Break Rules, Change The World!

Indeed, we are living in an exciting time of dramatic changes in our world. Nowadays, when you talk about the channel, it can be YouTube, not MTV. When you need a ride, it can be Uber, not a taxi. When you are going to shop it can be on Amazon or Alibaba, not at Wal-Mart and we can count on further changes in the future.

By the way, Uber is the largest taxi company, but it has no cars, same as Alibaba which is the largest retailer, but it has no stores. Today I want to review the currency that has no controlling government, but has the value, the value that people are ready to pay for with real fiat money.

Cryptocurrency, digital currency, virtual currency are all the names of Bitcoin (BTC), the digital asset as described in Wikipedia. It doesn't matter what you call it as long at it performs well. Let's look at how it has been behaving for the last year on the chart below.

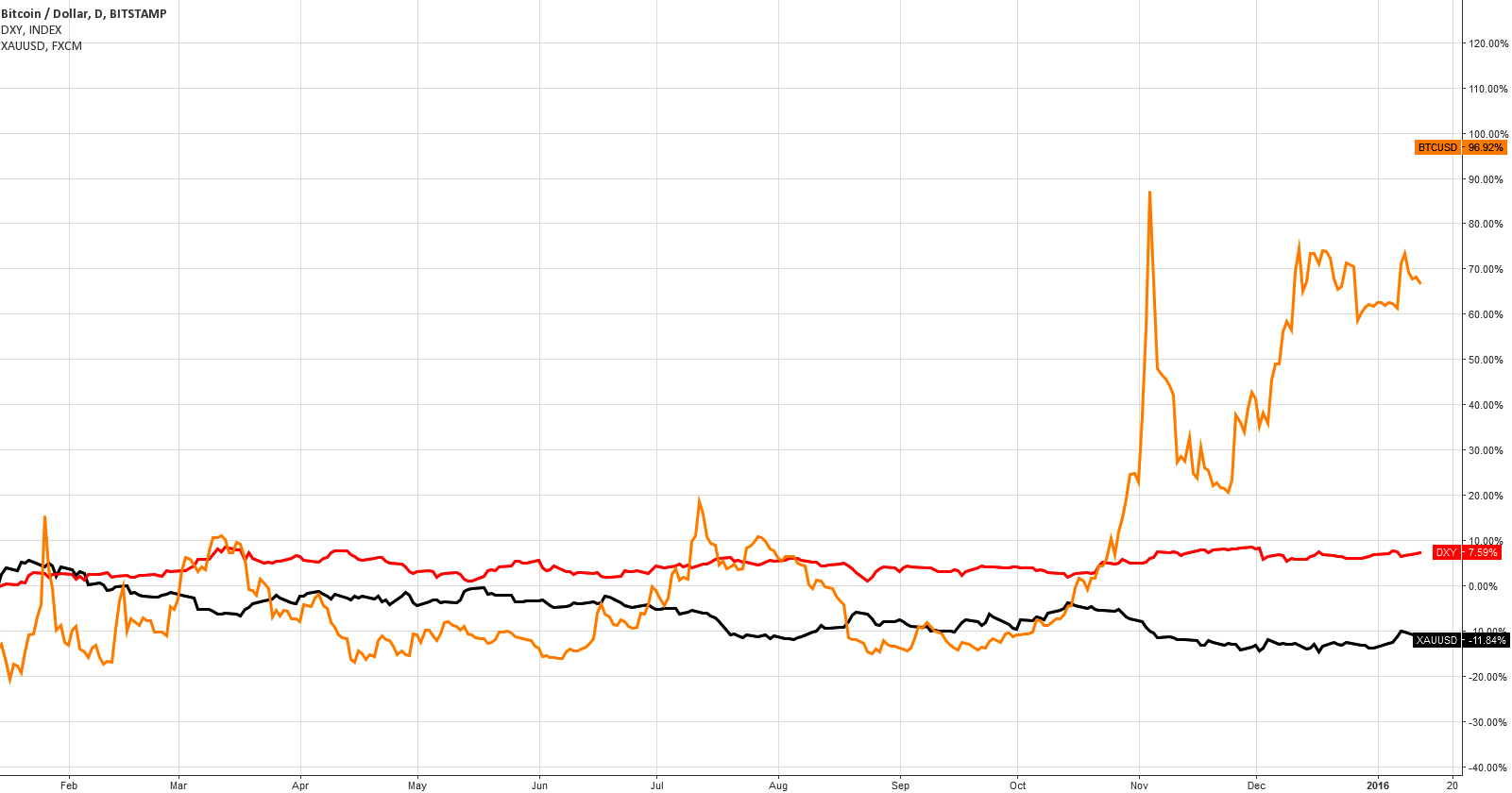

Chart 1. 1-year comparative dynamics of Bitcoin, Dollar Index and Gold: This Kid Stole The Show!

