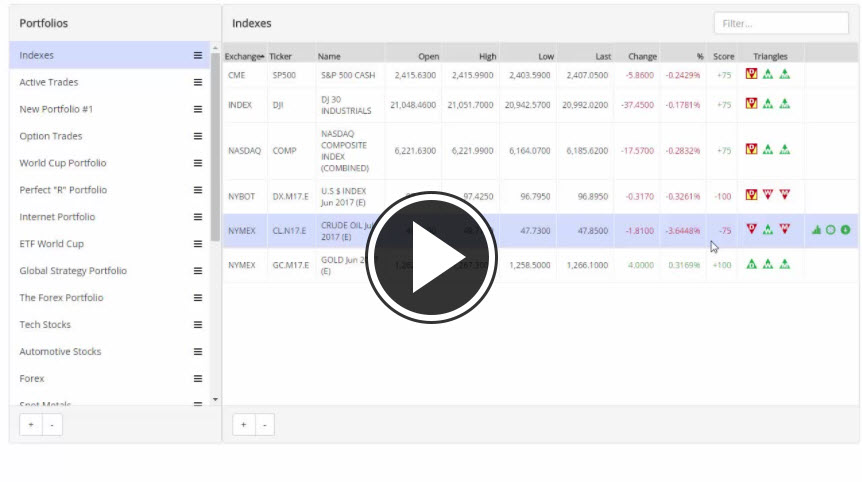

Hello MarketClub members everywhere. The Nasdaq has fallen more than 1% today, retreating from an early record and turning sharply lower for the week. The technology sector has abruptly fallen this afternoon on what could be viewed as profit taking after the recent run-up.

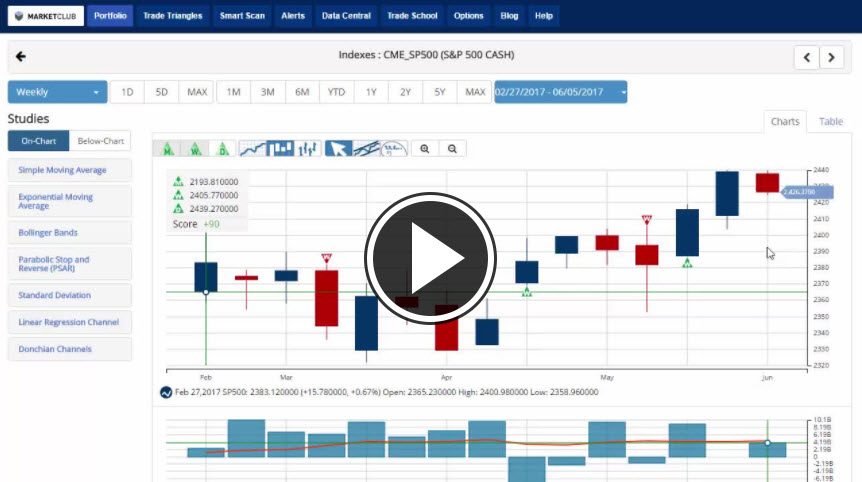

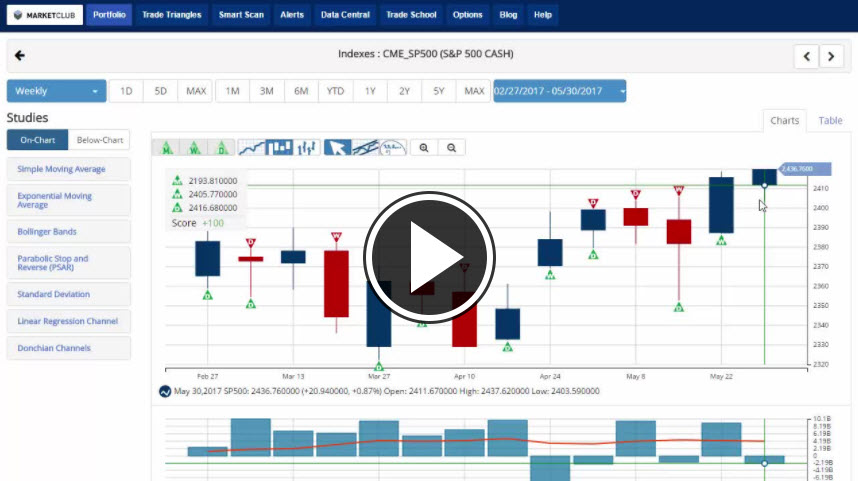

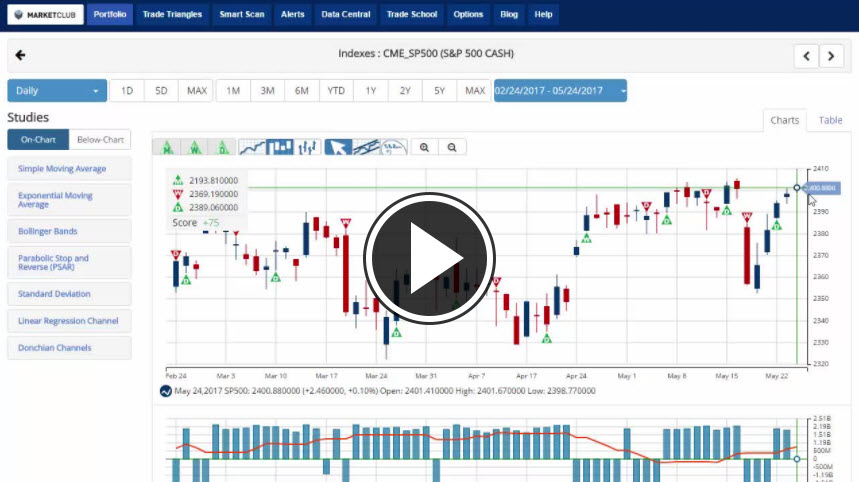

The Dow is fighting to stay in positive territory for the day and week while the S&P 500 has turned slightly lower for the day and the week as gains in both financial and energy shares offset the losses in the tech sector.

Key levels to watch next week: Continue reading "Tech Selloff Ruins Record Day"