Introduction

The biotechnology sector has witnessed unprecedented growth that has left all major indices far behind in both annual and cumulative performance over the past decade and more notably 5 years. Using the iShares NASDAQ Biotechnology Index (IBB) and SPDR S&P Biotech (XBI) as proxies, these ETFs have posted annual returns of greater than 30% over the past 5 years while more than quadrupling returns on a cumulative basis over the past decade. It is noteworthy to point out that both IBB and XBI have risen to all-time highs recently while IBB broke the $400 per share barrier as well.

A novel way to play the biotechnology cohort has entered into the ETF universe via BioShares™ Biotechnology Products (BBP) ETF. BBP offers a pure biotech play with no holdings in the generic, specialty pharma, life science tools, medical device, diagnostic or other healthcare companies. Thus this ETF focuses solely on the biotechnology cohort with at least one FDA approved product in its portfolio. BBP was launched in December of 2014 and based on the nascent performance thus far BBP has outperformed the red-hot IBB and XBI thus far in 2015. Considering its unique focus, BBP may be worth considering in any long portfolio desiring exposure to the biotechnology sector without the highly speculative clinical stage biotech names.

High-Level Overview

• Over the past decade, using IBB and XBI as proxies for the biotech cohort, cumulative returns have more than quadrupled.

• This pure biotech ETF, BBP has entered the ETF investment landscape to focus on the biotechnology niche with at least one FDA approved product.

• BBP is a pure biotech play with no holdings in the generic or specialty pharma, life science tools, medical device/diagnostic, or other healthcare companies.

• BBP has outperformed the broader-scoped IBB and XBI since its nascent launch thus far in 2015 in annual returns by 15.4% and 1.3%, respectively year-to-date.

• BBP may offer a further refined biotechnology ETF option which may translate into a superior formula to maximize benefits with exposure to the biotech industry while potentially mitigating risk due to its commercial stage focus.

