Options trading can serve as a powerful means to generate consistent income and mitigate portfolio risk while producing high probability win rates. Options trading allows one to profit without predicting which way the stock will move. Options aren’t about whether or not the stock will move up or down; it’s about the probability of the stock not moving up or down more than a specified amount. Options allow your portfolio to generate smooth and consistent income month after month without predicting which way the stock market will move. Options are a bet on where stocks won’t go, not where they will go. Running an option-based portfolio offers a superior risk profile relative to a stock-based portfolio while providing a statistical edge to optimize favorable trade outcomes. Options are a long-term game that requires discipline, patience, time, maximizing the number of trade occurrences and continuing to trade through all market conditions.

Put simply; an options-based approach provides a margin of safety with a decreased risk profile while providing high-probability win rates. Despite this favorable trading backdrop, occasionally options can be assigned and move against you despite managing the risk profile. How do you manage these unrealized losses and navigate these assignments to mitigate downside risk and ultimately sell your assignment at a net gain? This is the scary side of options that is rarely talked about, here I’ll demonstrate the actions I take to manage these assignments.

Assignment

Even though options trading provides a statistical advantage and generates high probability win rates, being assigned shares inevitably occurs. Briefly, when selling a put option, you agree to buy shares at an agreed-upon price (strike price) by an agreed-upon date (expiration) in exchange for premium income.

You collect premium income to compensate you for agreeing to buy shares at the agreed price by the agreed-upon date. As the contract lifecycle unfolds and the stock does not break below the strike price, profits can be realized early by buying-to-close or letting the contract expire to capture the entire premium. When the stock breaks down and trades below the agreed-upon price at expiration of the contract, the stock will be assigned.

For example, a stock trades at $50 per share and you sell a put and agree to buy shares at $47 one month into the future in exchange for $0.75 per share in premium or $75 since contracts trade in blocks of 100 shares. If the shares are assigned, then the effective share price would be $46.25 when factoring-in the premium income received. If the shares break down below $46.25 then shares will be assigned since you agreed to buy shares at $47. Any price movement below the $46.25 will result in an unrealized loss.

