BITSTAMPUSD) market action. One thing is for sure, the Bitcoin market is not going down anytime soon based on the technical charts that I look at.

This is a follow up post to my earlier Bitcoin post. Now you can see Bitcoin charts and quotes on MarketClub and on our public website, INO.com. The truth is, Bitcoin trades just like any other market, including gold.

Is Bitcoin the new gold standard?

Chart Legend & Technical Picture For BITSTAMPUSD (Black Numbers)

1. Classic base

2. Classic chart breakout

3. Double top

4. Double bottom

5. Downtrend line

6. Double bottom

7. Watch for breakout

8. Trade Triangles

Bitcoin (BITCOIN:BITSTAMPUSD) technically looks a lot like gold did after it made its double bottom last December. The key level to watch in this market is a break over (5) on the chart. Any move over $700 should be viewed as extremely bullish for Bitcoin, signalling a move to test the $1,000 area.

Every success with MarketClub,

Adam Hewison

President, INO.com

Co-Creator, MarketClub

I would like to present only two comments:

1- Money itself has its own "STANDARD" so no meaning to measure or compare it with anything else.

2- Story of bitcoin suggest or indicates future requirement or desirableness to get some Bitcoin alike any other instruments alternate or supplementary to our present monitory system, because people are slowly loosing faith on the "Money"

It is a good point to state that money has "its own monetary standard" but this claim misses the point that today's government-issued **currency** is, indeed, **not money** for not being a real **store of value**; having lost 97% in just over 50 years would be a lousy record for "money", so it's rather like MTA subway tokens or dry-cleaners' receipts. Bitcoin (as an asset class of its own) could, therefore, very well be a "gold standard" just like any other asset (let's say crude oil or tulip bulbs or Chilean UF (unidad fomento, a fiscal unit of account) just as Adam Hewison wrote.

The desirability of obtaining Bitcoin (or any other similar Crypto coins alike) will, in the long run, depend on how much of a real economy there is behind "coins" in circulation. Silk Road was an ill-conceived attempt to create such an economy, better ones are appearing one after another. This goes for both bitcoins themselves as well as any other Crypto coins like peercoins, mintcoins, mazacoins or any other of these competing currencies (a concept present in Austrian Economics); and potcoins might be another way of "investing in the Cannabis boom" on the cheap as there, clearly, **is** an emerging billion dollar economy behind that specific coin already. Depending on developments in Iceland, this could also be true for auroracoins presumably going to be backed by a good part of the local economy there. All these facts are a lot better than one shoddy Silk Road outfit "supporting" the 2011-2 value of the original bitcoins. This will be an essential ingredient to watch for fundamental Bitcoin analysis and in order to get an idea of upcoming price developments in the wider Bitcoin arena.

Adam Hewison's post and addition data for dollars vs bitcoins is highly appreciated for it will make price movements more visible (and life for myself more convenient as I do use INO every day and also happen to watch Bitcoin)!

@Marquix,

Your statements lead me to consider additional implications of the advent of xxx-coins of all types and intents, (there's a strange thought eh - porncoins). But anyway, the idea I began to consider is regarding the velocity of money and its impact on the inflation rate and general monetary policies of nations.

If more and more commerce begins to take place through crypto/digital-currencies this must naturally displace the use and processing of commerce through nation state currencies. This lowering of the velocity of money generally has a deflationary impact. The last 5 years of 0% interest rates and $4B worth of quantitative easing 'should' have driven inflation through the roof. Yet it did not. Why? Well one theory could be that due to the FED member banks throttling of credit the injection of the QE dollars never made it into the M1 and M2 money supplies. Without an increase in these supplies and therefore monetary velocity - inflation was suppressed and here we are.

Regardless of whether the above theory is at all accurate, the general consensus is that the velocity of money DOES impact the onset or delay of inflation. By executing consumer (or institutional even) financial transactions using alternative currencies, more and more, will this lead to deflation in prime currencies like the U.S. Dollar? Taken to an extreme, if we suddenly all started using OurCoins instead of dollars what would happen to the economy? An open question...

...and a very interesting one, indeed.

Seing the explanation for that surprising lack of inflation (yet) very similar, a supposed increase in Crypto transaction might, in effect, "help" overall evading any inflation after all -- and despite everyone's expectations (and preparations), including mine, about what happens "when everybody starts wanting a hammer again and buying one" bringing about that inflation hidden in the corners -- focal points rather, as it's the too-big-to-fails -- of the monetary system as we know it. Despite my interest in Crypto coins, which I see as supplementing precious metals, this wouldn't be the outcome I had expected. It might still result from a **sudden and large** shift toward Crypto currency use.

