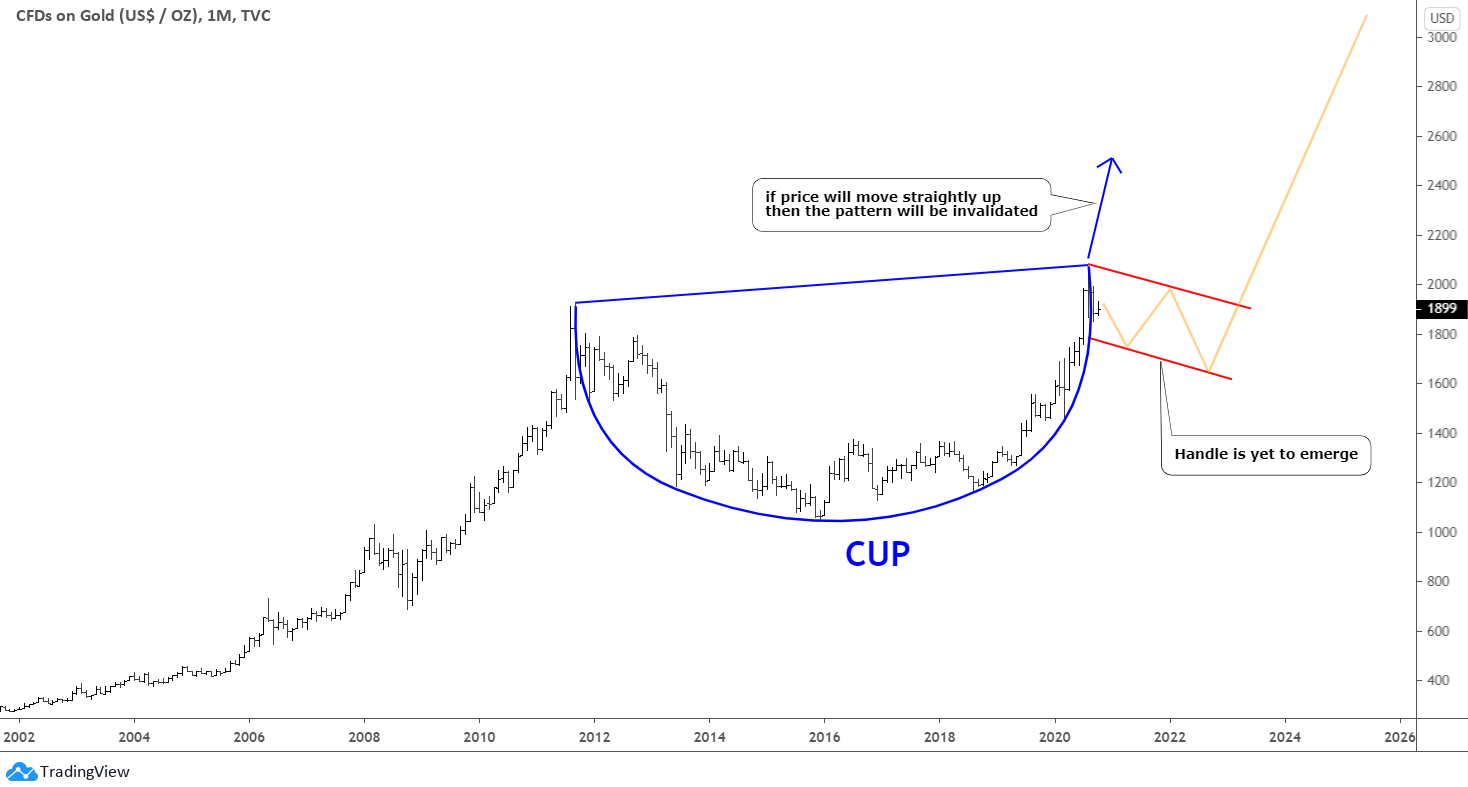

Back in October 2020, one of our readers suggested that the famous Cup & Handle pattern could have been built in the gold chart. I have checked his idea and visualized it in that very chart below from the past.

At that time, the main element Cup had already been shaped (blue). The final part of Handle was yet to appear. I highlighted the hypothetical trajectory with an orange zigzag in the declining red channel.

Let's see what is going on in the gold futures monthly chart below to check if that assumption came true. Continue reading "Gold Update: Handle Is Broken, Cup is Next, Target $2,800"