Results

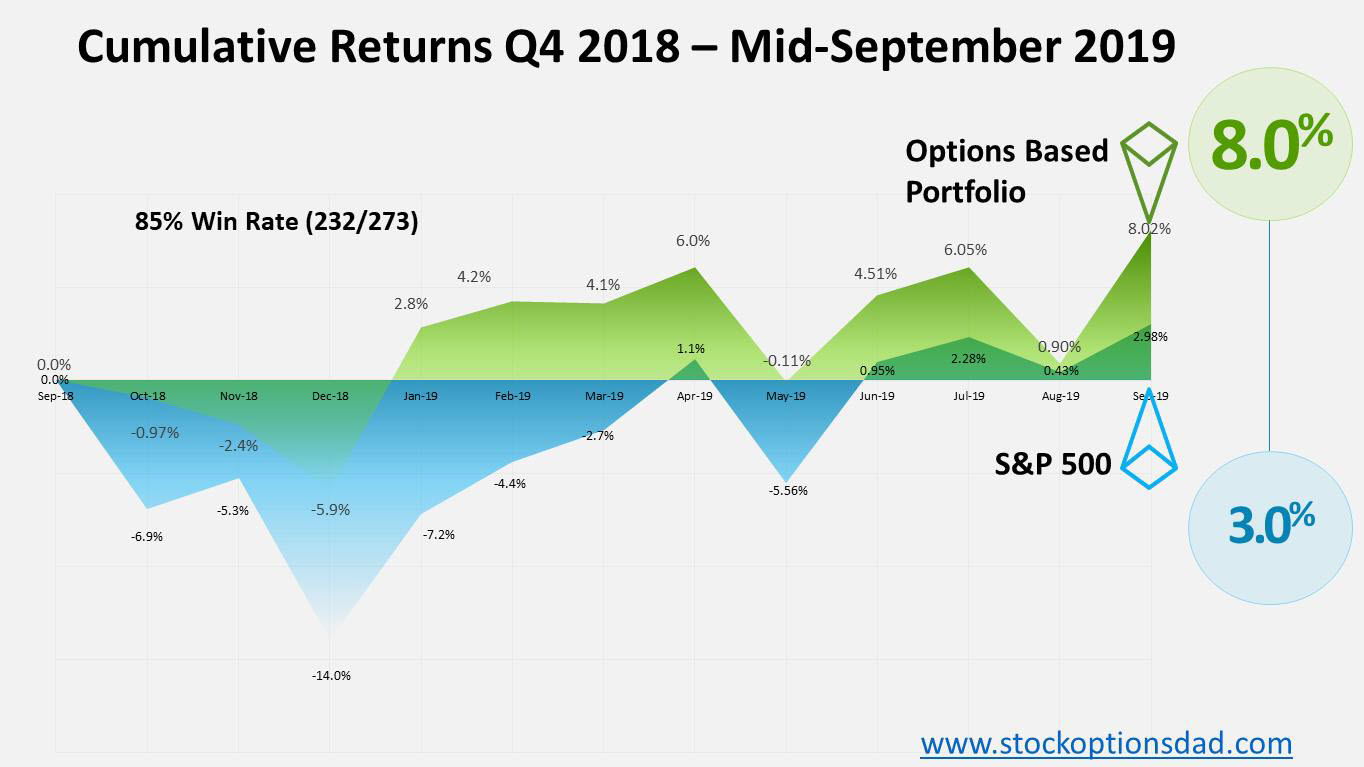

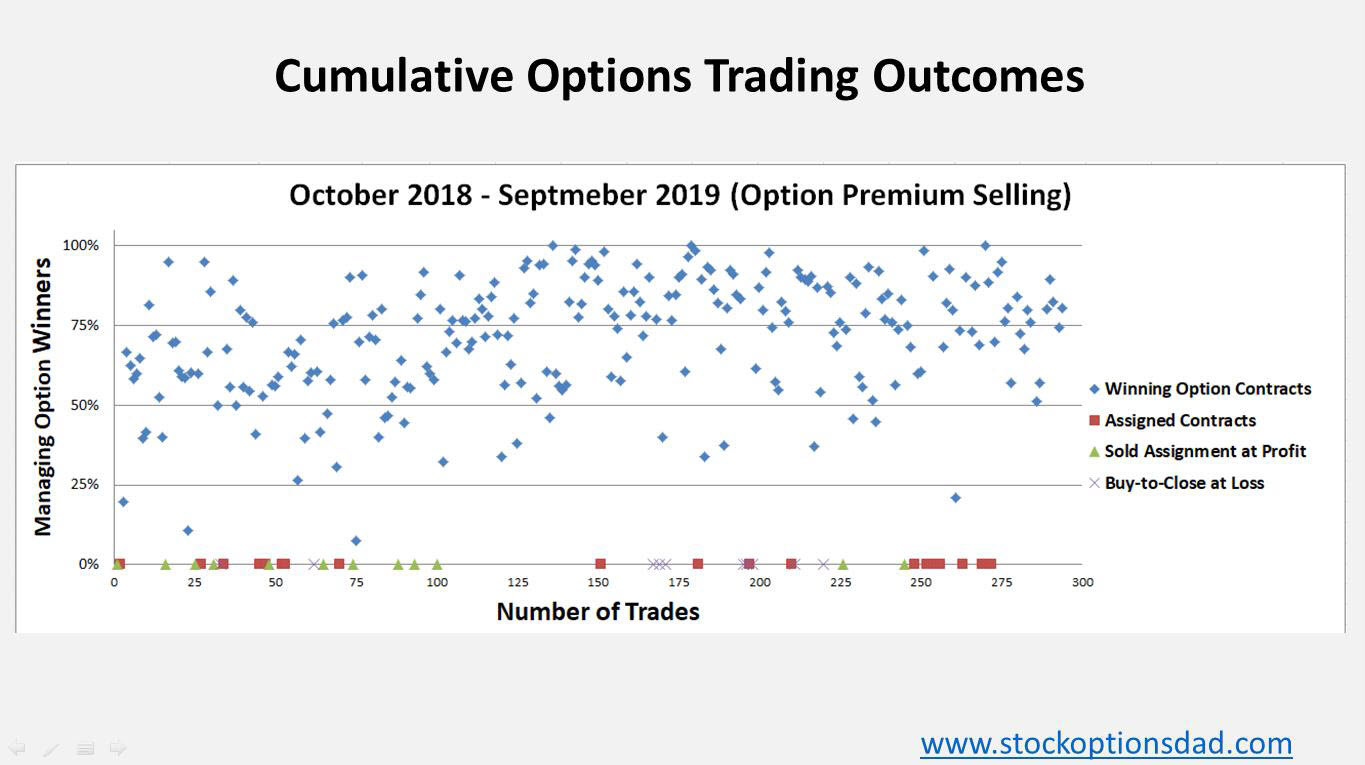

Before discussing actions surrounding option assignments, comprehensive results of this options-based approach is highlighted. Sticking to a set of fundamentals, an options approach can provide long-term, high-probability win rates to generate consistent income while circumventing drastic market moves. Over the previous ~12 months through both bull and bear markets my win rate percentage was 85% (232/273). The options-based portfolio outperformed the S&P 500 over the same period by producing an 8.02% return against a 2.98% for the S&P 500 (Figures 1 and 2).

Figure 1 – Comprehensive options-based portfolio approach outperformance

Figure 2 – Comprehensive dot-plot of all trades executed with outcomes (~290 trades)

Shares Assigned – Now What?

Ideally, the assigned shares will rebound back above your effective assigned price, and you can sell your position at a profit while collecting dividend payouts in the process. In the event this isn’t a possibility; there are a few different actions one can take to mitigate further downside risk and unrealized losses. These are keys to driving long-term portfolio appreciation while mitigating further losses.

1) Sell covered calls above your assigned price to strategically relinquish shares

2) Sell a combination of calls and puts to lower your share price, mitigate unrealized losses and potentially be assigned to lower overall purchase price

For #1 - It’s essential to restrict covered call selling to a level that’s above your assigned price so if your shares get called away, you can still profit from the overall position. Selling calls below this level in a stock that has already sold off in a meaningful manner runs the risk of bouncing unpredictably and breaking through your strike to force you to sell shares below your assigned price and realize a loss.

For #2 – I realize that selling additional puts isn’t the most popular idea however if you’re assigned shares at a certain level and the shares fall another 10%-20% then potentially buying more shares via selling a put will dramatically lower your cost basis. If you’re not assigned, then you collect the premium and still mitigate your unrealized losses.

Regardless, be patient, collect the dividend, and sell opportunistic calls above your assigned price and sell additional puts if the stock slides 10%-20% from your assigned price. This is in an effort to collect premium in a de-risked stock while potentially adding to your position to decrease your average share price.