Chart courtesy of tradingview.com

Firstly, you can easily see that Bitcoin is a very volatile asset as it has hit both margins at +20 and -20% in just one year. The digital currency had been in extremely high demand at the end of October when the best-performing assets stood flat and metals crashed heavily along with crude oil amid worsening investor sentiment.

Conservative traders were happy to stay in cash with the Dollar's 8% gain compared to Gold, which has lost almost 12%, but look at Bitcoin's result – it made an unbelievable 97%. It literally doubled it's value!

The US dollar is still the King in the world of fiat money. However, look around, the world itself is changing at a high speed, it typically takes new technology 10 years before it gets a high level of implementation and yet Bitcoin has made great strides in the last 2 years. It has grown from nothing – as it had no value in 2009, to a high of $1250 for 1 BTC in 2013. Currently, it is being traded at the $450 level.

To see a full picture, let's look at the graph below:

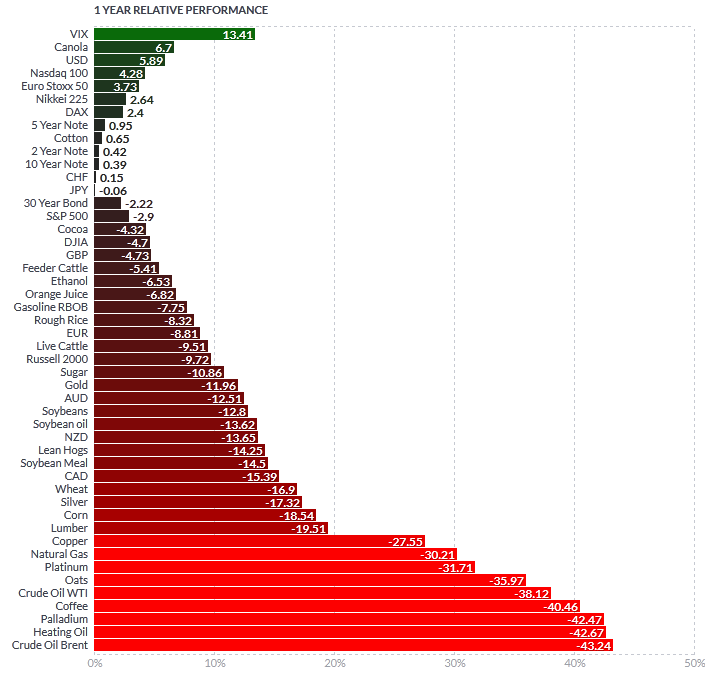

Chart 2. 1-year Comparative Futures Dynamics: No Equal

Image courtesy of finviz.com

As we can see on this "all-stars" graph above, Brent oil was the best among conventional instruments for the past year, of course, we should have shorted it to get 43% of the profit. Among long positions, the best is the VIX future with a laughable +13%. However, none of them were equal to Bitcoin last year.

To Mine Or To "Mine"?

It is amazing that in Bitcoin's pre-history there was a suggestion to name the first digital currency "bit gold", another interesting coincidence is the same name for both the process of Gold extraction and the process of Bitcoins creation – mining. Maybe it is not a simple coincidence, but the sign of destiny. Time will tell for sure.

