Which currency is set to outperform? Is it the US Dollar or the Pound Sterling? Consider if you will that, despite some notable headwinds, the Fed is moving closer to a rate hike. For many, that suggests the Dollar as the best bet for the next 12 months. Especially with unemployment at 5.3% and core CPI now rebounding to 1.8% Year on Year. Yet some US data releases are still only "mildly" positive; for example gains in wages, slowed from 2.3% to just 2%.

On the other side of the Atlantic the Bank of England has signaled that it's warming up towards a rate hike, too. Yet, unlike in the US, gains in wages have been rising by 3.2% Year on Year. Moreover, GDP has been growing at a pace of 0.4% (QoQ) in Q1, far better than the negative figure posted by the US. So is the Sterling looking better than the Dollar? Not exactly. Then is the Dollar looking better than Sterling? The answer is, once again, not exactly. But here's the thing. Both have the most hawkish sentiment among G7 central banks and they share very similar fundamentals. In some areas, the UK economy is outperforming while in others the US economy is taking the lead. Where the US is weak the UK is doing better and where the US is strong the UK is doing not so well.

Why Hedge and not Trade?

The first thing you might conclude is that, perhaps, before taking a position in GBP/USD, you need more clarity. Well, that's certainly one way to look at it and one could presume it a prudent decision. But with the pair range bound for more than five years, "clarity" really hasn't proven very lucrative in the long run. Let's say you're a Dollar bull and you want to protect yourself from sudden soft patches in the US economy. Those "soft patches" have been known to derail the Dollar.

Remember the nose dive in GDP growth that took place in the US during the first quarter? The two currencies complete each other and have very similar circumstances in some cases. Given that, why not make good use of the Pound Sterling and the US Dollar, instead of pitting one against the other? For example, a short EUR/USD could be hedged with a short EUR/GBP, or a long USD/JPY could be hedged with a long GBP/JPY? This allows you to ride on very similar currencies so that they complement rather than compete with each other.

Where the Dollar Shines

So where does Sterling lag versus the Dollar? Two major areas which suggest that the Dollar has the upper hand are inflation and the current account deficit.

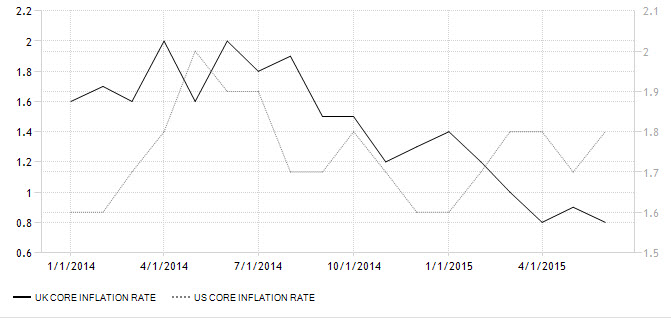

When comparing US and UK, it's evident that the US inflationary outlook is more stable. That provides more space for a rate hike, which can be seen clearly in the chart below. The US Core Inflation rate nudged higher to 1.8% and is trending higher. Meanwhile, the UK Core Inflation rate is sliding lower at and is currently at 0.8%, well away from the BoE's 2% target inflation rate. From this particular perspective, then, the US seems more ready for a rate hike than the UK.

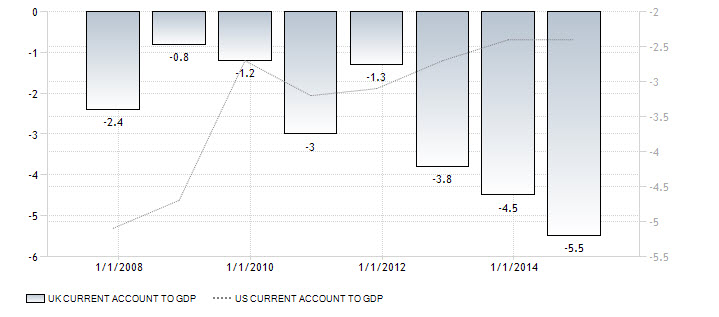

Now let's compare the UK and US current account deficit. From the chart, it's evident that the US current account deficit over the past few years (as a percentage of GDP) has narrowed to -2.4%. In the UK, the current account deficit has broadened to -5.5%.

Where does Sterling Shine?

There are, of course, some other areas where the UK economy shines. You might be surprised to learn that, first and foremost, the UK has a tighter labor market. Despite recent improvements in the US labor numbers, these indicators provide the proof.

Participation Rate in the Labor Market: This is a strong indicator that measures how much of the potential workforce is participating in the labor market. A higher rate means a larger part of the population that can work is already in the job market. A lower rate means there is some slack in the job market. The UK's Office of National Statistics reported that the participation rate is 77.7%, and it's trending higher. That's far above the stagnant participation rate of the US at 62.6%, which is the lowest it's been since the 1970s.

Wages: While US wages are growing at a fairly reasonable pace of 2% (YoY), UK wage growth has accelerated to 3.2% (YoY). That's significantly higher than the inflation rate and a clear sign that a rate hike is warranted in the UK. As far as the job market is concerned, the UK is clearly more ready for a rate hike than the US.

