Last week the Organization of the Petroleum Exporting Countries or OPEC announced that the group had to come an "agreement" to reduce oil production. The new deal slated to cut production from an estimated 33.2 million barrels per day down to 32.5 million barrels per day.

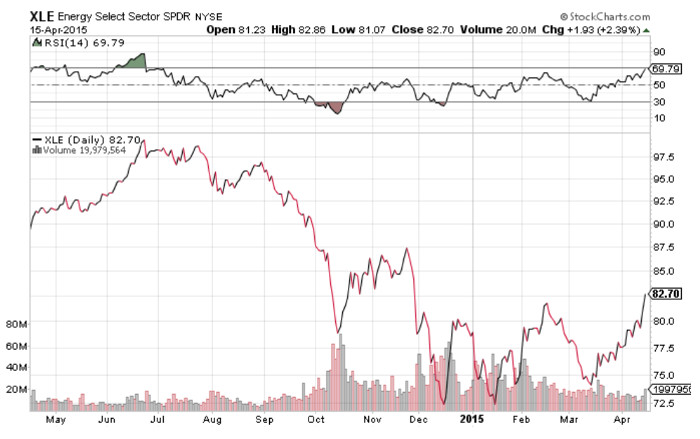

While some Wall Street analysts don't believe the production reduction will actually happen, the fact remains that since OPEC made the announcement, the price of oil is up rather dramatically. Prior to the announcement oil was trading around the $44.50 range and has since jumped to the $50 range.

Many investors are looking at the price of oil and wondering how they can get a piece of this action. Let's take a look at three Exchange Traded Funds you can buy if you believe oil prices will continue to increase. Continue reading "3 ETFs To Buy If You Think Oil Will Continue To Rise Following OPEC's Decision"