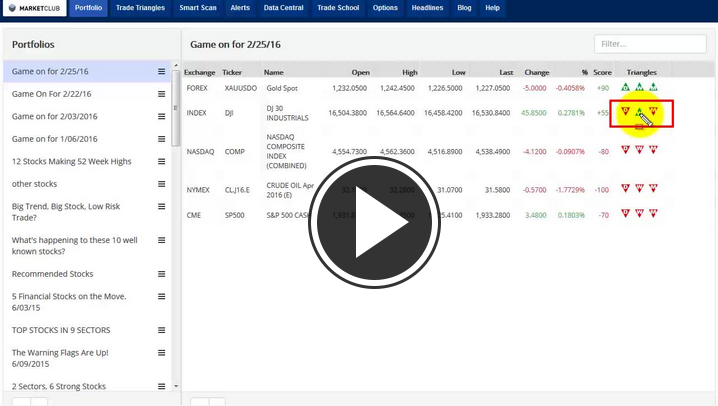

Hello MarketClub members everywhere! Despite the rally on Friday, there's been little change to the overall status quo of a broad trading range that I believe the indices are in.

Indices

On Friday the DOW (INDEX:DJI) closed at its best levels in 10 weeks, bringing it back up to the Nov/Dec lows which should act as natural resistance. The Dow is still in a 61.8% Fibonacci close-only retracement mode and should begin to falter around current levels. That's not to say that it can't go a little higher, but I think that it's doubtful that it can sustain higher values.

You can see much of the same picture with the S&P 500 (CME:SP500) as it is back into an area of Fibonacci resistance. I still believe that this index is cranking out a major top which began in August 2014. This week should be an interesting one as I expect to see more two-way trading, the key of course is where it closes Friday. Continue reading "This Is Status Quo Time"