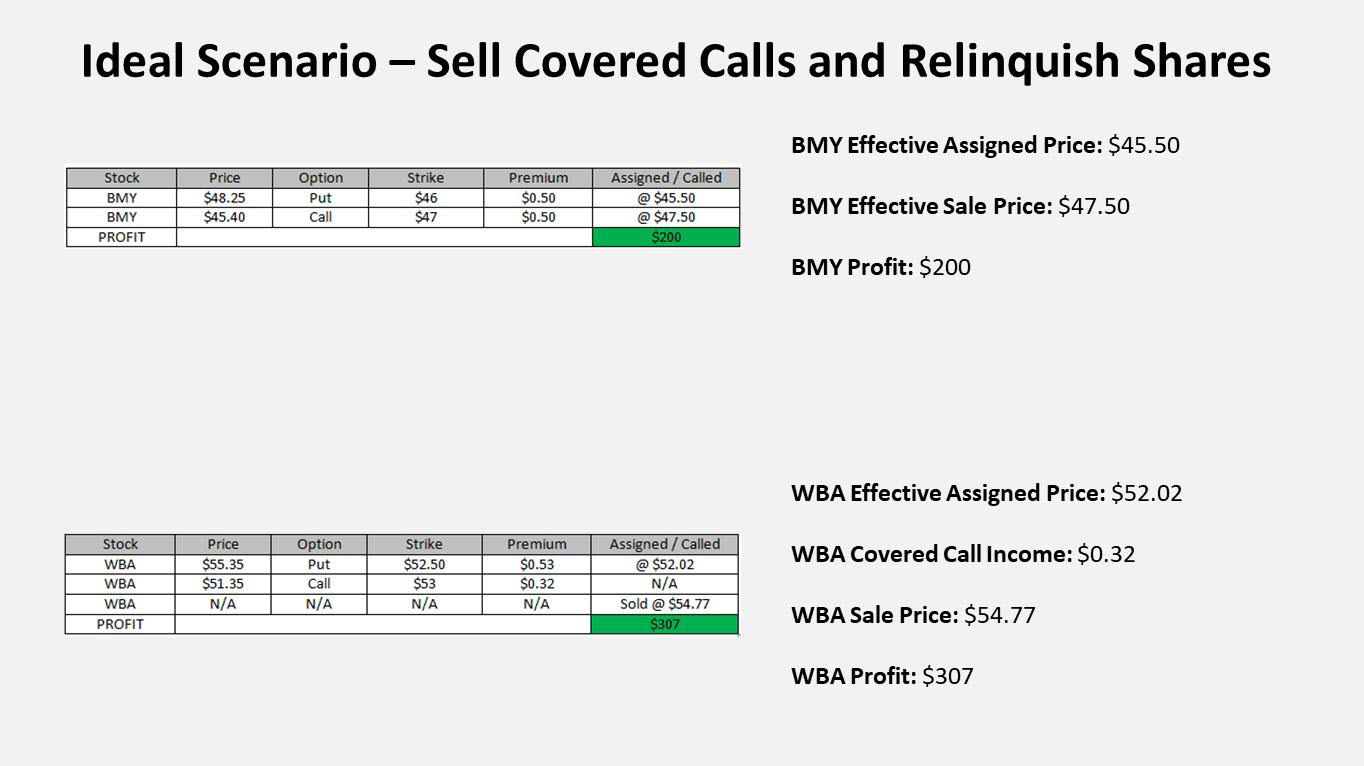

Ideal Scenarios – Sell Covered Calls and Relinquish Shares - #1

You can sell covered calls above your assigned share price to strategically relinquish shares via shares being called away, and the option exercised. Recently, I sold a put option on Bristol Myers Squibb (BMY) at a strike of $46.00 and received $0.50 per share in premium. I was assigned at an effective share price of $45.50, and I subsequently sold a covered call and relinquished my position at an effective share price of $47.50 for a total profit of $200 on the BMY position (Figure 3).

Walgreens (WBA) was assigned at $52.55 per share via a put assignment, and I received $0.53 per share in premium for an effective assigned price of $52.02. I sold a covered call for $0.32 per share in premium and then allowed time for the shares to appreciate. I sold the shares at $54.77 for a net sale price of $55.09 for a total profit of $307 on the WBA position. Here, I sold a covered call and allowed time for the shares to appreciate above my purchase price to realize a gain (Figure 3).

Figure 3 – Ideal scenarios of selling covered calls and relinquishing shares at a profit