The Bottom Line

As we've shown, it's unclear which economy is really doing better; both are growing at roughly the same pace. Hence it's unclear where GBP/USD might be going. What is clear, however, is that both economies are the better performers in the Western Hemisphere. Each economy has a particular strength where the other tends to lag. Therefore, don't pit the Sterling against the Dollar. Rather, use each as diversification towards the other when taking positions against other peers such as the JPY, Euro or any other currency for that matter.

Look for my post next week.

Best,

Lior Alkalay

INO.com Contributor - Forex

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Considering prevailing financial situation, inclusive many linked issues like some recent Currency related incidents, Euro crisis, Chinese Stock Turmoil, Down trend of Precious Metals and Crude Oil, etc.etc. very clearly point-out that some major Financial crisis yet remains due, batter to say that this is quite long over due, and most probably that will be a kind of Currency War, at present, we are unable to get even any primary clue there about, however, EU, and BRICS (Brazil, Russia, India, China and South Africa) countries are all ready in trouble, out of which, up to some extend, India and South Africa is less affected. So now all these areas are became shock proof, and there will be no hurt or any fatale effects possible any more, because they are all ready passing through bad weather. So now onwards, there will be more risk on countries, which are non-affected or having comparatively stronger financial situation. One more point is also important that such evaluation must not be based or work out upon data or Numbers like GDP or Current Account Data, or any such figures, because now we batter realise that up to which extend, such data is reliable or applicable.

With a view to above, now countries like US, UK, Canada, Australia have more risk and pressure to preserve their Economies, and therefore, I think, there will be no meaning of Hedging between any two countries, which have equal risk profile.

As per my personal view, some strange or "Dark Horse" Currency will be a winner of that probable betel.

Hi Rasesh!

I believe the general geopolitical reasoning about "dark horse" don't touch the core idea as suggested by the author.

The author gave the valid reasons for a specific deal:

one short EURUSD and one short EURGBP (hedge ptf) is a way better than two shorts EURUSD (naked ptf).

1. Fundamentals. GBP strongly outperforms EUR for a quite time fundamentally.

There is an evident monetary policy divergence between EU and UK.

2. Technicals. The daily and weekly wave structure of EURUSD and EURGBP are both in strong downtrend.

There are six possible scenarios given GBP stronger than EUR.

-- EUR up GBP up. An average probability outcome. The hedge is substantially better than the naked. +++

-- EUR up GBP down. A low probability outcome. The hedge is worse than the naked. --

-- EUR down GBP down. A high probability outcome. The hedge is slightly worse than the naked. -

-- EUR down GBP up. An average probability outcome. The hedge is substantially better than the naked +++

-- EUR up GBP flat. A low probability outcome. The hedge is at par with the naked. 0

-- EUR down GBP flat. An average probability outcome. The hedge is at par with the naked. 0

-- EUR flat GBP up. An average probability outcome. The hedge is better than the naked. ++

-- EUR flat GBP down. An average probability outcome. The hedge is worse than the naked. --

One can clearly see the P&L of the hedge weighted by the scenario probability is better than that of the naked.

The probabilities are assigned according to the fundamentals and technicals stated above.

A small correction

there are nine possible scenarios.

Please, add this one

-- EUR flat GBP flat. An average probability outcome. The hedge is at par with the naked. 0

A skew still remains in a favor of the hedge.

Dear Andrii,

Thanks for such detailed analysis, covering all most probabilities.

As you explain that "general geopolitical reasoning about "dark horse" don't touch the core idea as suggested by the author". However, that is based on "Data" and you may be well aware about that factual situation that how often and surprisingly we are finding all relevant figures totally changed or even reversed, so At this stage, again I express my doubt about the significance of that study, which is purely based on Fundamental Data Only, and therefore I am mentally prepared for any change in an ultimate out-come, because i am having very very little and just negligible trust on the data or figures, published or announced by all Governments, without any exceptions, and even this may be prove as a great foolishness to plan any trade on the basis of such data based studies.

Dear Rasesh,

Please, look more carefully at my post.

There are also the technical considerations regarding market's wave structure for this instruments. I have additional more complicated trading set up which validates the trade.

Furthermore, one could say that it wasn't possible to make any trade at all if one takes seriously your reasoning.

Any trade deal isn't deterministic but based on a probability distribution.

That probability could be estimated using a specific strategy, complex, or simple.

The writer have given us the sound arguments to estimate that probability and to carry out the deal with 2% drawdown and risk/reward 1:3 The deal is suitable even for the most conservative risk profile.

Your answer could be applied to ANY deal on the market. It means nobody could trade.

If you don't bear the heat it's better to leave the kitchen.

Something might happen and turn the odds against the portfolio manager that's why a stop (technical or money stop) applies.

One couldn't be 100% sure he/she couldn't be smashed by a car on a pedestrian line. A 1970 edition fiat car driven by a drunk woman.

That one happened in my life.

Namely, the probability that make rotate the Earth

Life isn't deterministic and Life is trading.

Regards.

Thank you, Sir!

Very fair reasoning.

I select a similar approach in my long-term strategy.