2019 has ushered in one of the most surprising bull markets that nearly no one saw coming. Unfortunately, the vast majority of Wall Street analysts underestimated the strength of this bull market as we enter into mid-November. Expectations for 2019 were largely muted when factoring in a slew of potentially negative economic issues such as the U.S./China trade war, Brexit, inverted yield curve, potential recession, Federal Reserve actions, and the presidential impeachment efforts. Despite all of these headwinds, the indices continue to post record highs, with the Dow Jones and S&P 500 notching gains of 18% and 23%, respectively.

This market has been dubbed the “most hated bull market in history,” illustrating the point that the ability for anyone to predict market returns is a futile endeavor. Reiterating why 92% actively managed funds do not outperform their benchmark and why there’s only a 36% chance of picking a stock that will outperform the market. An options-based portfolio approach can offer a superior alternative to traditional stock picking and position your portfolio to thrive in any environment such as this surprise bull market. An option-based strategy mitigates risk and circumvents drastic market moves. Selling options and collecting premium income in a high-probability manner generates consistent income for steady portfolio appreciation in both bear and bull market conditions. This is all done without predicting which way the market will move. Options trading is a great way to generate superior returns with less volatility over the long-term regardless of market conditions such as this “most hated bull market in history.”

Options and the Most Hated Bull Market

Market headwinds aplenty coupled with coming off a tough 2018, Wall Street had a negative view of stocks for 2019, and as a result, the vast majority of analysts missed one of the best years of the longest bull market in history. This market continues to make new highs after new highs. Per CNBC, of 17 forecasters for S&P 500 price, just three have targets that are above where the broad market index traded as of November 4th, 2019, with still nearly two months left in the year. Furthermore, negative sentiment is seen in the put-call ratio (a measure of sentiment among options traders), has remained above one since mid-September, a contrarian indicator that the market could be headed higher due to overly negative sentiment.

An option-based strategy positions any portfolio to thrive when faced with these surprise market conditions (i.e., Q4 2018 and 2019 bull market). Despite these record returns for the broader indices, an option-based portfolio has kept pace with a lower risk profile and a significant portion of the portfolio in cash. Options insulate your portfolio from drastic moves in the broader markets while generating consistent income to allow your portfolio to appreciate month after month.

Options-Based Returns Keep Pace with Bull Market

“Alpha” (α) – A term used to describe a strategy's ability to beat the market. Alpha is also referred to as “excess return” or “abnormal rate of return,” eluting to the theory that markets are efficient. Thus there’s no systematic method to generate returns that beat the broader market’s returns. To illustrate this point, 92% of actively managed funds do not outperform their benchmark thus do not generate any alpha giving rise to the efficient market theory.

Those who subscribe to the efficient market hypothesis believe that there’s no edge or advantage when picking stocks. Thus, stock picking is a binary event and boils down to a 50/50 probability or simply chance. Everything that can be possibly known about a stock is known, and all the available information, technical analysis, and fundamental analysis are priced into the underlying stock price. As a result, the efficient market theory may be the Achilles heel of professional money managers’ performance and their inability to outperform their benchmarks. If the efficient market theory is correct, is there a strategy that places the statistical odds of success in one’s favor to generate alpha consistently?

The only way to consistently and reliably profit from efficient market behavior is via options trading. Options trading allows one to profit without predicting which way the stock will move. Options trading isn’t about whether or not the stock will move up or down; it’s about the probability of the stock not moving up or down more than a specified amount. Thus, running an option-based portfolio offers a superior risk profile relative to a stock-based portfolio while providing a statistical edge to optimize favorable trade outcomes.

