INO Health & Biotech Stock Guide

Preview Issue #8 - January 11, 2017

BIOTECH, HEALTH & PHARMA NEWS

Healthcare related stocks and more notably the biotech cohort saw a very tumultuous 2016. As the political backdrop, drug pricing debate and presidential election were thrusted into the spotlight, healthcare related stocks responded erratically to any news that would have a perceived impact on the industry. Now that 2016 it’s in the books, investors can look to 2017 and the new administration under president-elect Donald Trump. Since Donald Trump voiced his concerns over drug pricing, the initial rally in healthcare-related stocks has largely eroded to pre-election levels. Initially, the entire cohort saw significant gains as traders viewed a republican controlled government in positive light with regard to the healthcare sector. Considering the aforementioned factors throughout 2016, the iShares NASDAQ Biotechnology Index (Ticker:IBB) traded in a wide range with pronounced volatility after the presidential election posting a range of ~$240 to $344 or a 104-point gap. The upcoming 2017 year is shaping up to be an eventful one with continued uncertainty with regard to the political climate, governmental stance on mergers and acquisitions, potential deregulation, potential restructuring of the Affordable Care Act and a potentially more favorable tax and repatriation rates throughout the industry.

WHAT'S NEXT

Mired in the drug pricing controversy, Mylan has capitulated and is now offering a generic version of its EpiPen. Mylan was the subject of several governmental inquiries regarding its aggressive price hikes and specific threats from high ranking governmental officials, notably Hillary Clinton and Bernie Sanders during the campaign trail. Mylan is now offering a generic version for $300 per two-pack which translates into a more than 50% discount from the brand name EpiPen. This timely event comes just weeks after 20 states filed a lawsuit against generic drug companies over pricing matters, one of which was Mylan. Mylan is also paying $465 million to settle questions regarding the misclassification of its EpiPens for government healthcare costs.

The drug pricing debate is clearly not going away anytime soon and will likely persist into the new administration. Drug companies appear to be entertaining self-regulation on drug price increases in a reasonable and responsible manner. Brent Saunders, CEO of Allergan has suggested self-regulation as a path forward for the industry considering the governmental and public backlash due to a few bad actors, vowing to limit drug price increases to single-digit percentages once a year. This proposed action may arrest the drug pricing debate and put some of the negative sentiment behind the industry. As political uncertainty abates under the new administration along with a favorable merger and acquisition backdrop, the sector may move higher.

INDUSTRY OUTLOOK

The Walgreens acquisition of Rite Aid is back in the spotlight after Fred’s agreed to purchase 865 Rite Aid stores for $950 million in an all-cash deal. This is in response to an increasingly hesitant Federal Trade Commission regarding Walgreens’ proposed acquisition of Rite Aid. Walgreens is hoping this will appease regulators and green-light the merger. Walgreens remains actively engaged with federal regulators and aiming to close the transaction by early 2017. This proposed combination would result in the largest drugstore chain followed by CVS Health. In other M&A news, Allergan made another acquisition recently, making it number twelve on the year. Allergan is purchasing LifeCell, a regenerative medicine play for $2.9 billion in cash. Allergan stated that LifeCell’s 2016 sales are expected to be $450 million and grow at a mid-single digit rate and expects the deal to close in the first half of 2017.

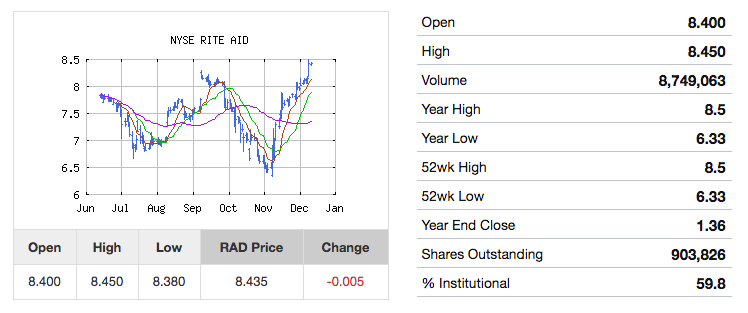

FEATURED STOCK / ETF - Rite Aid (RAD)

ABOUT THE EDITOR - Noah Kiedrowski

I am biotechnology professional with a diverse scientific background and detailed knowledge in many therapeutic areas such as monoclonal antibodies, immunotherapies and antivirals. I have a personal interest in finance, investing, trading and global markets. My analysis is focused on stocks and exchange traded funds (ETFs) while exploring niche opportunities such as derivative trading via options. This newsletter is intended to provide investors with the latest developments and trends regarding the overall healthcare sector with a biotechnology emphasis. I'll be highlighting sector trends, merger and acquisition activity, noteworthy current events, political developments and drug approvals. My focus will be centered on well-established mid-cap and large-cap companies as well as utilizing appropriate ETFs as proxies for sector trends. This is a bi-monthly newsletter service that reflects my own opinions and analyses. This newsletter is not intended to be a recommendation to buy or sell any stock or ETF mentioned. I am not a professional financial advisor or tax professional, rather an individual investor who analyzes investment strategies and disseminates my analyses. I encourage all investors to conduct their own research and due diligence prior to investing.

---

This bi-monthly newsletter service reflects the opinions and analyses of INO Contributor, Noah Kiedrowski. This newsletter is not intended to be a recommendation to buy or sell any stock or ETF mentioned. Kiedrowski is not a professional financial advisor or tax professional, rather an individual investor who analyzes investment strategies and disseminates his own analyses. All traders and investors should conduct their own research and due diligence prior to investing.