As Brexit wreaked havoc on international financial markets, it presented a brief opportunity to capitalize on the collateral damage fallout within the biotechnology cohort. This event may continue to offer entry points as the reverberations are felt throughout the markets. I didn’t factor in the possibility that a major economic power within the EU would vote to relinquish its membership and move forward as an independent nation. However as Brexit became reality, I utilized this opportunity to deploy capital in the biotechnology cohort via the iShares Biotechnology Index ETF (NASDAQ:IBB) as a long-term investor within the space. As the UK proceeded with its divorce from the EU, markets sold off in a meaningful way. Brexit introduced instability throughout the region thus negatively impacting financial markets abroad. I largely view the Brexit as an extraneous event unrelated directly to the biotechnology cohort; thus I utilized this brief opportunity to add to my position in IBB and may continue to add in periods of weakness.

Extraneous Events Have Been Plaguing Biotech Throughout 2016

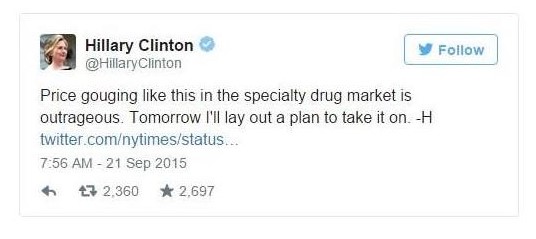

In February of this year, the culmination of extraneous events such as sustained lower oil prices, a relentless obsession with an ostensibly imminent rate hike and weakness in China had indiscriminately pummeled the biotech sector. Following this turn of extraneous events, a sector-specific story with regard to price gouging by Turing Pharmaceuticals and the subsequent comments by Hillary Clinton exacerbated this sector decline (Figure 1). These former events are seemingly unrelated to the biotechnology sector, yet this group was taken along for the downhill ride with the broader indices in lock-step. The latter events have been detrimental to all healthcare related stocks as this is a direct threat to pricing power and potential further governmental regulation. I view the latter as an extreme case and it unfairly paints a broad brush across the entire space.

Figure 1 – Democratic presidential candidate Hilary Clinton tweeting about reigning in drug prices

The Parallels Between The February Sell-Off And The Brexit

The parallels between the February sell-off and the Brexit induced sell-off, in my opinion, is the unique buying opportunity that’s presented. The unprecedented secular growth streak in biotech has been more than tested as of late with biotechnology officially in bear territory posting its worse performance in years. These latest events, some unrelated and others directly related to the biotech sector have provided a unique opportunity to add to a current position or initiate a position over time as these corrections intermittently occur. Based on annual and cumulative performance throughout both bear and bull markets, IBB may provide the opportunity investors have been waiting for in the face of our current market conditions. IBB touched down 40% from its 52-week high, shares plunged from $400 to $240 per share during both market sell-offs in February and the most recent Brexit market weakness, presenting great buying opportunities (Figure 2).

Figure 2 – Google Finance graph representing the 52-week performance of IBB and its touchdowns to the $240 level in February and after Brexit

Capitalizing On Market Sell-Offs May Have A Meaningful Impact Over The Long-Term

Taking advantage of the market wide sell-offs outlined above, I added to my position in IBB at limit price of $250.00 in both February and the day after Brexit when the market fell over 600 points. By adding to my IBB position on these two occasions, I’ve been able to decrease my average share price by 5.2%. Capitalizing on these opportunities may have a meaningful impact when it comes to dollar cost averaging and adding to an existing position over the long term as a long investor. My purchases at $250.00 offer a potential upside of 37.5% based on its 52-week high.

Conclusion

As events, seemingly unrelated to the biotech cohort bring this sector down in lock-step with the broader markets, present great buying opportunities for any long investor. Political pressures and price gouging allegations with subside as the political cycle matures into 2017 and beyond. As market cycles ebb and flow with regard to oil prices, weakness in foreign markets and Federal Reserve rate hikes patients will still require medication to treat and cure medical conditions. In particular, as America continues to absorb an aging population the rise in prescription drugs will only increase as more and more elderly people will live longer and healthier lives as a result of ground breaking therapies entering the market. I remain long IBB and will look to continue to add strategically over time as IBB is off over 40% from its 52-week high in large part due to unrelated events.

Noah Kiedrowski

INO.com Contributor - Biotech

Disclosure: The author currently holds shares of IBB and the author is long IBB. The author has no business relationship with any companies mentioned in this article. He is not a professional financial advisor or tax professional. This article reflects his own opinions. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned. Kiedrowski is an individual investor who analyzes investment strategies and disseminates analyses. Kiedrowski encourages all investors to conduct their own research and due diligence prior to investing. Please feel free to comment and provide feedback, the author values all responses.