BBP characteristics and criteria

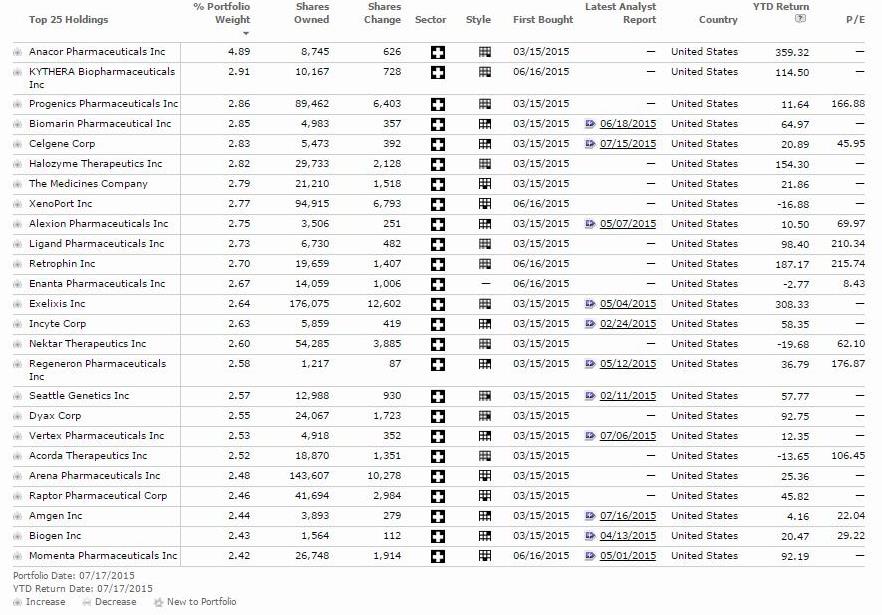

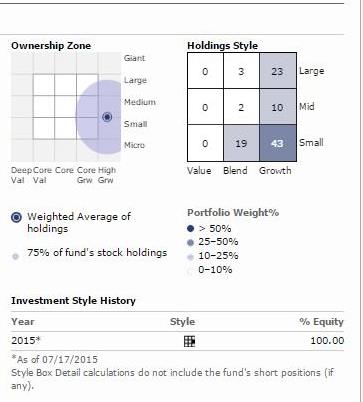

BBP is composed of biotechnology stocks which have at least one FDA approved and commercialized product on the market (Figure 1). This focus lends itself to investing in more well established companies that may be less dependent upon clinical stage outcomes or raising capital to fund future growth. This specific biotechnology investing approach may provide a unique niche in which to maintain exposure in the sector while mitigating risk in the more volatile clinical stage companies due to its commercial focus. This is in contrast to IBB and XBI which hold a blend of clinical and commercial stage companies spanning all market capitalizations. The top 10 holdings comprise ~30% of the BBP portfolio by weight while employing a mostly equal weighting formula along with an investment market capitalization minimum of $250 million. The vast majority of its holdings (76%) are invested in biotechnology growth stocks while 74% of its holdings are concentrated within the micro, small and mid-caps, providing ample opportunity for growth (Figure 2).

Figure 1 – Morningstar top 25 holdings within BBP

Figure 2 – Morningstar portfolio allocation with respect to market capitalization

Performance of BBP verses biotech proxies IBB and XBI

The returns for IBB and XBI have been very impressive in both the long and short-term horizons, unparalleled by any major index. Over the past 10-year timeframe, IBB and XBI have more than quadrupled returns (Figure 3). Despite this tremendous performance by IBB and XBI, a further refined biotechnology ETF may possess an edge in its formula to maximize benefits in biotech while potentially mitigating risk due to its commercial stage focus. BBP lacks much of any historical data, specifically in any market turbulence due to its launch in December of 2014. Despite this drawback in historical data, its performance thus far has been impressive, even compared to the highly impressive IBB and XBI (Figure 4). BBP has outperformed IBB and XBI year-to-date by 15.4 and 1.3%, respectively suggesting that this portfolio formula may possess an edge however this remains to be seen until longer term data are available.

Figure 3 – Google Finance graph showing the 10-year cumulative returns of IBB and XBI

Figure 4 – Google Finance graph showing the YTD performance of BBP relative to IBB and XBI

Exposure to the biotechnology sector

The companies that constitute the biotechnology cohort are at the forefront of innovation across many traditional therapeutic areas including oncology, virology and immunology as well as emerging therapeutic areas via immunotherapies and genomics-based therapies. The aggressive investment in research and development within the sector has paved way for many blockbuster approvals. Along with these approvals often times comes with lucrative rewards for shareholders. Due to the high-risk and difficulty of identifying one company in hopes that a clinical stage drug candidate comes to fruition, BBP offers exposure to the entire sector and mitigates that risk by default by honing in on companies with at least one FDA approved treatment and avoiding clinical stage companies altogether. This may serve as a viable alternative to those unwilling to take on a single company investment strategy while still maintaining portfolio exposure to this secular growth sector. Considering the long track record of innovative treatments and market performance, IBB may serve as a great companion holding for any long portfolio with a long-term time horizon to buffer any volatility within the biotechnology sector.

Conclusion

BBP may serve as a viable alternative to the traditional biotechnology ETFs via a pure biotech play with no holdings in the generic, specialty pharma, life science tools, medical device, diagnostic or other healthcare companies. Furthermore, this ETF focuses on the biotechnology cohort with at least one FDA approved product and thus potentially mitigating risk by default. BBP may offer a more refined biotechnology ETF portfolio that may translate into a superior formula to maximize the benefits while potentially mitigating risk due to its focus on commercial stage companies. Based on the nascent performance thus far since the launch of BBP in December of 2014, BBP has outperformed the red-hot IBB and XBI thus far in 2015. With an expense ratio of 0.85%, this ETF is pricy relative to the ETF universe however given the limited performance data this ETF provides high returns unrivaled by any major index including its counterparts, IBB and XBI. BBP may serve as a great satellite holding for any long portfolio desiring exposure to the biotechnology sector with a long-term time horizon.

Noah Kiedrowski

INO.com Contributor - Biotech

Disclosure: The author currently holds shares of IBB and is long IBB. The author has no business relationship with any companies mentioned in this article. He is not a professional financial advisor or tax professional. This article reflects his own opinions. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned. Kiedrowski is an individual investor who analyzes investment strategies and disseminates analyses. Kiedrowski encourages all investors to conduct their own research and due diligence prior to investing. Please feel free to comment and provide feedback, the author values all responses.