Figure 1 – Empirical results over the course of October

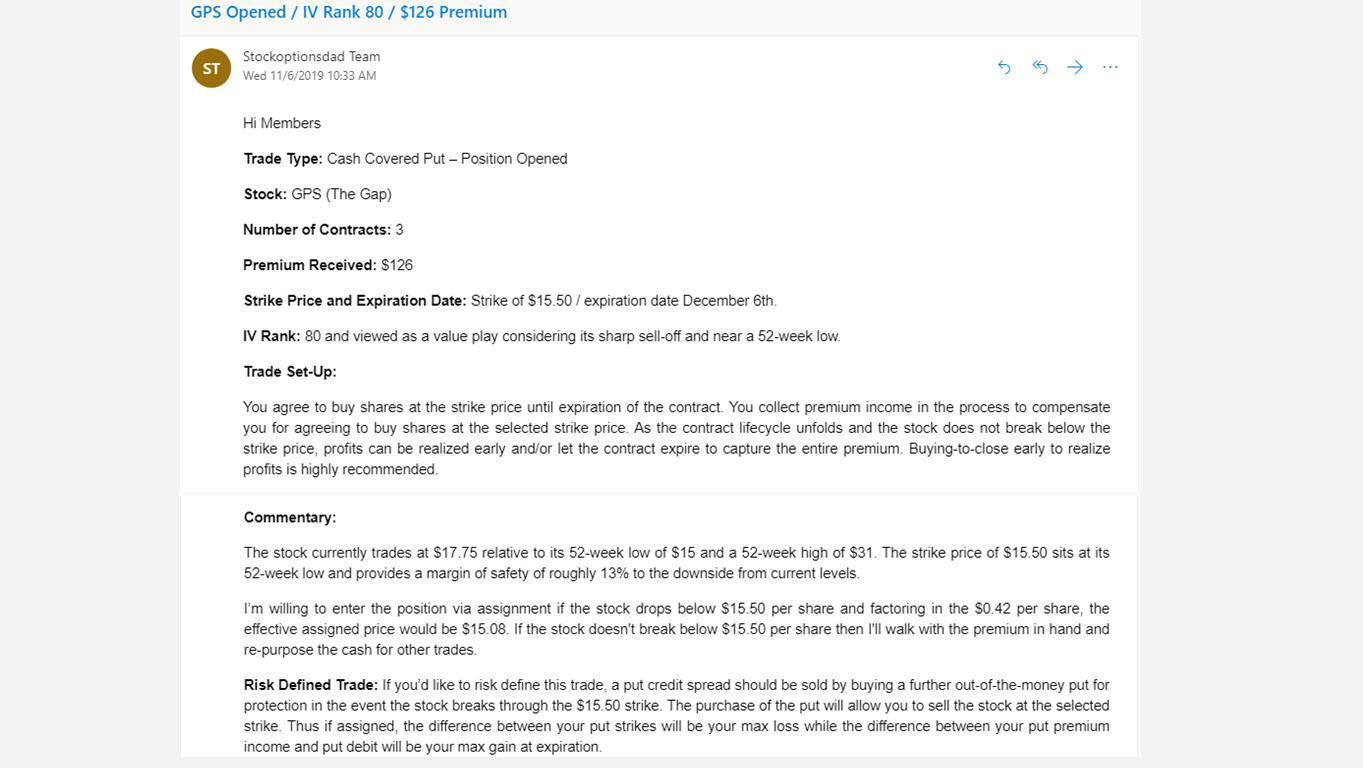

Figure 2 – Example of a trade which breaks out the details

Comprehensive Options Portfolio Results

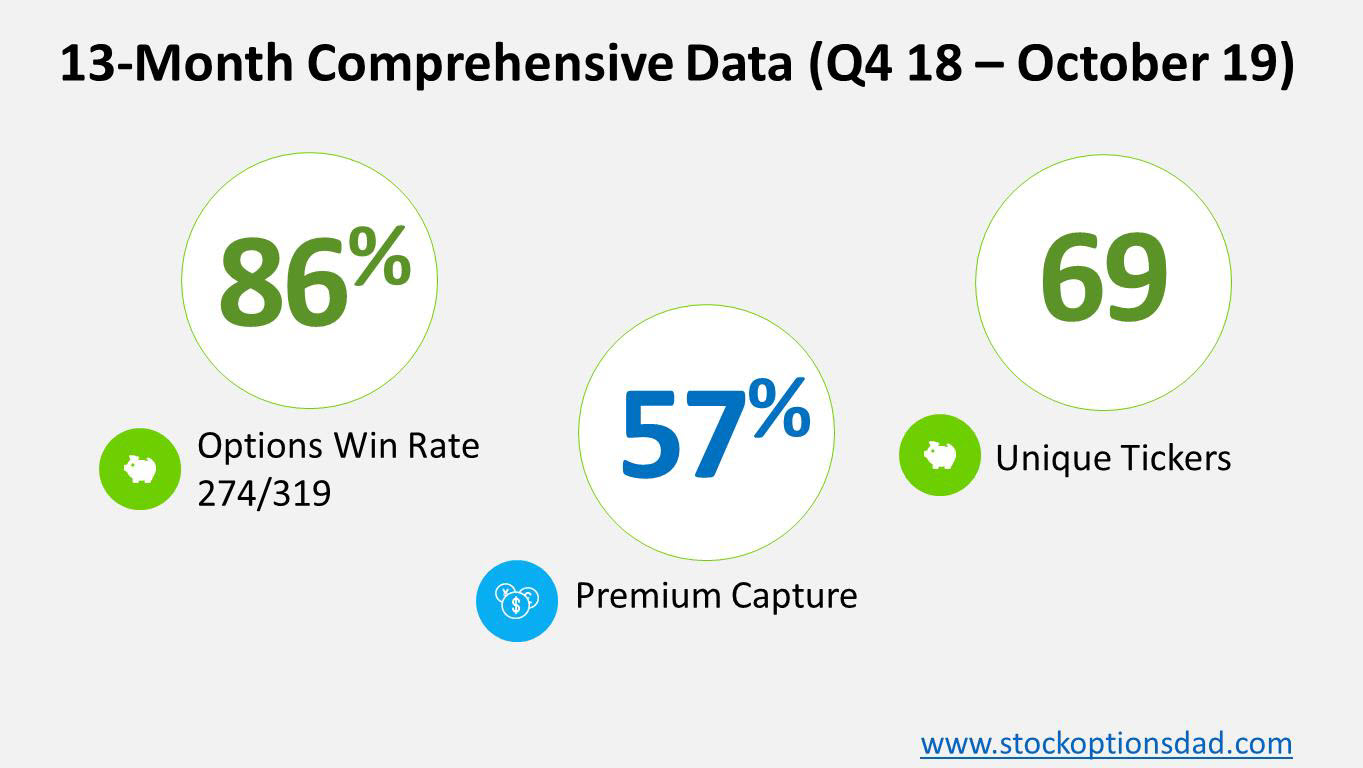

Empirical results demonstrate true alpha over the previous ~13 months through bull and bear market conditions, outperforming the index by a wide margin (Figures 3-5). An options-based approach provides long-term, high-probability win rates to generate consistent income while circumventing drastic market moves. My win rate percentage was 86% (274/319) while generating an 11.3% return relative to 5.6% for the S&P 500 (Figures 3-5).