Selling a Combination of Calls and Puts - #2

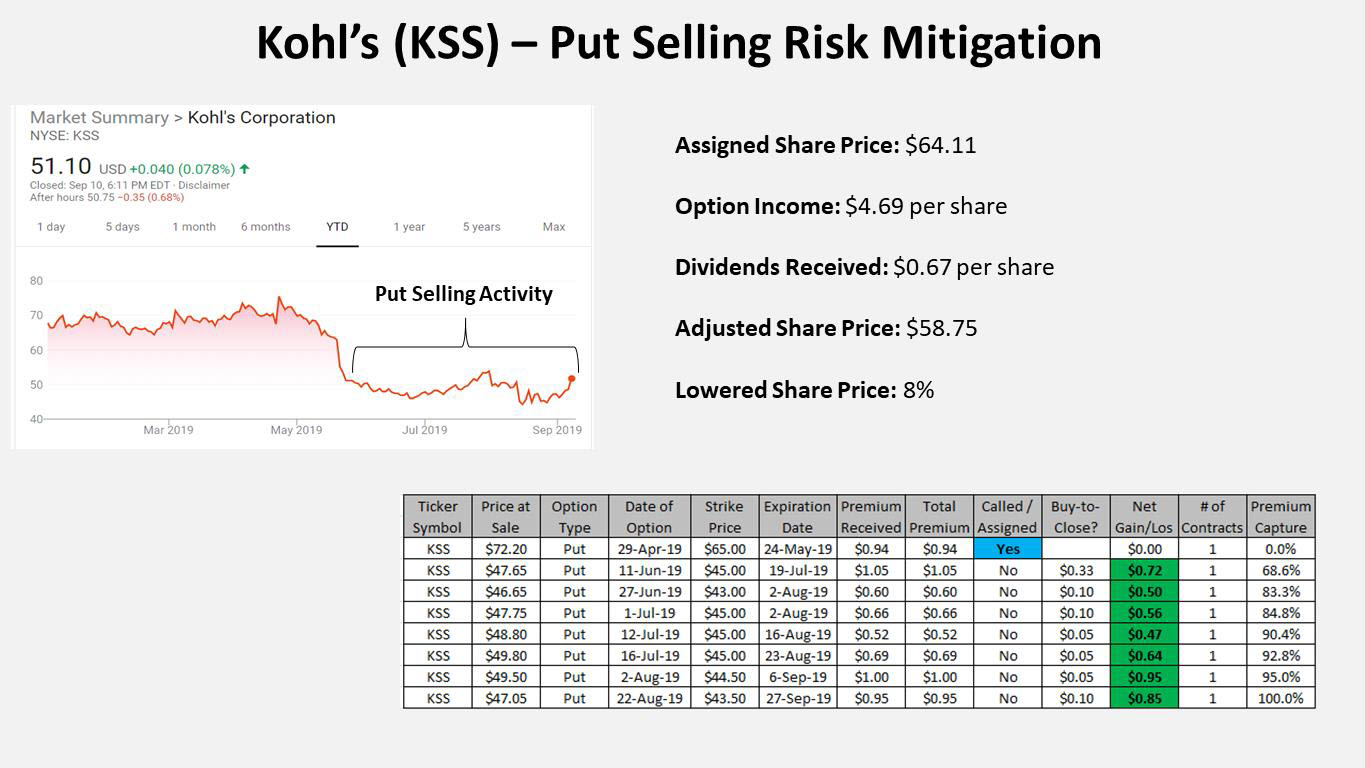

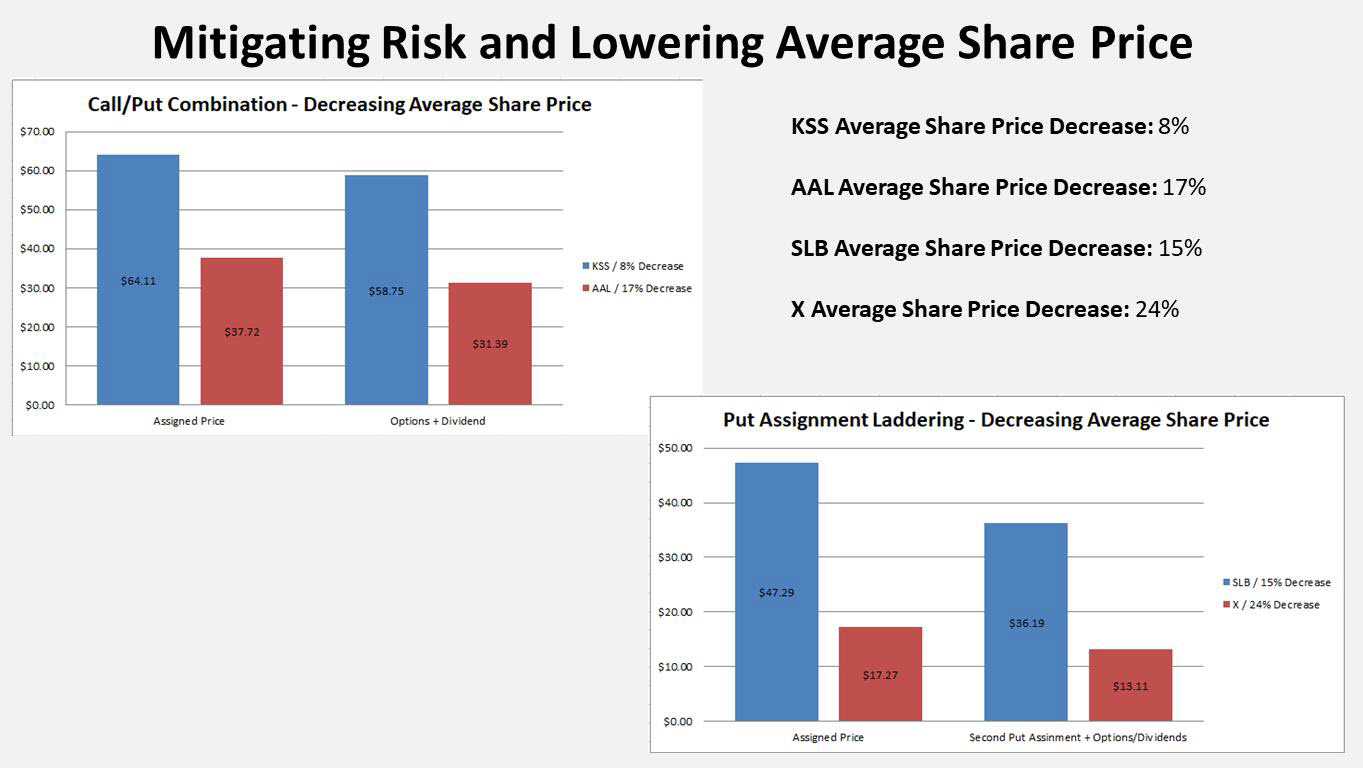

Selling a combination of calls and puts to decrease share price and mitigate unrealized losses can be an effective tool when stocks are moving against you. When assignments occur, sometimes the stock will continue to move lower, resulting in further unrealized losses. Just like a normal stock purchase, investors like to add to their position if the stock drops in an effort to lower your average share price while collecting the dividend along the way. By selling additional puts against my Kohl’s (KSS) position, I was able to decrease my average share price by 8%. By selling additional calls and puts against my American Airlines (AAL) position, I was able to decrease my average share price by 17% (Figures 4 and 5).

Figure 4 – Sell a combination of calls and puts to lower your share price, mitigate unrealized losses and potentially be assigned to lower overall purchase price

Figure 5 - Sell a combination of calls and puts to lower your share price, mitigate unrealized losses and potentially be assigned to lower overall purchase price

