Continuing my little mini-series on energy investments that are actually performing (see also my recent refiners and solar articles), today I’ll turn my attention to pipelines.

Many pipeline companies, of course, remain very profitable despite the crash in oil prices, since the vast majority of pipeline companies’ revenue typically comes from fees paid by its oil-producer customers based on the quantity, or volume, of oil and petroleum products transported. Thus, energy pipeline companies (commonly structured as Master Limited Partnerships, or MLPs) are normally not terribly sensitive to oil price changes. Further, MLP stocks historically exhibit little correlation to oil prices, over the long term.

A company with rising dividends, solid management, AND a great technical setup

Take a look at Magellan Midstream Partners (NYSE: MMP; chart courtesy of MarketClub).

The stock has been consolidating below $85 or so since June 2014, and now trades just above its 30-, 60-, and 200-day moving averages. You can see the very visible bottoming process that started around January 14th, 2015 – complete with 3 higher highs and 2 higher lows so far.

MMP owns America’s longest refined products pipeline, with about 9,600 miles focused primarily on gasoline and diesel. MMP’s assets can tap into nearly 50% of the country’s refining capacity and store more than 90 million barrels of petroleum products.

MMP also owns crude oil pipelines, on a lesser scale, and has plans to expand its crude capacity in the future. In fact, on Friday, MMP announced the formation of Saddlehorn Pipeline Company, a 50/50 joint venture with Plains All-American Pipeline LP (NYSE: PAA). Saddlehorn will transport up to 400,000 bpd of various grades of crude, from eastern Colorado’s Niobrara play to Magellan’s storage facilities in Cushing, Oklahoma. MMP estimates service delivery beginning in the 2nd quarter of 2016, pending regulatory approval and building permits. An MMP presentation from December 2014 indicated Saddlehorn already had binding commitments from Anadarko Petroleum (NYSE: APC) and Noble Energy (NYSE: NBL) to use the pipeline. Finally, my somewhat-educated assumption is that “Saddlehorn” doesn’t carry anything close to the political baggage that “saddles” Keystone XL.

For those who see MMP through the lens of a long-term investor, the stock sports a 3.1% distribution yield, plus a phenomenal track record of increasing its distribution every quarter since the LP’s inception (54 consecutive quarters, based on data from MMP’s website). Increases are projected to continue at a double-digit rate for at least 2015 and 2016, and earnings are projected to continue easily covering the distribution.

Keep in mind, LPs like MMP have unique tax treatment. MMP’s website does a nice job presenting this tax info in an understandable way. Be sure to check out that tax info even if you are considering MMP as an investment within an IRA, as much of MMP’s distribution is typically considered “unrelated business taxable income,” or UBTI, by the IRS. UBTI is taxable to IRAs to the extent it exceeds a $1,000 annual threshold.

Other energy MLP investments

Of course, many other MLPs exist, including some very high-quality ones. I discussed several of them (not including MMP) in my December 16, 2014 post, and I’ll surely write about MLPs in the future.

Another approach to investing in MLPs is to use a fund. Several alternatives exist for those interested in owning exposure via a single, diversified MLP investment.

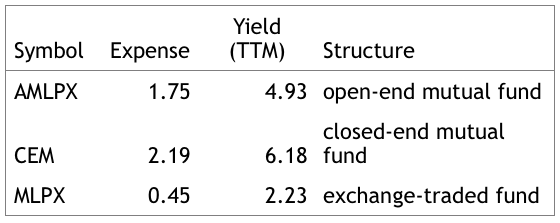

I did a quick scan in Morningstar, looking for competitive performance, and found these 3 funds to consider:

As for taxes, using a fund to invest in MLPs may simplify the tax implications by providing (in some cases?) a single 1099 instead of (potentially) multiple K-1s if you’re using more than one MLP. Additionally, funds may or may not pass along any UBTI, which could be important for IRA investors to understand. Obviously, I’m not a tax expert, but I do know you should consult a qualified tax advisor for more insight about your personal situation.

MainGate MLP Fund’s manager commentary

The managers of MainGate MLP Fund (AMLPX, the open-end fund referenced in the table above) write a quarterly fund commentary. In MainGate’s 4th quarter 2014 newsletter, the fund’s managers express the following, referring to petroleum:

“There is little doubt in our viewpoint that the U.S. is well positioned to substantially grow production and gain market share at the expense of other higher cost producers, and for many years into the future….

“We are optimistic that oil production in the U.S. will continue to rise significantly in future years, after what might be a six or year slowing or pause in production growth beginning about mid-2015 due to the combined effects of weaker oil prices and an expected significant decline in active rigs drilling.”

To back up their view, MainGate’s managers cite research about low U.S. break-evens from both IHS Energy and the IEA. The managers strongly believe U.S. companies will ultimately continue growing production, even if slightly less profitable in doing so.

One additional point from MainGate’s 4Q newsletter is this:

“Production growth of oil, natural gas, and natural gas liquids (NGLs) will likely continue in the U.S. to meet soaring demand for natural gas in electric generation and NGLs by the chemical industry, among many other important and growing users.”

They go on to explain that the chemical industry is “now in the process of investing $135 billion in 211 projects, all directly related to sourcing natural gas and NGLs from the U.S. shale basins.”

Best,

Adam Feik

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.