INO Health & Biotech Stock Guide

Preview Issue #3 - Sept 28th, 2016

BIOTECH, HEALTH & PHARMA NEWS

Myan’s CEO is grilled by congressional leaders on Capitol Hill, Allergan (NYSE:AGN) and Johnson & Johnson (NYSE:JNJ) step up merger and acquisition activity and the presidential debates are underway.

Mylan has dominated the pharma news headlines recently over its aggressive pricing increases regarding its EpiPen which uses an auto-injection of epinephrine to treat severe allergic reactions, particularly deadly in school age children. Since Mylan acquired the product in 2007, and the “list” price increased from $100 in 2008 to its current “list” price of ~$600. Elijah Cummings was quoted as saying, "to get filthy rich at the expense of our constituents” and compared Mylan’s CEO, Bresch to former Turing CEO Martin Shkreli and ex-Valeant CEO Michael Pearson. Bresch countered "I think many people incorrectly assume we make $600 off each EpiPen. This is simply not true." "The wholesale price for a two-unit pack of EpiPen auto-injectors is $608. After rebates and various fees, Mylan actually receives $274. Then you must subtract our cost of goods which is $69. This leaves a balance of $205. After subtracting all EpiPen Auto-Injector related costs our profit is $100, or approximately $50 per pen" (Figure 1).

Figure 1 – Subtext Cummings addressing Mylan’s CEO and stating "to get filthy rich at the expense of our constituents," regarding the EpiPen price increases.

Common ground was shared across both sides of the aisle in attacking and accusing Mylan (NASDAQ:MYL) of price gouging and taking advantage of its monopoly in the space. This negative publicity along with continuous political attacks is negatively impacting the biotech cohort. With ongoing presidential debates and political posturing occurring, this will likely continue to be a source of volatility. Buying opportunities may present themselves throughout the sector due to extraneous political rhetoric regarding the drug pricing debate.

WHAT'S NEXT

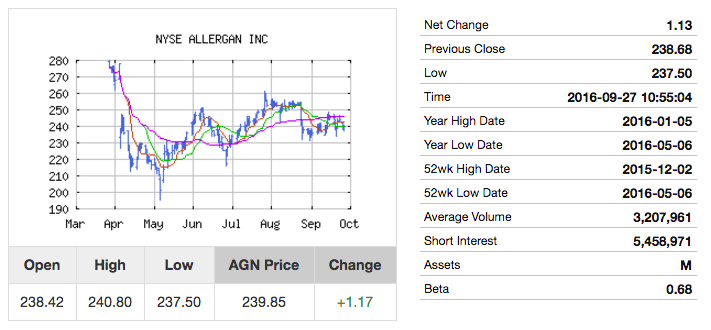

Allergan and Johnson & Johnson have both made sizable acquisitions recently targeting nonalcoholic steatohepatitis (NASH) and medical optics, respectively. Allergan announced two acquisitions focused in the NASH space by acquiring Vitae for approximately $640 million and its intention to acquire clinical-stage biopharma company, Tobira (NASDAQ:TBRA), for $1.7 billion and privately-held biopharma company Akarna for an up-front payment of $50 million plus additional payments on the achievement of certain milestones.

Johnson & Johnson is attempting to strengthen its eye care presence with the acquisition of Abbott’s Medical Optics unit for $4.3 billion in cash. The anticipated closure of this acquisition is targeted for the first quarter of 2017. Abbott’s Medical Optics unit reported $1.1 billion of sales last year, has a presence in cataract surgery, laser refractive surgery and consumer eye health. The acquisition will allow J&J to expand its presence in the eye care business and surgical optometry.

INDUSTRY OUTLOOK

Merger and acquisition activity within the biotech/pharma space has heated up as of late with Pfizer’s (NYSE:PFE) acquisition of Medivation (NYSE:MDVN) for $14 billion, Allergan’s acquisition of Tobira for $1.7 billion and J&J’s acquisition of Abbott’s Medical Optics unit for $4.3 billion. The entire healthcare cohort and more specifically biotech stocks have experienced major sell-offs year-to-date. As a result, many prospective buyout candidates may make a financially compelling case based on reduced valuations for a potential acquisition. As this acquisition activity heats up, the entire cohort trends higher as noted by the recent elusive $300 per share breakout of the iShares Nasdaq Biotechnology ETF (NASDAQ:IBB). The drug pricing debate continues to be at the forefront of politicians’ attacks towards pharma companies while the same fight is being waged in the court of public opinion. As candidates threaten drug companies with containing the costs of drugs, these actions will continue to negatively impact healthcare and biotech stocks in particular. As the political cycle comes to an end many of these headwinds will be removed and will likely allow the cohort to move higher as seen in the price action of IBB over the past couple of months as the political climate matures.

FEATURED STOCK / ETF

ABOUT THE EDITOR - Noah Kiedrowski

I am biotechnology professional with a diverse scientific background and detailed knowledge in many therapeutic areas such as monoclonal antibodies, immunotherapies and antivirals. I have a personal interest in finance, investing, trading and global markets. My analysis is focused on stocks and exchange traded funds (ETFs) while exploring niche opportunities such as derivative trading via options. This newsletter is intended to provide investors with the latest developments and trends regarding the overall healthcare sector with a biotechnology emphasis. I'll be highlighting sector trends, merger and acquisition activity, noteworthy current events, political developments and drug approvals. My focus will be centered on well-established mid-cap and large-cap companies as well as utilizing appropriate ETFs as proxies for sector trends. This is a bi-monthly newsletter service that reflects my own opinions and analyses. This newsletter is not intended to be a recommendation to buy or sell any stock or ETF mentioned. I am not a professional financial advisor or tax professional, rather an individual investor who analyzes investment strategies and disseminates my analyses. I encourage all investors to conduct their own research and due diligence prior to investing.

---

This bi-monthly newsletter service reflects the opinions and analyses of INO Contributor, Noah Kiedrowski. This newsletter is not intended to be a recommendation to buy or sell any stock or ETF mentioned. Kiedrowski is not a professional financial advisor or tax professional, rather an individual investor who analyzes investment strategies and disseminates his own analyses. All traders and investors should conduct their own research and due diligence prior to investing.