On November 30, 2016, OPEC’s press release announcing the supply target of 32.5 million barrels per day included the following reference to inventories:

“The numbers underscore that the market rebalancing is underway, but the Conference stressed that OECD and non-OECD inventories still stand well above the five-year average. The Conference said it was vital that stock levels were drawn down to normal levels.”

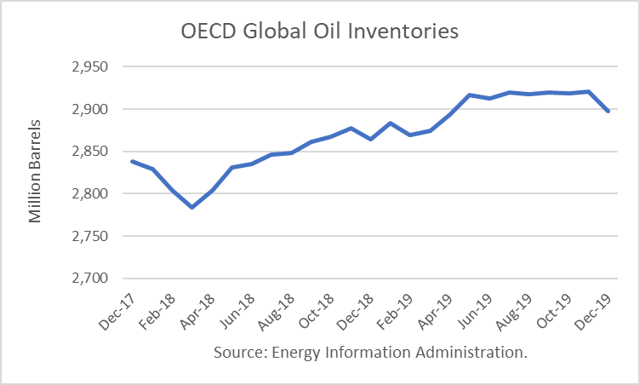

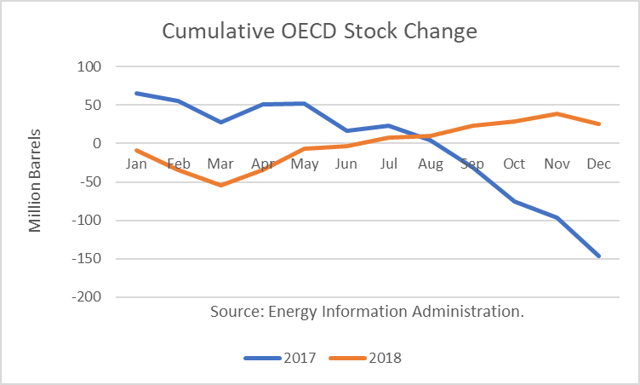

Since the middle of 2017, OPEC has compared the OECD inventories to the five-year average, which had been 2010 to 2015. At some point in 2017, OPEC adjusted the five-year average to include 2011 to 2016. In doing so, it included two-and-a-half years of glutted (not normal) inventory levels. The effect was to make current levels appear to be closer to “normal” levels.

Given that OECD inventories are approaching the elevated five-year average, Saudi Energy Minister Khalid al-Falih has recently questioned that yardstick.

"Do we need to adjust for rising demand and look at forward day cover? How do we deal with non-OECD inventory? (It's) less transparent and reliable,” Falih said. “We have to think of the global market, the center of demand has shifted from OECD to non-OECD.”

Analytical Findings

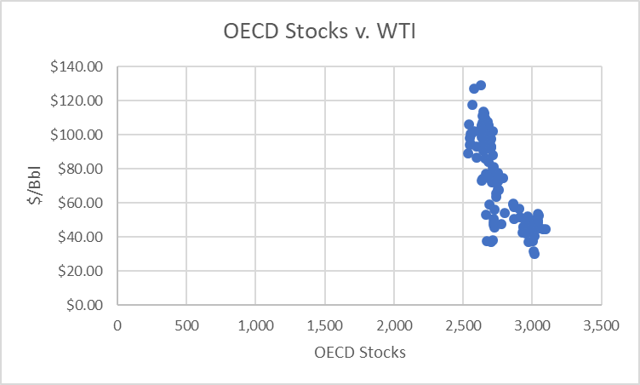

Using historical supply-demand data and prices, I found a correlation between stocks and prices over time, but it is far from precise. That makes sense because price behavior is much more complex than using one measurement to define it. Market sentiment and positioning tend to cause prices to overshoot and undershoot equilibrium prices. To paraphrase the Noble Prize-winning economist Robert Shiller, prices are more volatile than the fundamentals imply.

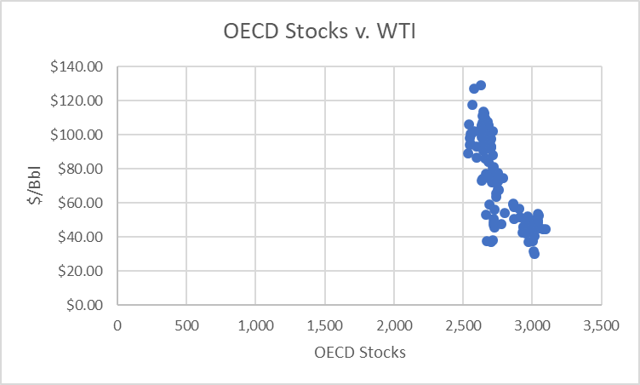

Using monthly data from January 2008 through December 2017 (a full 10-year period), I found a -79% correlation. The Cartesian coordinate graph is depicted below:

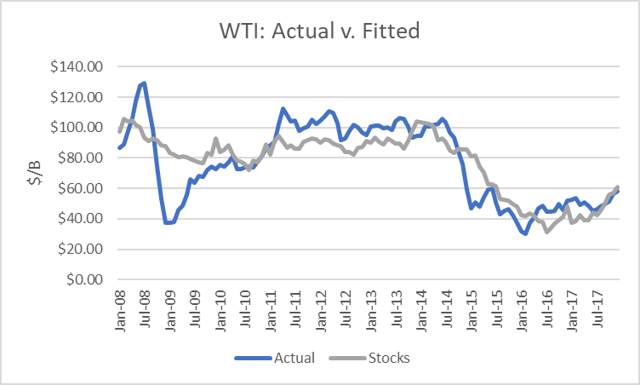

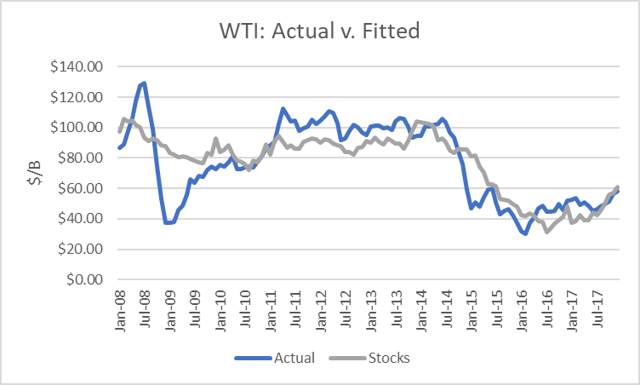

I developed a simple linear regression to fit prices, given the inventory level, and graphed the actual prices with fitted prices:

This illustrates how far prices can travel from an equilibrium price, especially in 2008-09. On the other hand, the fitted prices do match up with actual prices over time. And the December 2017 fitted price ($61) is quite close to the actual price ($58).

This historical analysis begs the question, where are prices likely to go in 2018 and 2019? It also serves as a guide for understanding what stock level OPEC+ needs to achieve by withholding supplies.

Conclusions

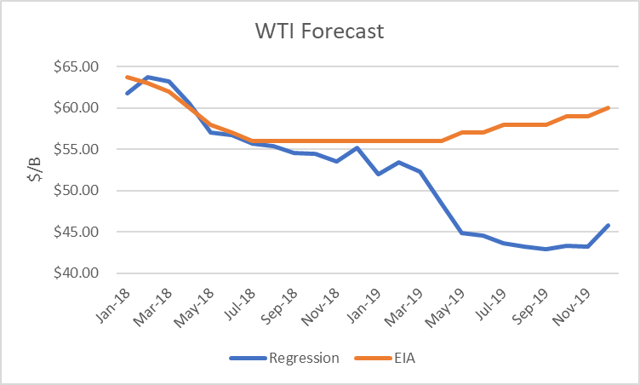

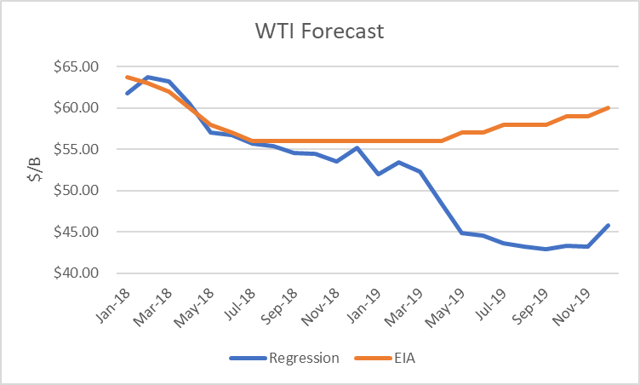

To answer the first question, I used EIA’s STEO forecast of OECD stocks for 2018 and 2019. The forecast shows stocks bottoming in February, which would correspond to a topping of prices at $63.76, using this methodology. It implies that the $66.66 reached in January is likely to be the peak for 2018 and 2019, with prices dropping back into the lower $40s next year.

I also included EIA’s own price forecast on the graph for comparison. It shows similar expectations for the first half of 2018, but that prices will hold above $55 for the forecast period.

Regarding OPEC’s target, the regression shows that if inventories remain right about where they were at end-December (2.870 billion), the WTI price would remain at $60/b. If it wants $70/b, it needs to get OECD stocks to drop to about 2.800 billion. By the way, the latest 5-year monthly moving average is at 2.830 billion.

This model is very simplistic and does not include the impact of trader positioning and sentiment, which I believe are highly influential to the price. For example, the large drop in prices during the first week of February illustrated that factor. I use my Vertical Risk Management model to assess sentiment for positioning.

The other qualification is that the marginal cost of production and the timing of supply response have changed greatly due to the shale oil revolution. The large inventory of DUCs and much faster response of short-cycle oil has changed the market. For those reasons, lower inventories are required to support the same price. On the other hand, there is much more demand at the same price than compared to five to ten years ago. On balance, those two factors may be doing a good job canceling each other out since my regression using forward cover, instead of stocks, produced a lower correlation.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.