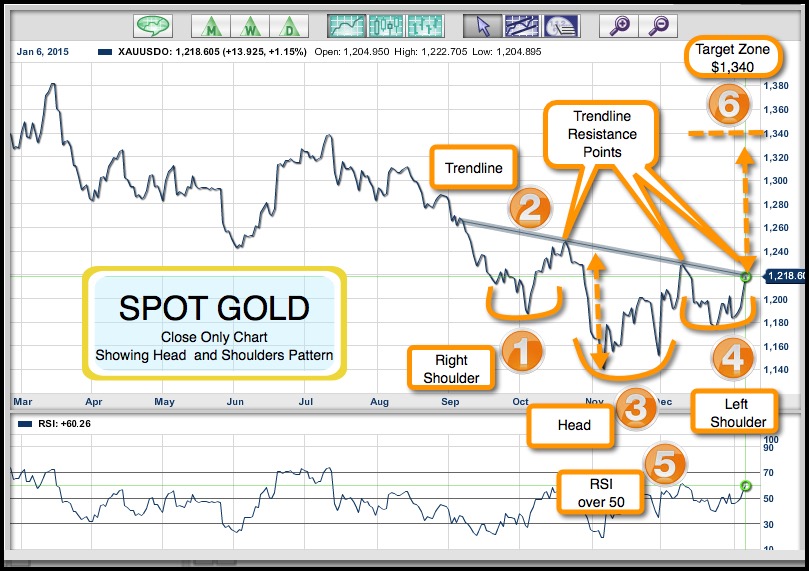

The price of gold is now in its fourth year of a bear market. It is shocking to many gold bugs that gold, a metal revered since ancient times, could fall so dramatically from its all-time high of $1,920.56 on September 4th, of 2011. The precipitous drop of almost $800 in less than four years was more than most gold bugs could stand as stocks soared to new highs. Many threw in the towel when gold hit $1132.05 on November 7th and moved into stocks. This could prove to be a bad omen in the future. Since reaching a low on November 7th, gold has for the most part moved sideways with a slight upward bias.

You can clearly see on the chart that there is a big divergence that shows. When prices were making their lows, momentum was building for the market to bounce.

Now for the good news! Continue reading "My Secret Formula For Successful Gold Trading"