When the broader stock averages all fall, savvy investors can find winning companies by watching for stocks that show a gain when all others show a loss.

Concern over the state of the global economy sent markets plunging on Friday with the S&P 500 shedding 3.19%, the Dow losing 3.12% and the NASDAQ dropping 3.52%. Stocks like Valero Energy and Ross Stores fell over 9% and further corrective activity is expected to follow next week.

But not all stocks are facing negative pressure. One company is the growing data storage field showed promise and lifted expectations following a surprise earnings beat that helped the stock gain 8.95% on a day where most others fell. Strength in a difficult market environment is a good sign of a solid company and could provide a safe haven for investors looking for bullish plays right now.

Bucking the trend with strong earnings and improving expectations

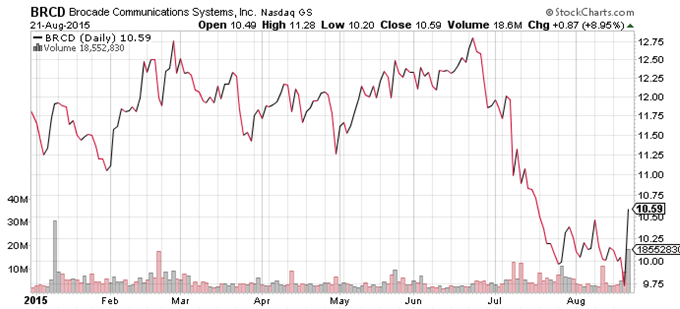

Brocade Communications Systems (BRCD) is a $4.4 billion data storage company that specializes in network infrastructure and IP solutions. The company's latest earnings report was a well-needed boost to the stock and investor's confidence after a disappointing June and July in which the stock fell more than 25% after future earnings estimates were cut and guidance was lowered due to challenging market conditions in enterprise data storage.

Brocade reported earnings of $0.27 per share beating the $0.22 expected by analysts – a 21% upside surprise. The company beat on revenue as well with $552 million versus $550.4 million. The quarter's results were widely unexpected given the weakness in the global economy and the strength of the dollar which hurt overseas sales, primarily in Europe. The earnings beat was enough to lift analyst expectations with Goldman raising its analyst rating as well.

The biggest improvement was in the IP networking products business segment with a 35% increase in sales and a 16% growth rate which continues to beat competitors. The company has consistently beaten earnings estimates for more than three straight years without a single miss while revenue growth has been equally impressive.

Taking a look at Brocade's chart shows a sharp stock decline followed by the recent surge following the positive earnings report.

Chart courtesy of StockCharts.com

Even now the stock is still down about 10% year-to-date and roughly 18% off its 52-week high giving it plenty of room for improvement.

The company is well positioned to keep beating expectations as well with expanded relationships with companies like Lenovo giving them more upside potential in the future. Brocade's relatively low debt liabilities give the company room to expand or weather hardships as needed making the company a growth stock with defensive capabilities.

The stock is cheaply valued as well trading at just 9.7 times earnings with a long-term growth rate of nearly 17%. That gives the stock a PEG ratio of less than 1 – a strong signal that the stock is trading at a discounted price. Compared to the industry average P/E of 19.5, Brocade looks heavily undervalued.

Estimating full year earnings and a reasonable P/E puts this stock at about $12 per share – a discount of more than 13%. With Brocade's history of beating earnings expectations, this stock could go even higher.

Check back to see my next post!

Best,

Daniel Cross

INO.com Contributor - Equities

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.