I wrote last week about the best oil ETFs. In the process, I discovered an interesting feature of the PowerShares DB Oil ETF (DBO), of which I had not previously been aware.

Specifically, as I described, other oil ETFs have a practice of automatically rolling into the next month’s oil futures contract when the current month contract expires – even if doing so will cause some price decay, as in “contango,” when the next month’s contract is higher priced than the current months (which commonly happens due to storage costs incurred by the party holding the physical commodity, etc). DBO, on the other hand, designed their ETF to NOT automatically roll into the next month’s futures contract, specifically to address that problem of decay, or “negative roll yield.” Instead, PowerShares uses what it calls an “Optimum Yield” formula to automatically roll into the most attractive near-month futures contract (of the next 13 months). In so doing, DBO thereby claims to optimize the fund’s “roll yield” (whether markets are in a state of contango or the opposite condition, known as backwardation).

As I showed last week, the performance of PowerShares DB Oil ETF (DBO) vs. two other commonly used oil ETFs (USO and OIL) does indeed show quite consistent outperformance by DBO in almost every single calendar year. Again, you can see last week’s post here if you’re interested in seeing the comparison.

In response to last week’s post, one reader asked whether any other “Optimum Yield”-type funds exist in other sectors. In fact, several broader commodities funds use some strategy to address the “negative roll yield” problem. I’m somewhat baffled as to why OIL and USO seemingly make no attempt to address the issue.

Broad energy futures funds

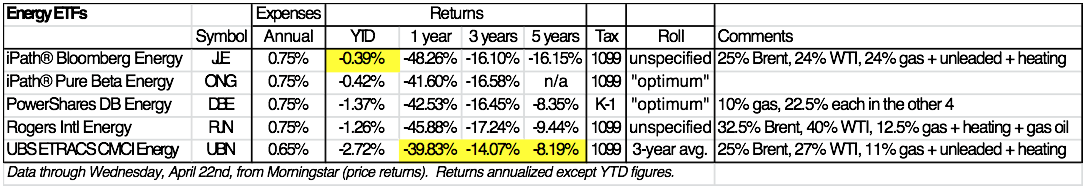

Here’s a chart comparing 5 energy funds. Again, last week’s post focused on funds focused specifically on oil. These 5 funds also branch into natural gas, gasoline, heating oil, gas oil, etc.

Be advised, all 5 of these “broad” energy funds are extremely small in terms of assets invested. PowerShares (DBE) is by far the largest of the 5, weighing in at about $146 million… still very small compared to the commodities funds discussed below. All 3 of the oil ETFs discussed last week (USO, OIL, and DBO) are well over $500 million in assets.

I’ve highlighted the best performing fund for each time period. As you can readily see, UBN has the best 1-, 3-, and 5-year returns. UBN’s strategy for addressing the negative roll risk associated with contango is to allow itself the latitude to use futures contracts ranging from 3 months to 3 years.

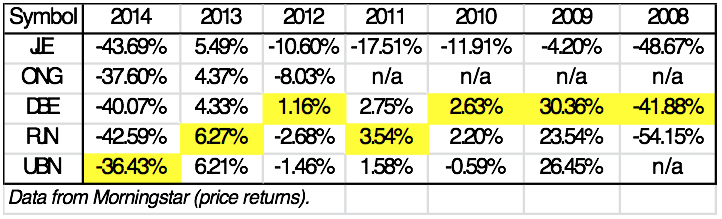

Now look at the calendar-year returns for these 5 funds.

As with our analysis of PowerShares Oil ETF (DBO) last week, PowerShares Energy ETF (DBE) comes through as the most consistent outperformer in the group. UBN is not far behind.

As for the others, Barclays’ iPath Pure Beta Energy Fund (ONG) uses a proprietary strategy for mitigating negative roll yield, similar to PowerShares (DBE). JJE and RJN apparently make no attempt to address negative roll yield, as far as I could tell.

For a discussion of tax implications, please see my article from last week.

Broad commodities futures funds

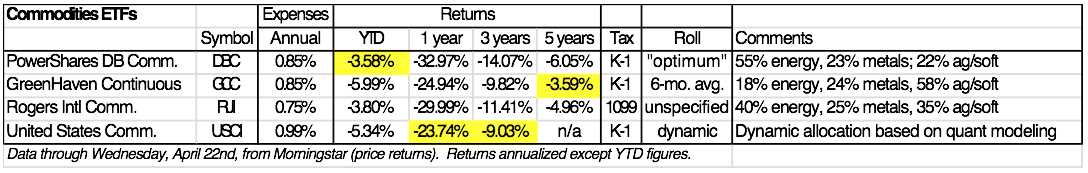

I also looked at broad commodities funds. Among funds with at least $150 million in assets, and with at least a 4-year track record, 4 funds stand out (in terms of having relatively good historical performance). Here’s their past performance:

DBC has by far the largest ongoing exposure to energy commodities among these 4 funds. If this fund interests you, I’d point out that PowerShares launched a “new & improved” fund (my term) in November 2014, called the PowerShares DB Optimum Yield ETF (PDBC). PDBC sports a 0.59% expense ratio, and is structured as an ETF instead of as a commodity pool or ETN like its competitors. PDBC issues a 1099 instead of a K-1. Finally, PDBC is an actively managed ETF with the same benchmark as DBC. I find PDBC very interesting, and I’ll even go so far as to say, if choosing between the two, I’d choose the newer PDBC for its structure, which is an improvement. ETNs are really unsecured debt obligations of the issuer. ETFs like PDBC are 1940 Act funds, similar to mutual funds.

USCI also looks very interesting. USCI seeks to track the performance of the SummerHaven Dynamic Commodity Index Total Return, which is reconstructed monthly to invest in 14 commodities out of a list of 27, based on price market signals, including backwardation and 12-month price change. The fund/index appears to have the latitude to invest in futures contracts at least 9 months out (based on my observation of current holdings).

RJI apparently makes no effort, as far as I could tell, to address negative roll yield, other than to disclose the existence of the issue in their prospectus.

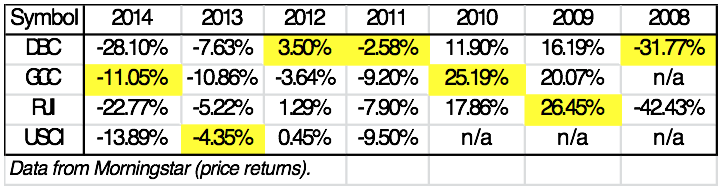

Here’s the calendar-year returns for these 4 funds. Once again, PowerShares takes the prize for consistency.

Conclusion

All I’ve done is to review past performance and learn a little about what each fund’s sponsor describes as their strategy. After this cursory analysis, it appears funds with a strategy to mitigate negative roll yield may in fact be better positioned to deliver consistent outperformance versus funds that make no attempt to solve this technical issue involved in futures trading.

Best,

Adam Feik

INO.com Contributor - Energies

Disclosure: At the time of post publication, this contributor owned Enterprise Product Partners (EDP), but did not own any other stock mentioned. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Hi,

Each time you come to analyze energy funds, UCO is left aside. Which surprises me, because I think it is by far the most appealing one. I am curious to learn what are your reasons.

Thanks.

cdl