Today I would like to share with you some observations I have made in the Gold (FOREX:XAUUSDO) market. This market is looking more and more interesting right now. In this short 4 minute video, I point out some key technical characteristics that I believe will be driving gold in the future. I also give you a very important level in gold that, in my opinion, will skyrocket gold to new highs.

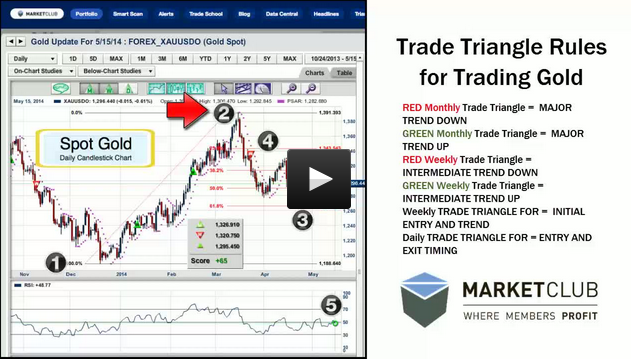

If you have a few minutes, you may enjoy learning how you can trade gold using MarketClub's Trade Triangles. In the past, the success rate of the Trade Triangles in the second quarter of the year was about 80%. With that in mind, I am watching Gold (FOREX:XAUUSDO) very closely.

Every success with MarketClub,

Adam Hewison

President, INO.com

Co-Creator, MarketClub

Since 2012, when Gold was quoted around $1850+++, i am providing constant warning about the strong probabilities about Gold bear face, but very very few readers ready to accept this hard and bitter fact.

Actually, if you are ready to accept situation with bias free mind, even basic rule of Technical Analysis very clearly point-out signs of Bull face end scenario, and till the time, next target for Gold for $ 800 or even lower marks remains pending.

Considering the fact that the cost of exploaration in meny places is about $ 900 or even 1000 $ per OZ I dont think that gold will beat low that $800. In my opinion current situation is very attractive for potential buyers. The other question is how much gold is really in the world? No one can count it. Look at the amount of gold that had been bought by India and China? If really gold is no longer profitable investment why China do not want to publish official data about gold import?

Regards,

Michal, Trader

Thanks for feed-back.

I observe two future possibilities like:

1- Cost may come down due to global down trend across the sector, and accordingly, Gold move within its normal cost plus range, or against heavy supply of Gold in the market, same due to global situation, new exploration or refining work will may be stoped because of " High or Reverse Costing Factor"

2-As per second probability, gold will be traded in a very thin normal range just around ts cost of about $ 600 to $ 800 for a long long period, without any remarkable change in prise range which will be allmost flat, but in that situation, if Gold investment will evaluate on cumulative interest plus based calculation, it will be found in a in a negative return constantly, for many years.

Considering both above probabilities, looking quite appropriate at present, one should keep away for any long term base investments in a Gold, and finally, we never got exact, applicable, logical or admissible reasons, either for Bull run or for Bear Run, and markets are never bothers or take care of allied so called reasons.

With regards,

Rasesh Shukla

India.

Do you have references to the heavy supply of gold. From what I can tell the supply is dwindling (for instance, the Swiss melting bullion down to create smaller denominations for the Chinese market.)

References for this "cumulative interest plus based" calculation?

The two monetary factors that should have pushed gold higher, global lower interest rates and QE, have not had that affect. The expected inflation has not been forthcoming. Without inflation gold should remain lower. But, inflation should be returning -- this would prop up the price of gold. On interest rates, the one economy that may begin raising them is the BOE. A higher pound, it has already climbed considerably this year, would have a downward pressure on the US dollar and therefore an upward pressure on gold. With what looks to be a solid base in gold's chart, and the other factors mentioned gold looks to see its next high @ 1400 in the coming months.

The chart certainly shows a dense compression point - something is about to happen...

Your sources don't sound objective.

My sources? I was asking for "Rasesh Shukla"'s sources.

Here's some of mine:

Swiss sending gold to China

http://www.bloomberg.com/news/2014-02-20/switzerland-sent-80-of-bullion-exports-to-asia-in-january-1-.html

Chart structure:

https://dl.dropboxusercontent.com/u/217878013/Finance/Gold-2014-COT-divergence.png

Dear Friends,

i think, " Time is the Best Judge", so No meaning for any further discussion, however, let me remember whenever Gold touch its significant lower marks, all arguments will be proved its original worth or applicability by it self automatically.

I am with you on the possibility of Gold starting a new run. Gold is an asset class and all asset classes are running.

I would suggest that you be careful using the term "inflation", though. There are three possible results to monetary expansion: 1) consumer price inflation, 2) economic growth (eg. twice as many dollars are buying twice as much stuff), and 3) asset price inflation. For 3) I define that as meaning not just that asset prices are going up, but that the ratio of prices to earnings on the underlying asset are going up.

You never get both 1) and 3) at the same time on a large scale, and in fact if you get either 1) or 3) in two great a quantity, then it will reduce 2) as well as parts of the economy are trying to run without lubrication. Saying that you expect "inflation" to occur because rich people have a lot of money is like saying you expect meat prices to go up when you raise general taxes and use the proceeds to give a bonus check to vegetarians.

We've had some discussion on QE, inflation, interest rates and velocity here:

https://www.google.com/search?q=site%3Awww.ino.com%2Fblog%2F+anonymole+velocity

I see that your #1 is probably classical inflation. That #2 is an increase in velocity. But #3 looks like asset bubbles which I'm not sure is handled by the MV=PY equation. Bubbles seem to be outside of the normal economic realm of discussion, warranting their own considerable discourse.

When I say "inflation" I believe I mean the classic general price inflation.

Jeff is right with his attitudes. Right now gold is the best headge against inflation and possibilitty of another QE. It is also connected with investment in real estate. (Gold bars are buyed for the money from rent.

Regards,

Michal

As you were asking for my sources, What happened now? don't ask for, or never relay upon sources. You may check my older posts since September 2012 onwards, just from this INO plateform, or even my very recent post of May 28th, blog Captioned as "Chart of The Week - Gold"

Tahnks for reply Resesh.

What may be even more compelling is the silver story.

https://dl.dropboxusercontent.com/u/217878013/Finance/COTSilver-5-16-2014.png

COT report showing higher lows, and that multi-year pennant, you have to admit that a breakout is due SI soon. Up? Down? who knows, but my bets are on a breakout up.

You said this last summer. You fail to admit that this is entering the 4th year of a bear market. Only those who got it right and avoided savaging losses get to predict "the next big move." Yours is exactly the sentiment prolonging more of the same. In other words just.....knock it off. Thanks.

trading is all about taking set ups and going with them when it shows profit and stepping aside and minimizing losses when the set up fails. He has not given a buy call and is saying if this happens the odds favour this outcome. BTW if you look at Adam's track record on gold I think you will be impressed. He was short during the down turn so kindly check you facts before posting in the future.

Where can one find his documented track record, thanks!

http://broadcast.ino.com/education/worldcupportfolio2/?wcpvideo

That's not a documented track record that was a disclaimer.

That is not a documented annual gain/loss track record, that is a link to a disclaimer. Why did you post that.