This week the Federal Reserve addressed revisions to its current monetary policy in its attempt to reduce the current levels of inflation to an acceptable target. The statement released after the FOMC meeting, coupled with Chairman Powell’s press conference, resulted in extreme volatility in many financial sectors.

Market participants witnessed one of the strongest knee-jerk reactions and complete market sentiment reversal over 24 hours. The initial market sentiment was extremely short-lived as it was followed by a complete turnaround from the initial reaction the following trading day.

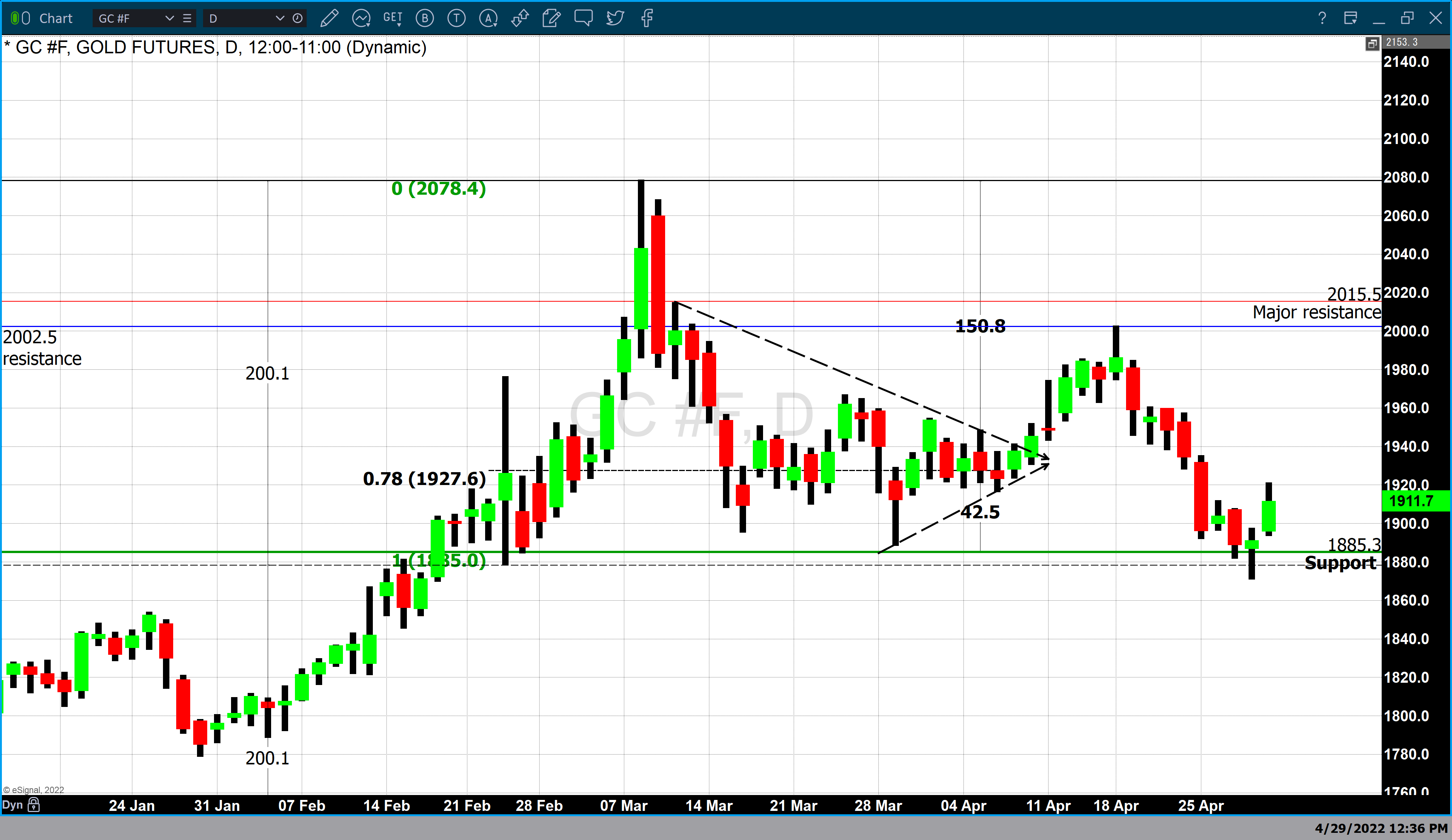

The release of the Federal Reserve’s FOMC statement, coupled with Chairman Powell’s press conference, resulted in a major rally in U.S. equities. The S&P 500 gained almost 3%, the largest daily gain in two years. Equities overall experienced the best Fed-day return since 2011. It significantly impacted gold, moving the precious yellow metal higher. Concurrently, the dollar had a significant decline losing almost 1%, and yields on U.S. Treasuries were also significantly declining. Continue reading "Gold Resilient Amid Market Sentiment Reversal"