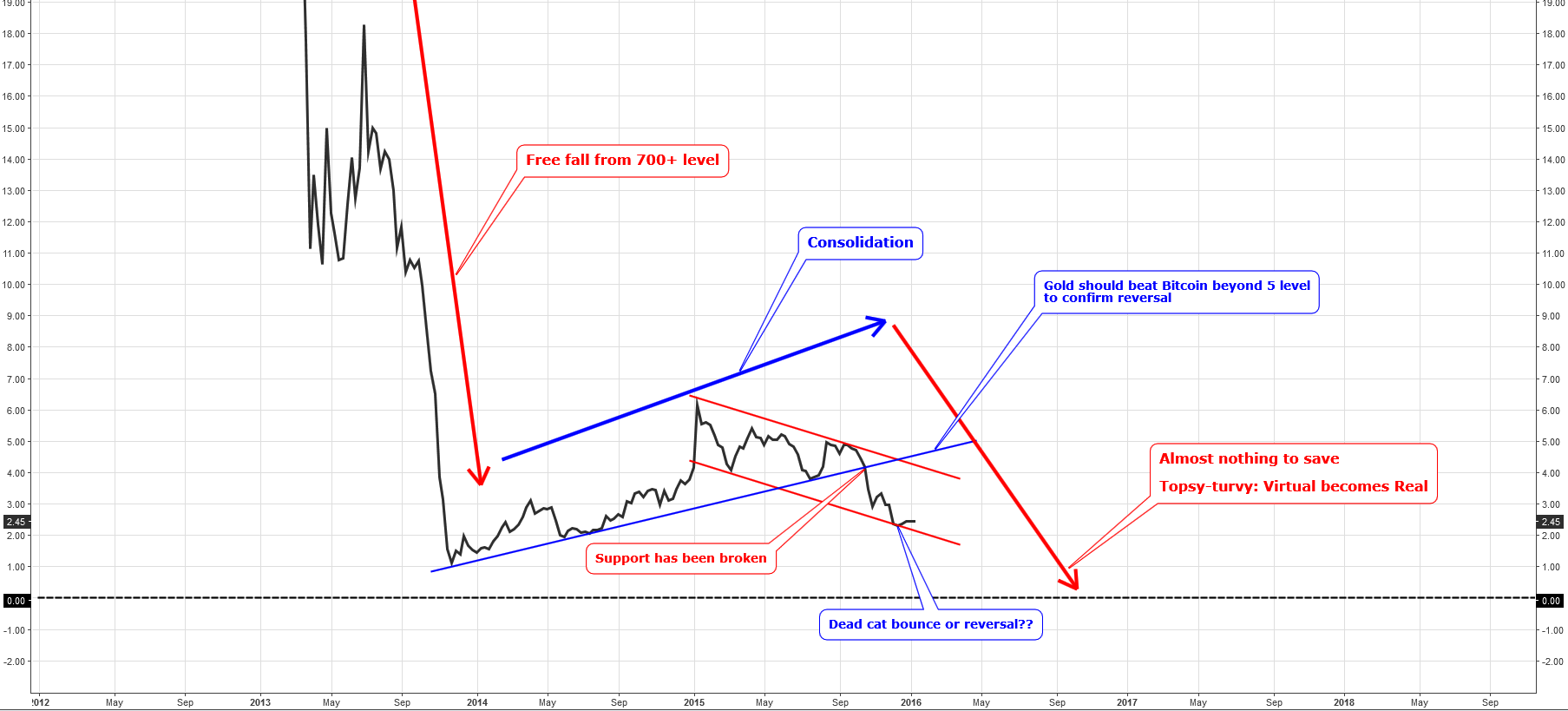

Chart 3. Gold/Bitcoin ratio: The King Is Dead. Long Live The King!

Chart courtesy of tradingview.com

There is only one direction on the chart over the last 4 years: down. Gold has lost almost all its value to Bitcoin; it has been in a free fall from the peak at 720 BTC per ounce in November of 2011 to an all-time low at 1.1 BTC per ounce in November of 2013. The ratio has grown six folds during the 2-year consolidation (blue arrow).

Last October, when both assets diverged heavily, the ratio broke below the blue rising support and continued its downside move. The Gold/Bitcoin ratio hit the bottom of a red downtrend at 2.3 BTC per ounce last month and bounced slightly back. We can consider this a "dead cat bounce" as it will not break through the 3.5 BTC per ounce level.

Overall, the trend will remain bearish below the 5 BTC per ounce level, with the current Bitcoin price at $420 Gold should rocket above the $2100 level to invalidate the downtrend. Let us wait and see!

Intelligent trades!

