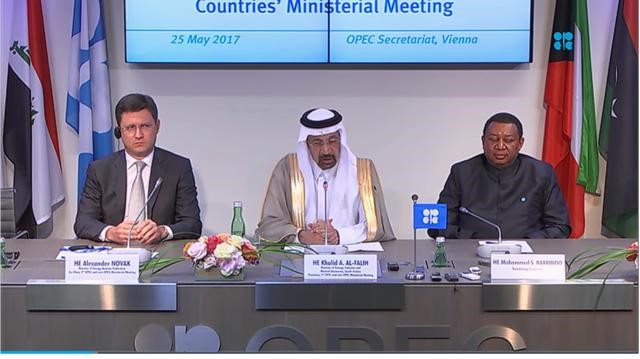

The drop in crude oil prices in the international market after the decision by OPEC to extend its production cut through March 2018 is not a major concern for now, the Secretary General of the group, Mohammed Sanusi Barkindo said. He's not worried about lower prices.

He explained that OPEC is only concerned with the fundamentals of supply, demand and inventories. He is not concerned about other market conditions. Presumably, he means the sentiment of oil traders.

That statement flies in the face of the extensive lengths Barkindo went to engage with hedge funds over the past year. And the CFTC Crude Oil Commitment of Traders reports show that OPEC lost the confidence of the financial traders it sought to, and had previously gained, leading up to the meeting last week.

A Sacred Beginning

Barkindo told Reuters, "It was at the Vatican that we first discussed the idea of OPEC reaching out to the financial players in the oil markets. The world of oil has changed, including the fundamentals and its dynamics. And so must OPEC."

OPEC's Secretary General met Citigroup's global head of commodities research Ed Morse in the Vatican's Sistine Chapel in the summer of 2016. There was an energy event held in the Chapel.

I had previously written on INO “OPEC Caught a Tiger By The Tail” that Morse reportedly arranged introductions between Barkindo and more than 100 hedge fund managers and oil buyers in Washington, D.C., New York and London, beginning in October.

OPEC Secretary General (R) with Mr. Ed Morse, Global Head of Commodities Research at Citigroup. Source: OPEC.

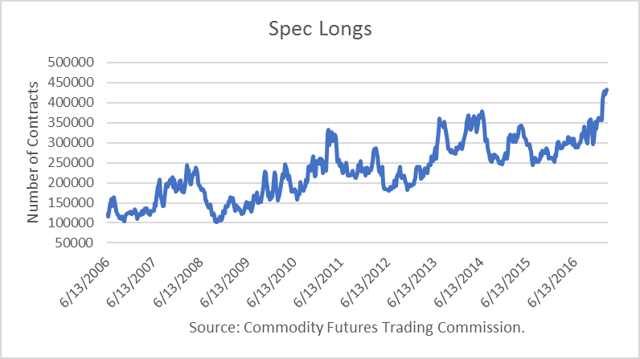

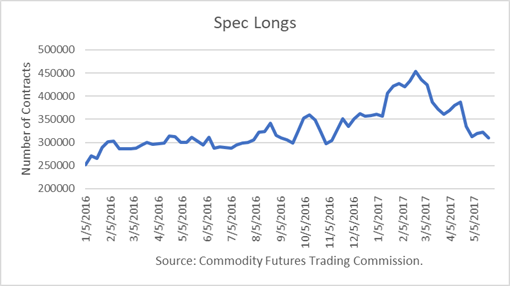

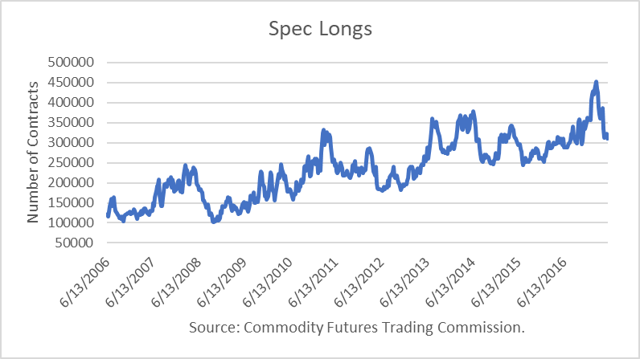

Barkindo's mission was to persuade the traders that OPEC was serious about reducing the glut. Mr. Morse said fund managers came away impressed. The hedge fund industry loaded up on long futures and options positions, reaching a new record level long by mid-February.

But U.S. oil data continued to show big crude oil stock builds, and the delayed OECD data was showing builds since December, and hedge funds (Spec Longs) began to bail from their record length. It was reported on May 5th that high-profile oil trader, Pierre Andurand, had closed out the last of his long positions after sustaining a 15%+ loss in 2017. Andurand had predicted oil prices would rise to $70 in 2017 and $90 in 2018. His thesis was not playing out.

In the CFTC data for the weeks leading up to the May 25th OPEC meeting, crude positioning revealed that the spec longs (hedge funds) were not buying OPEC's cut extension rumors, having lost money in 2017. And the data show a net decrease in long positions during May, as hedge longs continued to liquidate. (The price gains were based on buying by spec shorts, which trimmed their short positions, and are now poised to re-sell.)

Conclusions

OPEC duped hedge funds into buying their narrative of high compliance and a quick drop in inventories to the 5-year average. But OPEC members bit the hand that was feeding them higher prices. Hedge fund longs responded: "once bitten, twice shy." The loss of confidence of the hedge fund longs is a major failure for Barkindo and OPEC.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.