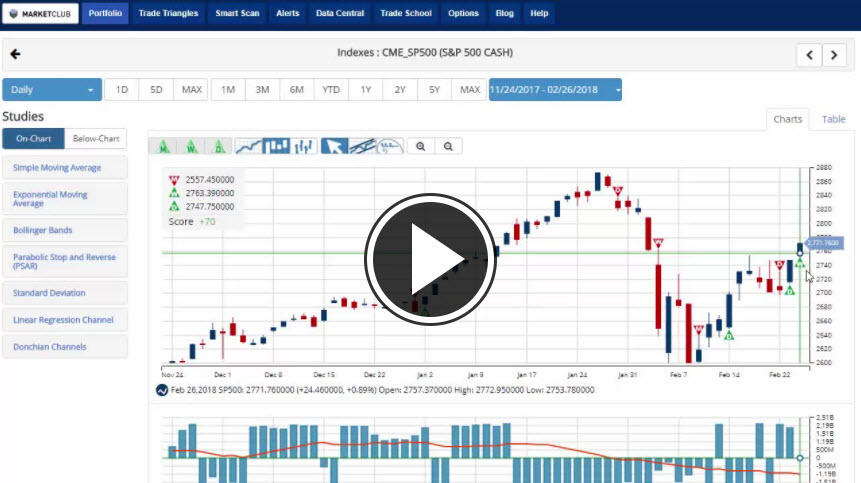

Hello traders everywhere. The stock market overall is trading at new three-week highs with the DOW, S&P 500 trading sharply higher for the third straight day triggering new green weekly Trade Triangles. The NASDAQ is trading higher as well, also triggering a new green weekly Trade Triangle.

Although the indexes are trading at three-week highs, they are still well off their all-time highs and have a lot of work to do to reach those levels again.

Do you think this correction is over, or we still due for a larger correction?

Key Events Scheduled For This Week:

- ECB President Mario Draghi speaks in Brussels on Monday.

- Powell testifies before a House panel on Tuesday. He'll discuss the Fed's Semi-Annual Monetary Policy Report and the state of the economy. Powell returns on March 1 before a Senate committee.

- Companies announcing earnings this week include Vale, BASF, Standard Chartered, Bayer, Lowe's, Galaxy Entertainment Group, Anheuser-Busch InBev, Peugeot, WPP, and London Stock Exchange Group.

- U.K. Prime Minister Theresa May delivers a speech on Britain's relationship with the European Union after Brexit.

- A barrage of data is expected out of Japan including retail sales and industrial production Wednesday, and capital spending Thursday.

Bank of Korea has policy decision and briefing on Tuesday. - In China, the official and Caixin purchasing managers' indexes on Wednesday and Thursday respectively may show growth momentum slowed slightly in February, though the signal may be clouded by the holidays.

Key Levels To Watch Next Week:

S&P 500 (CME:SP500): 2,872.87

Dow (INDEX:DJI): 23,360.29

NASDAQ (NASDAQ:COMP): 7,501.58

Gold (NYMEX:GC.G18.E): 1,327.70

Crude Oil (NYMEX:CL.J18.E): 64.97

U.S. Dollar (NYBOT:DX.H18.E): 90.45

Bitcoin (CME:BRTI): 6,194.46

Every Success,

Jeremy Lutz

INO.com and MarketClub.com

I think that the markets will try to suck as many retailers and some other investors possible then they will pull the plug again.

We will see another surge in the VIX index as the markets will downfall in a quick matter. Just my humble opinion.

I think we will see another ATH before we start going lower again. Maybe time to start hedging appropriately if that happens.