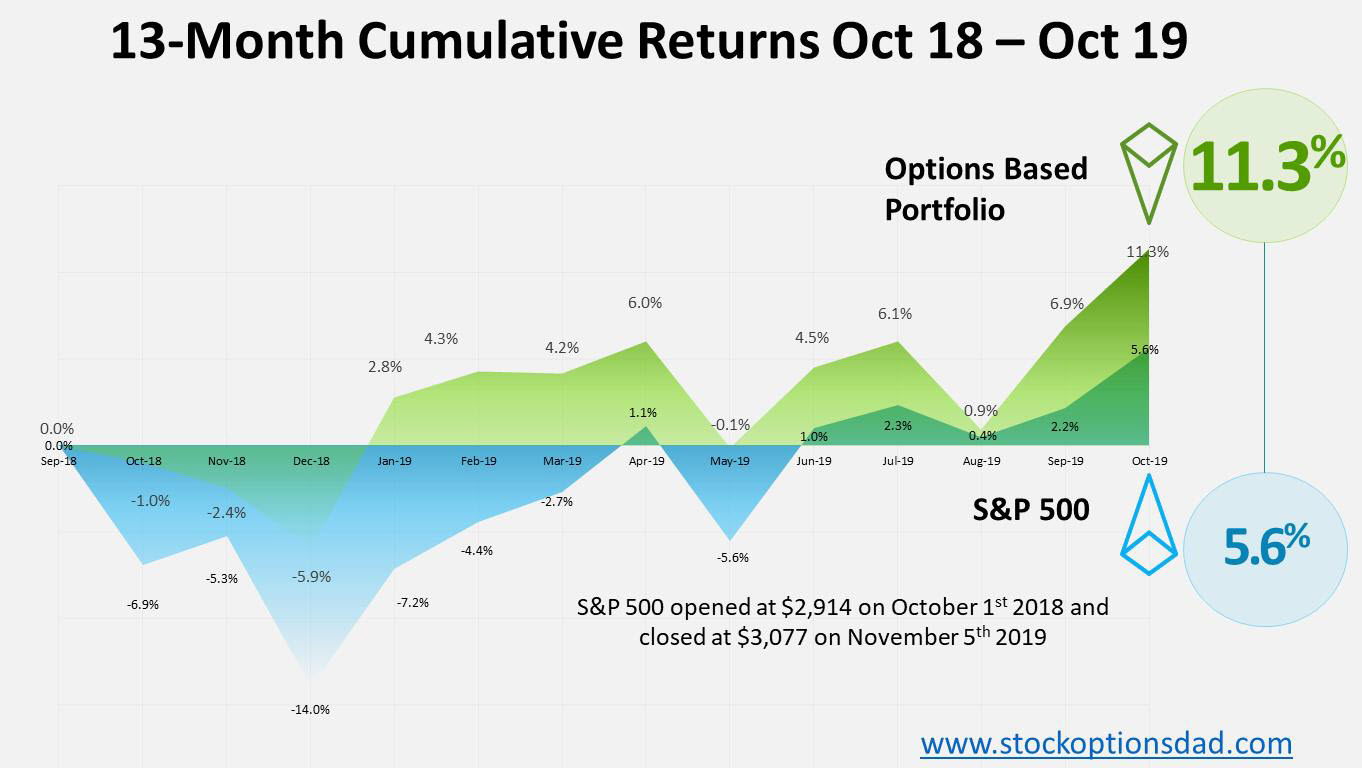

Figure 3 – Options based portfolio return (11.3%) in comparison to the S&P 500 return (5.6%) over the past ~13 months through both bear and bull market conditions. S&P 500 closed at $2,913.98 on September 30th, 2018, and closed at $3,077 on November 5th, 2019

