Analysis originally distributed on September 20, 2017 By: Michael Vodicka of Cannabis Stock Trades

Germany is quickly beginning to look like the next mega market for medical and eventually recreational cannabis. This is creating another big opportunity for savvy investors who are following the story and staying ahead of the curve.

Today, I am going to show you how you can profit.

But first - a little background.

Germany is the beating heart of Europe.

It is the largest country in the European Union with a population of 81 million.

It also has the largest economy in the European Union by a long shot. Its gross domestic product clocked in at $3.5 billion in 2016. Its per capita GDP of $42,000 makes it one of the wealthiest countries in Europe.

Companies that can gain access to the German consumer market have an opportunity to access tens of millions of wealthy consumers.

This is particularly true in Germany's young medical cannabis market.

Germany Voted to Overhaul its Medical Cannabis Program in January of 2017

Medical cannabis has actually been legal in Germany since 2005. However, it was difficult to get a permit, and after that, you basically had to grow your own stuff.

In January of 2017, Germany's parliament voted unanimously for a massive overhaul of its medical cannabis program.

The new law went into effect in March.

Here's a direct quote from Freedom Leaf:

Patients are now able to receive up to five ounces per month at the cost of $12 per ounce under public health insurance (which covers 90% of Germans). They can take their doctor's prescription to any licensed dispensary or pharmacy, to get it filled.

More than 1,000 patients have registered with the program. That number is expected to grow to between 5,000 and 10,000 per year for the next several years, depending on how doctors respond to government education efforts and patient demand.

This program is not as liberal as those in the United States and Canada.

For example, in California, you can get a medical card if you sneeze the wrong way. I'm kidding but barely.

In Germany, medication will only be accessible to patients suffering from a small group of serious conditions such as cancer, glaucoma, HIV/AIDS, Hepatitis C and Parkinson's diseases to name a few.

Germans must also receive a recommendation from a doctor that indicates cannabis is a last resort.

However - despite these initial limitations - this new legislation is a big win for Germany's cannabis market and cannabis investors.

- Medical cannabis will now be sold in pharmacies.

- It will be covered by insurance.

- As the program evolves, restrictions will loosen, and more conditions will be added.

And finally - and maybe most important of all - I also believe Germany's medical program sets the stage for a recreational program. We see this cycle play out in Canada right now.

In 2014 Canada implemented a huge overhaul of its medical cannabis program that has been widely considered a huge success. Today, less than four years later, Canada is set to become the first country in the developed world to legalize recreational cannabis in the summer of 2018.

I believe we are going to see this same cycle play out in other countries such as Germany and Australia.

Particularly because Germany and the broader European Union are struggling with too much debt and not enough tax revenue. I believe billions of dollars in potential new taxes will be simply too much for these countries to ignore.

Despite all the great news - there's just one little catch here.

For the time being, Germany isn't growing any cannabis domestically. When that happens, I will let everyone know.

So in the meantime, Germany is importing cannabis from foreign trading partners.

Below is a list of three companies that are making big moves to profit from Germany's young cannabis market.

3 Stocks Set to Profit from Germany's Cannabis Market

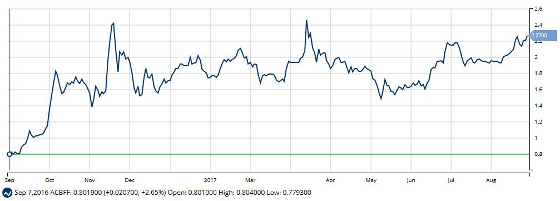

Aurora Cannabis Inc. (NASDAQ:ACBFF) is one of the largest cannabis companies in Canada with a market cap of $780 million. On May 26 Aurora announced it had acquired Pedanios, a leading wholesale importer, exporter, and distributor of medical cannabis in the European Union.

Directly from the press release:

Pedanios is a federally licensed medical and narcotic wholesale, and GMP inspected narcotic import company, holds all relevant licenses and permits, and has been successfully importing, exporting, and distributing cannabis for medical purposes since December 2015, into and within the EU.

Pedanios wholesales medical cannabis to a growing number of pharmacies - over 750 as of today - and offers the widest selection of products of any distributor in the German market, including ten of the fourteen products approved by the Bundesopiumstelle, a body of the German federal Health Ministry.

On the chart, Aurora is back within striking distance of its all-time high. Take a look below.

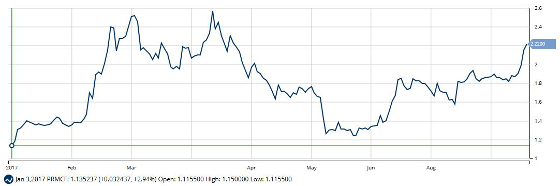

Cronos Group Inc. (NASDAQ:PRMCF) is also one of the largest cannabis companies in Canada with a market cap of $291 million. On September 1, Cronos announced that its wholly-owned subsidiary Peace Naturals Project Inc had entered into a supply agreement with Cannamedical Pharma, a pharmaceutical and narcotics wholesaler that is federally licensed for narcotics import. As of September 2017, Cannamedical is the fastest growing cannabis retailer in Europe with a network of 781 pharmacies and expectation to reach 2,500 by the end of the year.

Cronos was weak with the broader cannabis sector in the first half of 2017, but shares have rebounded sharply and once again in rally mode. Take a look below.

Here's the most speculative play of the group - and also possibly the company that offers the most leverage to the German market and potential upside.

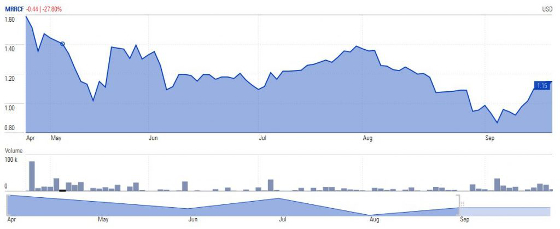

Maricann Group Inc. (NASDAQ:MRRCF) is a Canadian licensed cannabis company that is making a big move into Germany. Unlike the previous two companies, Maricann is still tiny. According to Morningstar and Ycharts it has a market cap of just $750,000.

Maricann purchased a food production facility from Cargill earlier this year located in Dresden, Germany for $3.8 million. Maricann is now in the process of building a 500,000 square foot cannabis greenhouse at this location.

There is still a lot of risk in this project. Even the best-laid plans need to be well executed. But if Maricann can pull off building this greenhouse it will be the largest in all of Europe and serve as a distribution hub to the entire European Union.

This is definitely a cannabis stock to keep your eye on. I will be sure to keep everyone posted.

On the chart, Maricann has been weak. Shares have rebounded recently but are still within 25% of the 52-week low. I view this weakness as a chance to buy ahead of the curve. Take a look.

The Big Picture

I will be keeping a very close eye on Germany. I see this as one of the best opportunities in the entire global cannabis market. If I see new ways to profit I will be sure to let everyone know.

Enjoy,

|

Michael Vodicka |

The information contained in this post is for informational and educational purposes only. The trading ideas and stock selections represented on the Cannabis Stock Trades website are not tailored to your individual investment needs. Readers and members are advised to consult with their financial advisor before entering into any trade. Cannabis stocks carry a certain level of risk and we accept no responsibility for any potential losses. All trades, patterns, charts, systems, etc. discussed are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect those of the publisher.

The organic Dutchman. Tgod we u.s.a. could not buy it as not available. That's wrong though we wish to trade.