Aibek Burabayev

INO.com Contributor, Metals

Disclosure: This contributor has no positions in any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

If Bitcoin had a volatility index, it would look like the career of bill Cosby. Be smart and buy things that can't go to zero. Silver.

Bitcoins are like Nintendo coins. Not real, and controlled entirely at any time by any mouse. RetardCoin is a better name.

How do you buy Bitcoin and where ???

And what do you get for your hard earned $ ?

Some virtual digital believes in the cloud ?

Dear Ernie,

Thank you for your comment.

First of all I need to clarify that I am not pushing anyone to buy Bitcoins, I am making comparative dynamics of assets to show you how wide is the financial horizon.

Bitcoins are sold at special exchanges.

I guess it was hard time when first paper money were introduced, when first steam-machine was created.

We can't deny that we are moving into digital world with digital identity, digital communication (we write each other without a single drop of an ink), self-driving cars and it is possible to have digital money (by the way, we have them in digits for a long time now as a record on banking account and only small part are printed on paper).

Best regards!

Dear Aibek,

I think, question raised by Ernie are applicable and answerable by all means, however, you are quite clear because of you had just illustrated performance of BC on the basis of Data, in a position of Analyst, and not a "Sales Person" of BC.

However when you are making comparative dynamics of BC as an assets, one basic question is why, how, on which Ground, and up to which extend we consider BC as an Asset?

I think, if BC or any alike VC introduced by any Government then many question automatically replied it self, or even not raised, but here is a different story and so must be evaluated or judged in a different manner.

Also this is more serious issue to be consider with a much broader perspectives, because Paper Money or any other Currency has its implied meaning of absolute and conditioned involvement of any Government, so now this become a case of "Parallel Currency" or "Parallel Economy" absolutely, without any direct or indirect involvement, restrictions or control of any Government exists on the Earth.

Dear Rasesh,

Thank you for your opinion.

You are right, it is a big and complex topic and it requires some time to proof its vitality.

It can be considered as an asset from two points: 1) BTC is a digital asset by definition; 2) Accounting would classify it as an asset.

Regards

You've read about the breakdown of the bitcoin team on how big a blockchain transaction should be? One of major players has left saying that BTC is doomed.

Frankly, I think BTC is a fad, but a fad that will morph into many variations of digital currency. For instance. What if every Euro state adopted its own BTC-GER, BTC-FRA, or BTC-GRE. Then each of those countries could pay their state institutions and employees in a currency that would float -- for that state only. But the EUR would still be the defacto hard currency. The lack of fiat float for each of these countries is one of the primary detractions of the Euro. Countries are shackled to Germany and its solid economy with no way to adjust for internal state inflation. Using state controlled BTC variations would allow some leeway and fudge for avoiding these massive imbalances countries like Greece build up.

Just a thought.

Dear Anonymole,

My old friend, thank you for sharing your thoughts, let us live and see!

Best regards!

Dear Aibek,

Gold lost it's glitter, and still some lower marks remains pending to quote, however, when there is absolute valuation, reliability or acceptation is concerned, Gold was, is and will be king forever, at list for a matter to compare Gold with Bitcoin.

As per my personal view, not only just Bitcoin, but all such a like Currencies are even dangerous then Derivatives, Swaps and other Financial instruments. This is just because so many questions doubts are either unanswered or at this stage, we are unable to think over about any probable future uncertainty.

Dear Rasesh,

I haven't seen your feedback for quite a long time! Thank you for sharing your view.

Main thing in our world is perception, we used to some things that can't be same for ages.

New generation prefer to rent/hire not to own to avoid loans. This can change a lot!

We had stone age, metal age, petroleum age...which one is the next?

Best regards!

Digita age 🙂

Dear Aibek,

Much thanks for such nice words with broad approach.

Regarding the mind reading of new generation and their acts,Your observation is very prefect and so fully acceptable. However, often we found highly damaging and all most got irreparable situation whenever any thing took place or any idea applied which is just against " Simple Rules of Life"simply because of it can be applicable anytime, anywhere, and for everything. Anyway, we just have to play a role of "Witness"thereof, and required to find way for our own.

With Warm Regards,

Dear Rasesh,

Thank you very much for interesting feedback (mini-dialogue) and wise words about own way.

Kind regards!