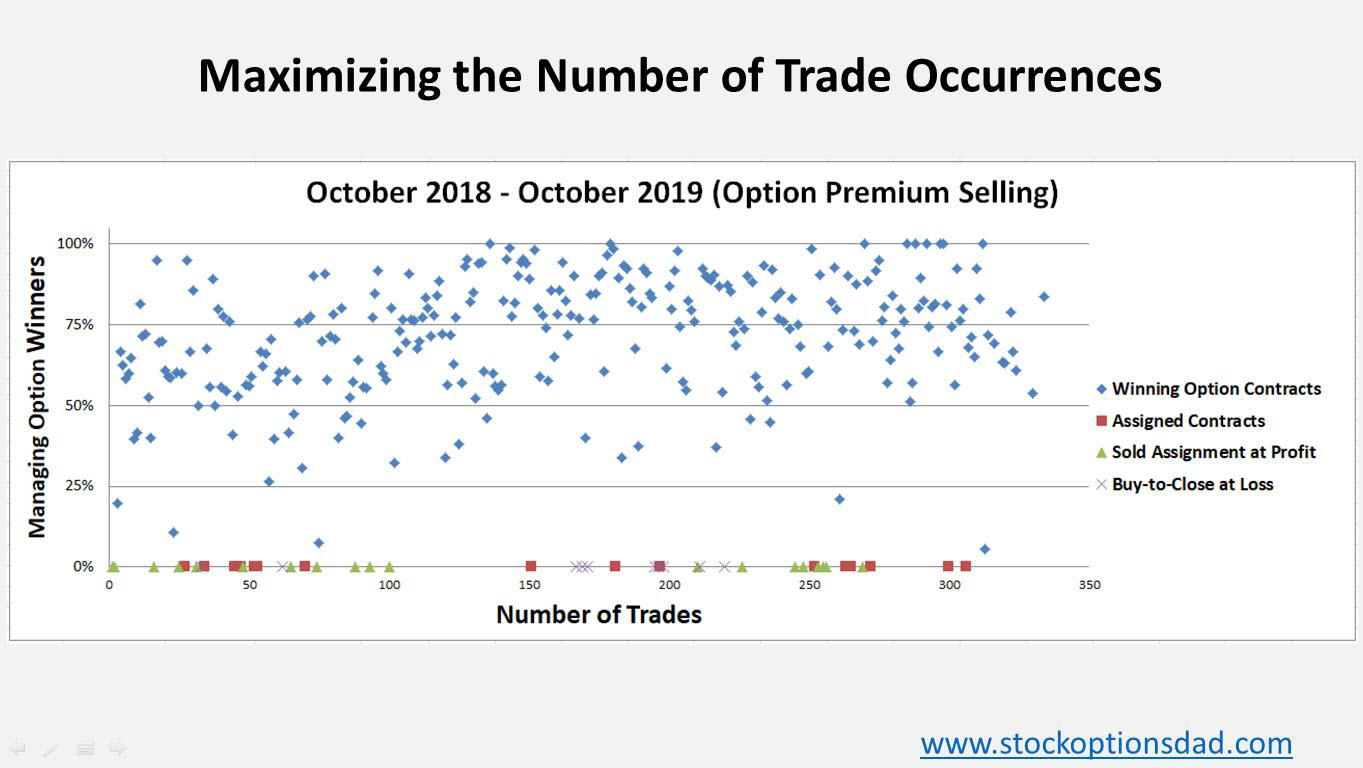

Figure 4 – Dot plot summarizing ~320 trades over the previous 13-month period

Figure 5 – Comprehensive options metrics over the previous 13 months

Conclusion

Options trading is a long-term game that requires discipline, patience, time, maximizing the number of trade occurrences, and continuing to trade through all market conditions. Put simply; an options-based approach provides a margin of safety with a decreased risk profile while providing high-probability win rates. The basic building blocks of running an options-based portfolio includes appropriate position sizing, diversity of tickers (stocks and ETFs), diverse sector exposure, trading through all market environments, maximizing the number of trades, managing risk, options liquidity, position-sizing, and taking profits early.

An options-based portfolio has allowed me to do something 92% of actively managed funds haven’t been able to accomplish, and that outperforms the broader index consistently despite the volatility in Q4 2018, May 2019, August 2019, and this surprise bull market that developed over 2019. Selling options with a favorable risk profile and a high probability of success is the key. Options provide long-term durable high-probability win rates to generate consistent income while mitigating drastic market moves.

Thanks for reading,

The INO.com Team

Disclosure: The author holds shares in AAPL, AMZN, DIA, GOOGL, JPM, MSFT, QQQ, SPY and USO. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.