Lacking sufficient incentives for wide-spread Crypto coin adoption of any significance, we may never get the answer in real life. Barring the unforeseen, I don't see it going to reach that "extreme". I'd rather expect any move to Crypto coin mass-adaption to be a gradual and slow one (unless fiat should entirely collapse, and fast, let's say triggered by a bond crisis). Then, virtual currency use might increase as sharply as to bring about the effects you mentioned, too late for fiat currencies to "profit" from it though.

Applied to BTC-USD, your theory might also explain the current lackluster bitcoin price and be of merit in so far: until real economies build behind coins, the lack of velocity of money in the Bitcoin space keeps (all) Crypto coins confined to niche markets and, hence, subdued in price.

"...triggered by a bond crisis"

Like perhaps Putin selling all of Russia's bond debt back into the market which triggers other holders to join him?

Putin want's high oil/gas prices. The U.S. wants to beat Putin back with sanctions or by perhaps releasing oil from the national reserves squeezing Russia's main source of income - oil/gas. The U.S. does that and then Putin strikes back with the dumping of their debt. Pow, down goes the dollar, up screams the price of oil. Maybe BTC screams up too...???

[Correction to my post. I just can't seem to get over writing the "Trillion" word or letter "T".]

"The last 5 years of 0% interest rates and $4 Trillion worth of quantitative easing 'should' have driven inflation through the roof. "

Thank you Adam, this is such an interesting issue that opens up so many more questions, as clearly pointed out by 'King tut' and Kevin.

Human beings cannot survive without air, water, food shelter or community. These physical things have intrinsic value, all other forms of value derive from those. Thus, despite what Aristotle said, gold is not intrinsically valuable, it only represents value by mutual agreement.

However, gold has been used as money and a store of value through the millennia because of its physical properties.

It is an element and therefore immutable. As a metal it easily divided into small amounts, or melted and molded into larger ones. It is immune to oxidation and corrosion, making it incredibly durable. It is scarce, with the effort of mining it costing almost as much as existing stocks. Its uses such as jewelry, dental implants and electrical connections allow reclaiming, which keeps the total stock of gold nearly constant over centuries. These properties among others guarantee its eternal status as a store of value.

Bitcoin is a feeble substitute for gold. Bitcoin has NO physical properties, it is purely symbolic. Even paper money allows for anonymous transactions, but bitcoin's block chains assure trasnactions will never be truly anonymous or private. Worse, Bitcoin needs to be online to allow transactions. But if it's available for transactions, it will be available for hacking and theft. Notice that people keep their gold (and paper money) in vaults. Keeping Bitcoins online is like keeping your gold in your mailbox, not exactly secure.

Finally, Bitcoin can be duplicated as many times as people would like. Crypto-algorithms are well known, and anyone with a little education can create a new digital currency, as we are seeing. New currencies might be created in good faith, or as an attack on other currencies. Once you have thousands of different digital currencies, only the government can police them by selecting one (or creating it in the first place) and making it the only legal tender. At that point Bitcoin would be only one of many private currencies, like, say, Airline Miles.

If technicals are visual representations of market psychology, are they not also occasionally representations of market psychosis, a la 1999-2000? I submit that that's the case with both Bitcoin and perhaps even the broad market right now. Just as market speculators during the dotcom era were throwing money at chimera companies, something similar is occurring right now, represented by this chimerical payment system called Bitcoin, a chimerical market soaring on QE-generated thermals, and wild, parabolic moves in speculative darlings like TSLA, DDD, and PLUG. We're even seeing an explosion in IPOs currently, reminiscent of the one that marked the end of the dotcom era. There are simply too many questionable aspects to this market right now which incline me to believe that the market is in the process of losing its collective mind once again. Yes, some of the charts are pretty. No question. But, so were the charts of At Home and CMGI right before the market broke down and got carted off to the loony bin for the better part of a decade.

@Kevin, excellent points.

An interesting read linked to from zerohedge:

http://www.oftwominds.com/blogmar14/Fed-failsA3-14.html

and this chart:

http://www.oftwominds.com/photos2014/Fed-SPX2.png

Amazing chart that. I wonder if BTC benefited from any of this FED nonsense?

Good point Adam. Call that chart Gold, change the prices and you'd convince many, including myself, that it is a chart of gold. Not only that, both BTC and GC appear to be in the same place, a critical juncture; albeit for different reasons. Gold still needs a sign from the dollar that it should move higher. BTC, well, I suppose it just needs a period of quiescence, or one with few or no fiascos.

On gold, I'd like to see gold plotted in other currencies. What does it look like in EUR or renminbi, pounds, or rupees. How are other cultures interpreting the price of gold in their native currencies>