At the start of this month, I shared with you the comparative dynamics of gold and gold stocks. I joked that the commodities traders could only envy the stock investors as the results of gold purchase were laughable compared to investing in stocks. And today I would love to show you an even more surprising results of silver stocks.

Part I. Comparison

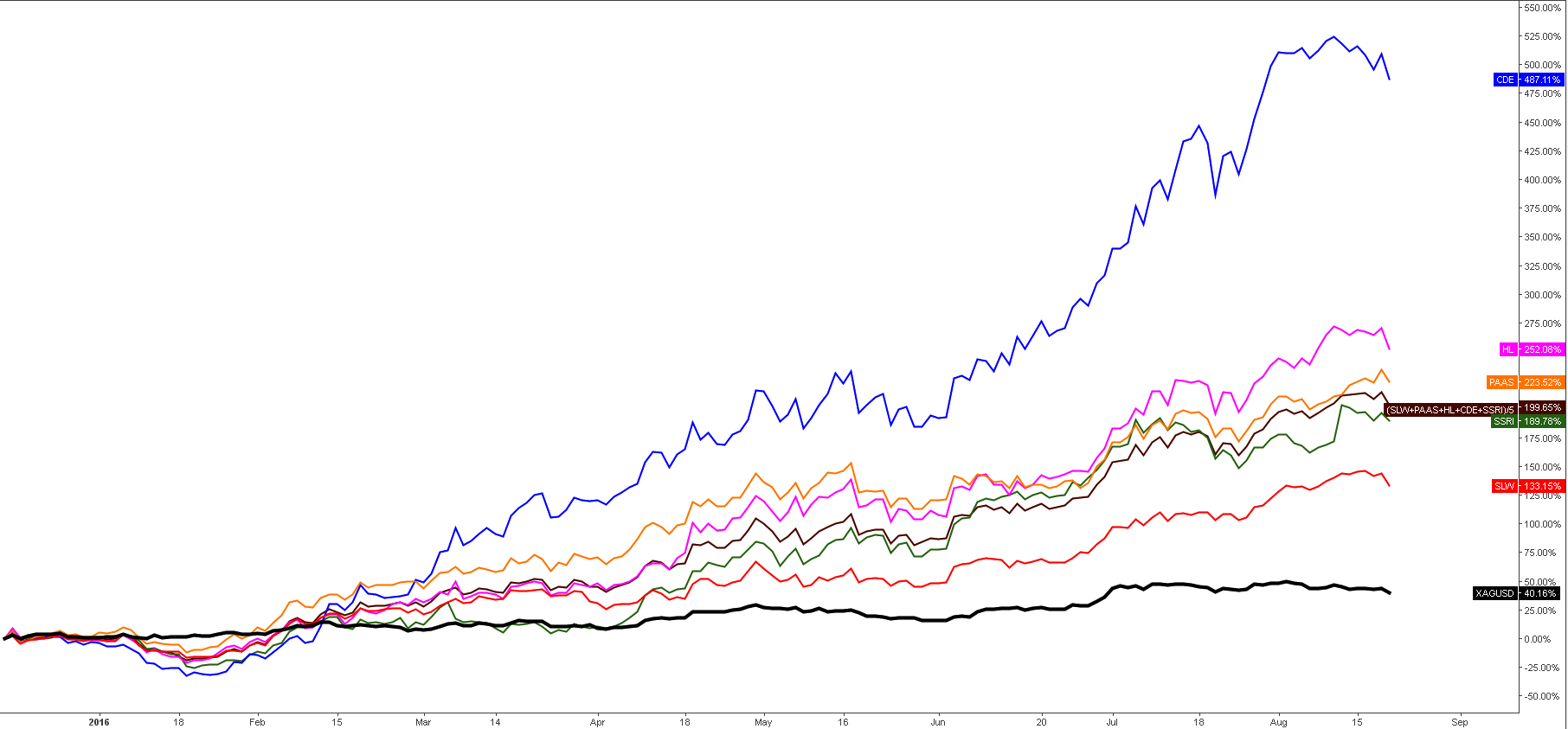

Chart 1. Top Silver Stocks Vs. Silver: This Brilliant League Is Not For Metal

Chart courtesy of tradingview.com

The above chart has a high resolution and to see it in a full size; please click on the chart. It shows us the comparative dynamics of silver and the top silver stocks by market cap.

The 5 stocks are sorted by market cap:

1. Silver Wheaton Corporation (NYSE:SLW) (red)

2. Pan American Silver Corporation (NASDAQ:PAAS) (orange)

3. Hecla Mining Company (NYSE:HL) (purple)

4. Coeur Mining Inc. (NYSE:CDE) (blue)

5. Silver Standard Resources Inc. (NASDAQ:SSRI) (green)

The chart starts from the bottom in silver price at the $13.6 mark on the 14th of December 2015 to show the effect of the metal’s strength in the stocks price behavior.

Indeed, the silver is a top performing future in the market with a 40% gain from the bottom in December. But the stocks ‘league’ has much higher performance requirements to succeed there. The worst performer and the largest company is a Silver Wheaton Corp. which made a great 133% gain to date, which is more than three times better than the metal could do.

The ultimate and indisputable leader of this race is the Coeur Mining Inc., which has hit the astonishing 500% gain and is now just below it. It is a case when we have a magic transformation from nothing to SOMETHING; the price bottomed at close to zero ($1.62) level and then it rocketed to the sky above the $16 mark. Congratulations to those lucky investors who could pick this stock among others.

The average synthetic dynamics of the five stocks (chocolate color) advanced for an almost 200% gain (again five times greater than the metal). Three stocks could beat the average: CDE, HL, and PAAS. Two stocks have poorer dynamics: SSRI and SLW. It’s interesting that the largest and the smallest companies couldn’t beat the average.

Part II. The Winner

The winner takes it all, so this part is dedicated to CDE. The Coeur Mining Inc. is the most bubbled stock: 12 times more inflated than silver and more than two times than the average of the five stocks.

Chart 2. Coeur Mining Daily: It’s Good To Quit (Sell) On Break Down

Chart courtesy of tradingview.com

The rocket move to the upside consists of two segments (blue arrows) which you can clearly identify on the daily chart above. The CD segment is greater and has a sharper angle than the AB segment. It reached the 1.27 Fibonacci ratio of the AB segment’s length at the top ($16.41) on 10th of August. It means that the chances of the reversal are growing.

The RSI was extremely overbought in July and is falling, despite that the price has made the higher high recently, which points at the divergence. The break below the 50 level on RSI could help the price to break the rising support line (black).

If we assume that the stock should at least fall to an average performance level, then the price of Coeur Mining could reach to the $8-9 area between the 50% and 61.8% Fibonacci retracement levels. It’s about an $6-7 gain. The risk for a short position is above the $18.5 level (CD segment = 1.618 AB segment; the upside of the trend on the weekly chart, not shown) or $3.5. Therefore, the gain outweighs the pain.

Intelligent trades!

Aibek Burabayev

INO.com Contributor, Metals

Disclosure: This contributor has no positions in any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

I would have to agree, greed ok fear ok pig you get slaughtered AG case in point 19+ from 2.40 gut told me to sell, street told me to sell i waited lost on average 5% each day for a week, be greedy be fearfull but never get glutonous i got hurt and only made a 250% proffit instead of a 500% proffit.