We have passed the middle of the year, so it’s time to announce the result of the 7th Pendulum swing pushed this January. The multiple winner Palladium and the earlier loser Lumber were put on the starting point at the beginning of this year.

Let’s see below which one you favored.

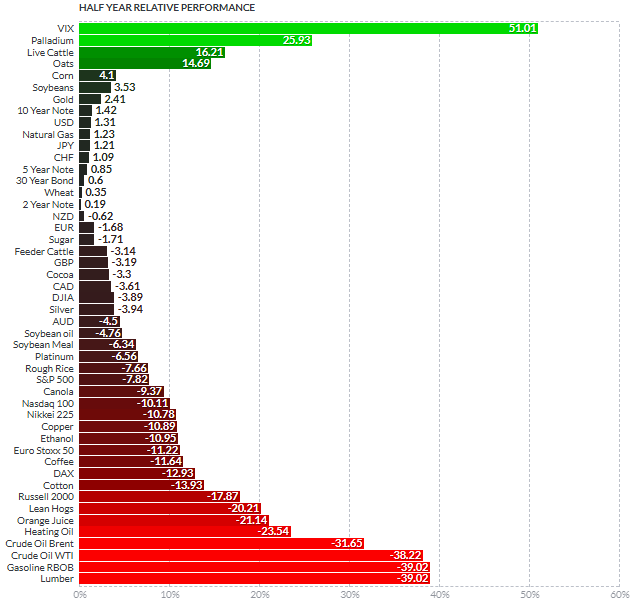

Most of you had bet that the metal would beat the forest product. And it appeared to be the right choice! This option was against the Pendulum effect as the lumber was thought to be the winner. I understand the majority’s decision as palladium was on the news as it hit the all-time high levels to become more precious than the gold amid insatiable demand.

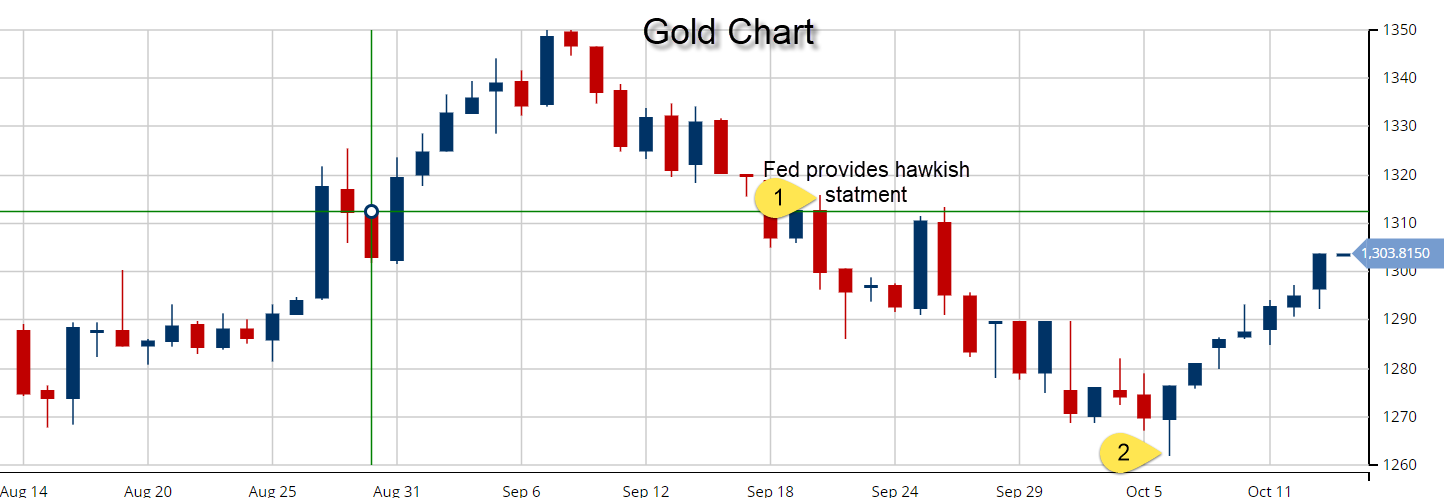

The lumber futures chart implied the upcoming weakness after a retest of the broken support. The price has accurately followed that forecast making a pullback to the broken trendline support and then continued down.

Please look at the chart below, all in all, the invincible metal has scored 29% and hit the top of the chart again in the second place. The lumber futures are also in green as it gained 13%, but it was not enough to beat the palladium. The latter kept resistant to the Pendulum effect this time. Continue reading "Pendulum Swing #8: Gasoline Vs. Natural Gas"