Selling Puts to Lower Cost Basis

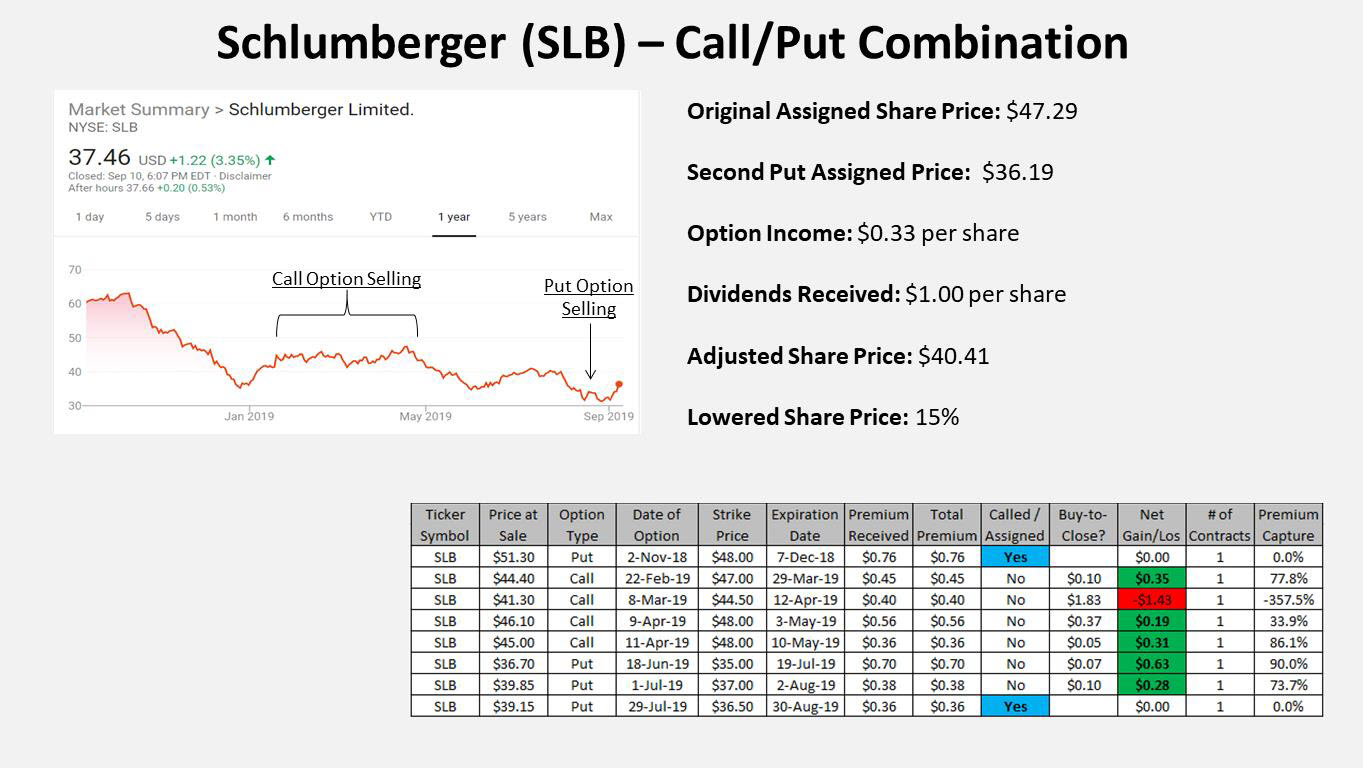

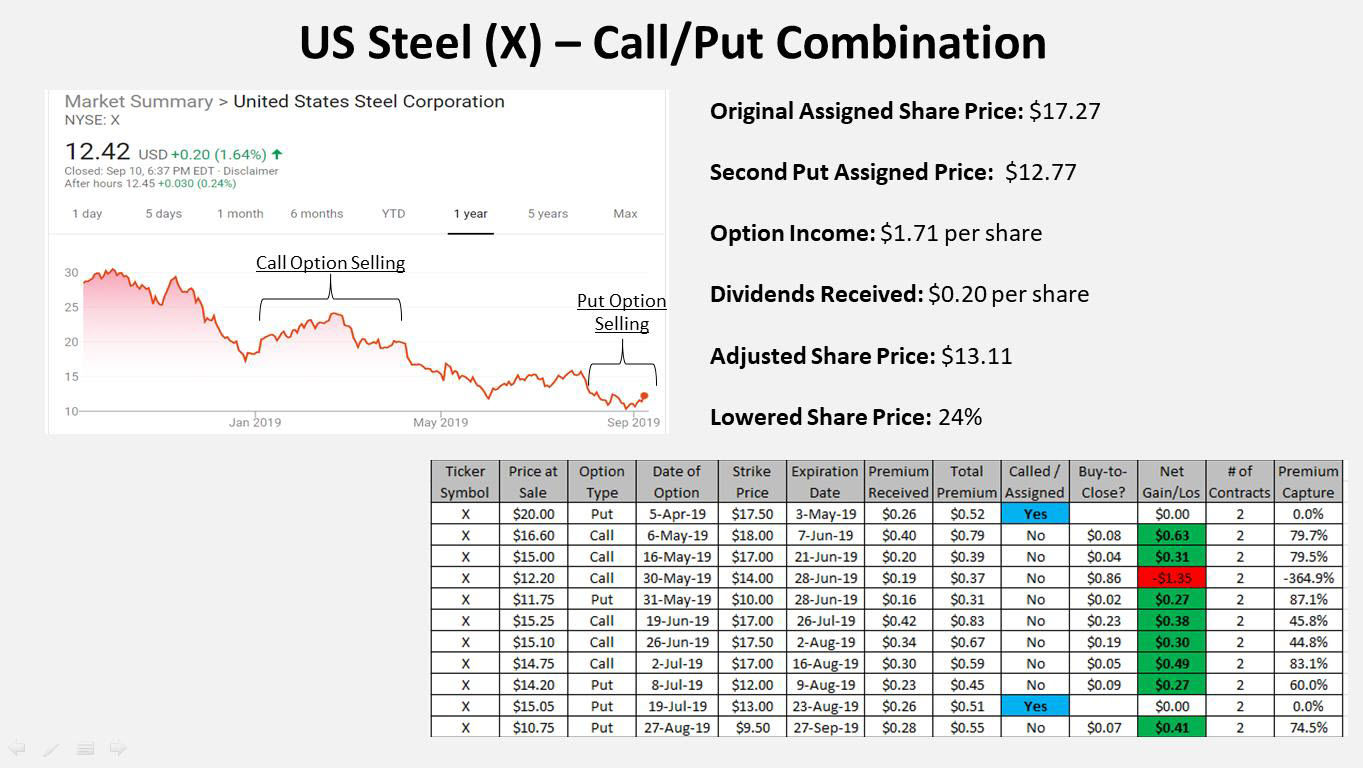

I know it’s difficult to be patient and watch your position lose money however being patient and looking for opportunistic scenarios to potentially add to your existing position to lower your average share price may bode well down the road. Decreasing your average share price gets you back to even sooner and allows you to sell covered calls at a lower strike while the position rebounds to your lower breakeven. By selling additional puts against my Schlumberger (SLB) position and being assigned again, I was able to decrease my average share price by 15%. By selling additional puts against my US Steel (X) position and being assigned again, I was able to decrease my average share price by 24% (Figures 6 and 7).

Figure 6 - Sell a combination of calls and puts to lower your share price, mitigate unrealized losses and potentially be assigned to lower overall purchase price

Figure 7 - Sell a combination of calls and puts to lower your share price, mitigate unrealized losses and potentially be assigned to lower overall purchase price

Figure 8 – Summary of selling a combination of calls and puts to lower your share price, mitigate unrealized losses and potentially be assigned to lower overall purchase price

Conclusion

Being assigned shares is the scary side of options that is rarely discussed or avoided altogether. Here I demonstrated what actions I take to manage my assignments. Option traders sometimes struggle as to what actions to take when shares are assigned. Often times, option traders lose the long-term perspective and discontinue the options based approach prematurely. However, if you’re patient and allow