Hello MarketClub members everywhere, it certainly was a "Super Tuesday" in many respects with the markets having their best moves to the upside in the quite some time. The weekly Trade Triangles all turned green in February indicating a sidelines position in all the major indices.

Indices

Now for some of you who like to swing trade, the upside objectives are pretty clear based on the technical formations that each of the major indices have created. The DOW (INDEX:DJI) has formed a double bottom and a pivot point that has been broken to the upside. If you're not familiar with this formation, we have a little lesson for you right here. The S&P 500 (CME:SP500) index also has this same formation.

The NASDAQ (NASDAQ:COMP) has formed a Head & Shoulders base and has broken out to the upside. I expect all three major indices to move higher, and I will give you the exact target zones of where these markets can go.

Gold

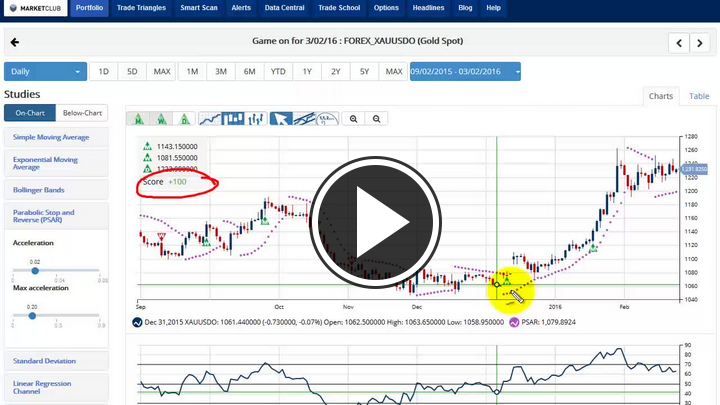

The gold (FOREX:XAUUSDO) market is also following a very powerful technical formation that I believe will push it significantly higher from its current levels. I'll show you what this formation is and where it will begin to accelerate to the upside.

Crude Oil

Has crude oil (NYMEX:CL.J16.E) finally made a turn to the upside, signaling the end of cheap gas? Yesterday, a green weekly Trade Triangle kicked in at $34.69 signaling that a bottom has been put in place for now. This is the first weekly Trade Triangle since October 26, 2015 when a red weekly Trade Triangle came in at $47.34. One only has to look at the chart to see that this was an enormously profitable trade. Is this going to be as big a winner as last time? I don’t know for sure, but I somehow doubt it's going to provide the same profits as the short trade. However, the Trade Triangles are signaling something is going on in crude oil.

Stay focused and disciplined.

Every success with MarketClub,

Adam Hewison

President, INO.com

Co-Creator, MarketClub

Thanks Adam, really appreciated. Any chance you could comment on the lack of volume?