I am sure by now you have heard that the citizens of Greece voted no to austerity and the latest deal that was presented to their country.

Here's a question for you, how is it that a small country like Greece with only 6.6 million people can suck in so much money from the international banking community?

It may be just a normal part of the Greek culture that they use deception to get what they want. Look back in history it started with the Trojan horse that the Greeks used to enter the city of Troy and win that war.

More recently in order to gain entry and acceptance into the European Union in 1981 and to later adopt the euro as its official currency in 2001. This was all done with deception, as the Greeks stated that their debt to GDP was 5% when in reality it was 15% and on an unsustainable track. I am sure that the Greeks looked upon it as another Trojan horse and they got what they wanted.

To put this perspective, the Greek economy only accounts for 2/10 of one percent of the world economy. In other words, it's not an economic powerhouse by anyone's imagination.

The question now is with the contentious Greek finance minister Yanis Varoufakis resigning shortly after the 61.3% NO vote, can Greece make a deal. His departure/removal was a clear gesture by Prime Minister Alexis Tsipras that he wants to begin fresh debt renegotiation.

The vote is indicating that Greek people did not want, nor would accept more austerity for their poor beleaguered country. Who in their right mind would vote to hurt and punish themselves? It was a brilliant political move by Prime Minister Alexis Tsipras to call the referendum when he did.

Okay, now for the big question, what's this No vote going to do to the markets?

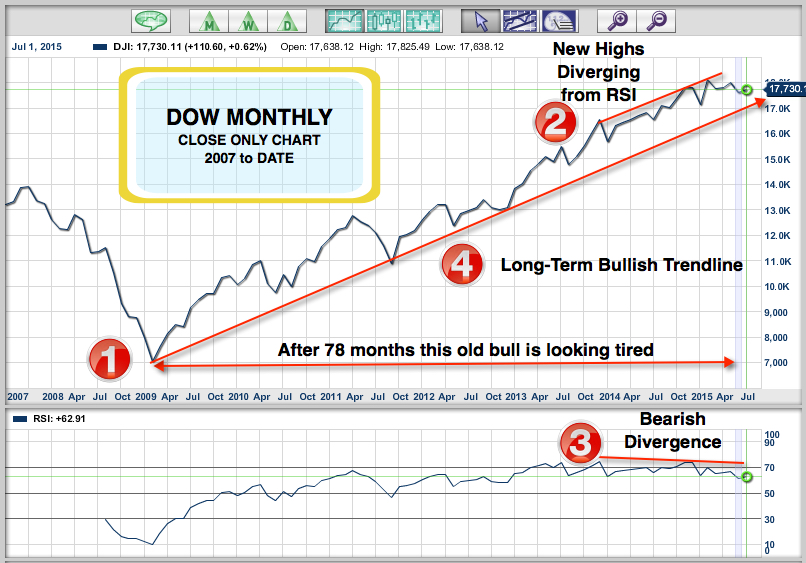

As you can see on all three major index charts, I have drawn the line in the sand. Until that line is violated the markets continue to be in a broad trading range here in the US. The US markets are going to be largely driven by economic developments and sentiment here and not in Europe.

When the Greek vote was announced late Sunday evening (East Coast Time), the markets immediately came under pressure and dropped 1.5%. Since that time, the major indices have all managed to make back half their losses.

The DOW, which only represents 30 stocks, is not looking particularly healthy as it does have a negative divergence in price action and this bull market is now 78 months old. One of the key levels to look for in my opinion is going to be the 17,000 level. At the moment the Trade Triangle technology is negative on the DOW. The line in the sand for this index 17,000.

The S&P 500 represents a slightly different picture than the DOW. You can see a negative divergence similar to what is happening in the DOW. The Trade Triangles are indicating a sidelines position in this index with the longer-term trend still in a positive mode. The line in the sand for this index 2,030.

The NASDAQ index is perhaps the healthiest of the three indices however that does not mean to say it is out of the woods yet. I'm still seeing a negative price divergence indicating potential trouble in the future. This indicator is in contrast to the Trade Triangles that continue to show that the longer-term trend is still intact. Based on the Trade Triangles you should be on the sidelines in this index at the moment. The line in the sand for this index 4,840.

With all the yearlong turmoil in Greece the markets have barely moved. I think now that the vitriolic and crazy Greek finance minister out of the picture, Greece may still have an opportunity to repair its differences and make a deal with the ECB and it European partners.

Either way, it's going to be interesting summer.

Thank you for taking the time to read this post and every success in the markets. Always remember, at MarketClub we have your back.

Every success with MarketClub,

Adam Hewison

President, INO.com

Co-Creator, MarketClub

You mentioned Greece population at 6.6 million (2nd paragraph). For the sake of accuracy it is actually 11.125166 million.

Congrats to Greece for voting NO and telling the Central Banks where to go!!!!!