opportunities to present themselves, these assignments can be navigated to generate positive outcomes. Employing the strategies outlined above, one can mitigate further unrealized losses, decrease average share price and collect dividend income throughout the process.

Despite the statistical edge that options provide, occasionally options can be assigned and move against you despite managing the risk profile. When this happens, selling covered calls above your assigned price to strategically relinquish shares is the ideal scenario. Selling a combination of calls and puts to lower your share price, mitigate unrealized losses, and potentially be assigned again to lower overall purchase price is the alternative.

An options-based portfolio has allowed me to do something 92% of actively managed funds haven’t been able to accomplish and that outperforms the broader index on a consistent basis despite the rolling bull and bear markets over the past ~12 months. Options fundamentals provide long-term durable high-probability win rates to generate consistent income while mitigating drastic market moves. I’ve demonstrated an 85% options win rate over the previous ~12 months through both bull and bear markets while outperforming the S&P 500 over the same period by a wide margin producing an 8.02% return against a 2.98% for the S&P 500 with a lower risk profile. Taken together, options trading is a long game that requires discipline, patience, time, maximizing the number of trade occurrences and continuing to trade through all market conditions.

Thanks for reading,

The INO.com Team

Disclosure: The author holds shares in AAL, BAC, C, CVS, GPS, GE, HLF, KSS, SLB, TRIP, URBN, USO, and X. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.