There is an age-old question asking: How do you determine if a trader is biased? Show him a chart and ask where he thinks the market would go and then show him the same, but reversed chart and if the answer is the same, then this trader is indeed biased. We call such a trader a Perma-Bull or a Perma-Bear. The market sentiment is often split even as there are a lot of biased traders and market is then trapped within a range as there is no dominant opinion among the participants.

Every day I see how the trading community spreads opposite signals in any instrument creating an overwhelming sea of information where it’s hard for novice traders to focus and make a trading decision. Different levels of experience and fantasy generate the diversity of chart patterns and models. People change time frames and squeeze or expand charts; all of this affects the perception and therefore, the final decision.

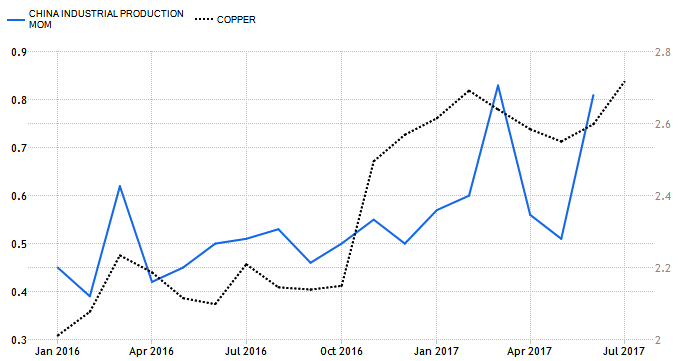

Let’s perform an educational experiment with two patterns that I found on different time frames for the same instrument, copper. I will add two separate charts with those patterns followed by explanations. I am eager to see what you think about the outlook for this instrument after reading and voting on the pole at the end of the article. Continue reading "Copper On Big Time Frame Charts: $0.6 or $6?"