The Greek government had a budget surplus from 2013 and 2014. The Greeks have been paying high taxes for 5 years. It caused most people to go broke. The debt under the current arrangement cannot be paid. The Greek government has been asking for an extension and haircut so that the taxes paid by the people can be manageable and paid by the people. But, when the TROIKA rejected a proposal from the Greek government that contained the exact same content the TROIKA proposed, the Greek government then, realized that the TROIKA was going to reject all proposals. That was when they announced they were not paying and decided to have a referendum vote.

Looks like the TROIKA does not want to solve Greek crisis. If it ends then, they move on to Italy and Spain. That is when the entire Euro will collapse when those countries drop it. The debt of these two countries is significantly more than the Greek debt. The Spanish and Italians already made it clear they will not go through what the Greeks went through.

Spain Debt: http://www.nationaldebtclocks.org/debtclock/spain

Italy Debt: http://www.nationaldebtclocks.org/debtclock/italy

France Debt: http://www.nationaldebtclocks.org/debtclock/france

It is my understanding that the Greeks have not been paying or collecting taxes due and there is is high unemployment.

Solution: make the unemployed the tax collectors.

WOW.

Every commentary that I see here and elsewhere always seems confounded or confused about the reason that a minor economy like Greece can have such international rippling effect. Well, here is the answer folks:

MASS MEDIA COVERAGE. The whole Greece affair has been and remains a media feeding frenzy. Even to the extent where guys like Mr.Hewitson himself has succumbed to sample the "food". Just listen to Bloomberg TV/radio their morning show is consistently using a chunk of time "eating"/"talking" Greece. Never mind that the US indexes are dangerously topping. Media--there's "the rub".

........."the Greeks stated that their debt to GDP was 5% when in reality it was 15%".

So we should sympathize with the European Union? They didn't do their due diligence, plain and simple, or they overlooked the facts in order to accomplish some other agenda. I rank this with hedge funds buying distressed Puerto Rican debt instruments, and then getting all huffy because they are going to lose money.

There have been many published reports about how Greece got into the EU. The US needed to see Greece in the EU for security reasons. The US hired Goldman Sachs to go to Greece and cook the books so that Greece met the requirements to become an EU member. Goldman Sachs sold the Greeks insurance policies on their debt, Goldman Sachs then shorted the insurance policies and caused increases in their debt payments. When the Greeks received the bailout loans their debt burden was too high to be repaid.

You blame the Greeks for the crisis but they were setup by the banks, specifically Goldman Sachs. The Germans also blame the Greeks for taking on too much debt. Yet Germany has repeatedly benefited from debt repudiation (Hitler after WWI) and debt forgiveness (in the 1950s 60% of their debt was forgiven).

Yet they want the Greeks to suffer even more than they already have. It is unbridled hypocrisy and selfishness.

Totally agree Steve - great post!

I'm curious what the significance of 2030 you said is line in sand for S & P?

There have been many published reports about how Greece got into the EU. The US needed to see Greece in the EU for security reasons. The US hired Goldman Sachs to go to Greece and cook the books so that Greece met the requirements to become an EU member. Goldman Sachs sold the Greeks insurance policies on their debt, Goldman Sachs then shorted the insurance policies and caused increases in their debt payments. When the Greeks received the bailout loans their debt burden was too high to be repaid.

AH: "It may be just a normal part of the Greek culture that they use deception to get what they want. Look back in history it started with the Trojan horse that the Greeks used to enter the city of Troy and win that war.

"More recently in order to gain entry and acceptance into the European Union in 1981 and to later adopt the euro as its official currency in 2001. This was all done with deception, as the Greeks stated that their debt to GDP was 5% when in reality it was 15% and on an unsustainable track. I am sure that the Greeks looked upon it as another Trojan horse and they got what they wanted."

Are you just trolling for comments, Adam? If not, how do you respond to Nick K's summary above? That would be an interesting post.

In the 70s this correspondent was in the restaurant supply business in Chicago. We served many of the Greek restaurants in that area.

Most, if not all of them shared two characteristics:

1} Usually looking for something for nothing.

2} Rarely, if ever, paying thier bills on time but stretching them out to the limit of suppliers endurance. The current situation is therefore no surprise.

At this stage, I want to ask just single question that why Economies and Stock Market of entire world become so highly depressive and absolutely disturb due to Grease Crisis, and surprisingly, where that Greek economy only accounts for 2/10 of one percent of the world economy?

I think, Greek Crisis must be evaluated in a broader perspective because over and above Grease, this issue is far more relevant to entire world's Economy, and we bound to recheck chain effects and linked consequences of Greek Crisis, as it is clearly apparent that there must be remarkable and considerable irregularities in so many other Economies too, unless and otherwise, it is hard to find such serious Financial effects as well psychological impacts of such deemed negligible issue.