Silver hit a 3-month high last week, but there is still plenty room for gains on the way to the conservative upside target above $21 level.

Last week I analyzed the top gold stocks, and I thought it would be interesting to look at the silver stocks to see if there are good opportunities amid Silver's growth. My previous update on the top silver stocks ranked by P/E was posted in July. This time I will use ROE (return on equity) as a selection criterion.

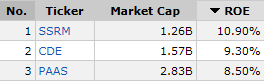

Table 1. Top Silver Stocks By Return-On-Equity (ROE)

Image courtesy of finviz.com

Top 3 silver stocks by ROE are SSR Mining Inc. (SSRM) (former ticker SSRI), Coeur Mining, Inc. (CDE) and Pan American Silver Corp. (PAAS) .

The leading silver stocks show pale performance compared to the top gold stocks, which have a ROE range between 10% and 30% while only one of the silver stock’s reading is above the 10% threshold. But the ROE above 8.5% is still an outstanding performance overall.

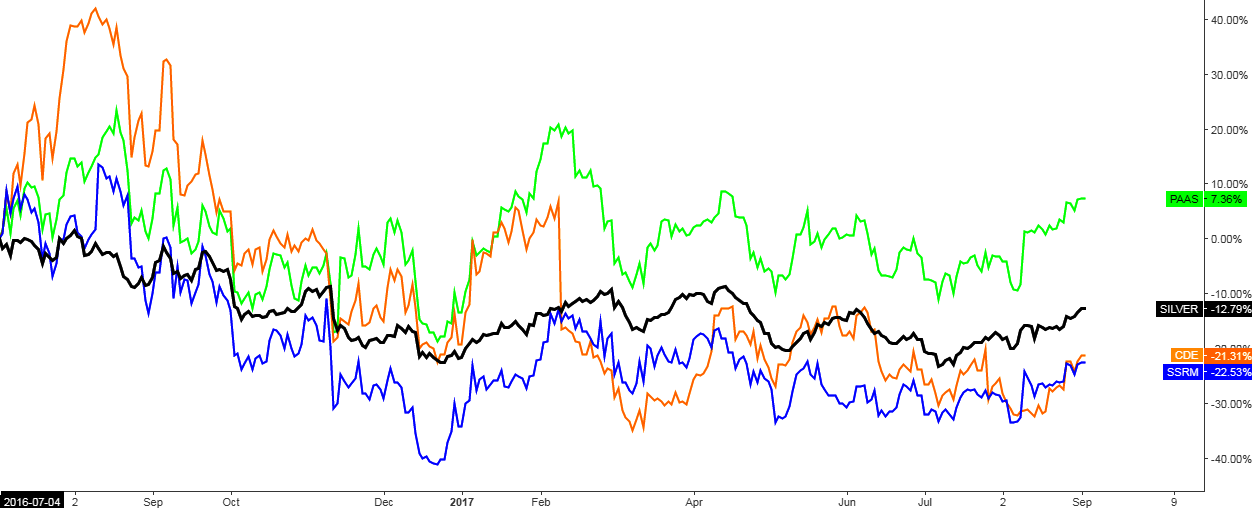

Chart 2. Top Silver Stocks By ROE Vs. Silver

Chart courtesy of tradingview.com

The comparative chart above starts from the 4th of July, 2016 when silver topped at the $21.13 level. The Flash-Crash in the silver market in July made a mess with the choice of the crucial growth points. That’s why I decided to avoid taking the July 2017 low as a starting point. Instead, I chose the previous major peak to see how the silver stocks survived amid this long lasting correction.

Only one stock beat the metal’s performance and even managed to erase its losses; The green line on the chart and ticker PAAS. This stock is leading the game despite being just the third in the list. Both CDE and SSRM are laggards with a huge gap of around 10% compared to the Silver's dynamics. I think you already guessed which stock can be a bargain hunting bet in today’s post.

Chart 3. SSRM Daily: Breakout

Chart courtesy of tradingview.com

SSRM (former SSRI) had the strongest structure among its peers in July. That is why I am not surprised that this stock finally breached the red trendline resistance last month.

This upside move could reach the previous top at the $15.84 mark. It could be confirmed when the price breaks above the upper part of the consolidation structure established at the $12.25 level. Risk should be limited below the $8.75 mark where May’s low is located. The risk/reward ratio is around 3, which is a very healthy number.

Chart 4. CDE Daily: Less Risk More Gain Potential

Chart courtesy of tradingview.com

Coeur Mining is the regular favorite among peers selected by different criteria. It usually has wild moves on the chart and it always tends to overshoot the metal’s trend both to the upside and the downside.

This time around the stock is struggling as it was walloped by the Flash-Crash and couldn’t recover for quite some time. One thing was active in the past two months – despite all troubles, the price managed to stay above the March low established at the $7.30 point. This level is still crucial and represents the first support for the current growth. Below it, there is no visible support, and when we have such a situation, we can use the magic of Fibonacci retracement levels to reveal hidden supports. The next support is located at the 78.6% Fibonacci retracement level at the $4.79 mark, which is way too far from the current price level.

CDE can’t boast of the breakout yet as does SSRM, but it already has tested the resistance. The RSI on the sub-chart screams of the future upside move as it crossed above the crucial 50 level last month. So let's watch and see if we could see a breach soon.

A break above the top of consolidation at the $10.24 is needed to confirm the bullish intentions. The target is located at the $16.41 mark where the former major high was established. In spite of unconvincing performance, CDE has both greater upside potential than the SSRM and the risk/reward ratio, which is around five now.

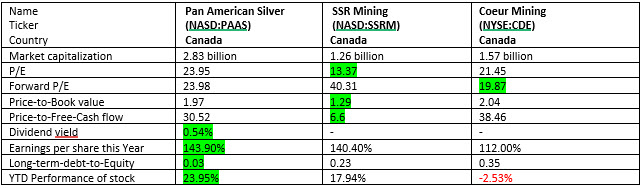

I added the table with fundamentals below for your information.

Table 5. Fundamentals

Source: finviz.com

Intelligent trades!

Aibek Burabayev

INO.com Contributor, Metals

Disclosure: This contributor has no positions in any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Worth watching the stock moves ...

Informative......