For some time now, I've been talking about the volatility of the markets and for the last three days, volatility has been front and center. So, what is an investor to make of this and what opportunities are there to make money?

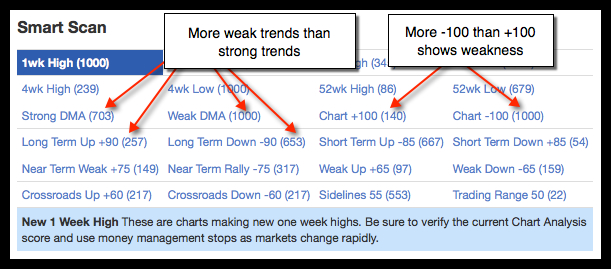

One way to take advantage of this difficult period is to look at our Smart Scan technology. In today's graphic, you can see that the market is beginning to tilt more and more to the bearish side of the ledger.

You can see by the Smart Scan numbers, the "Long Term Down" stocks now exceed the "Long Term Up" stocks by almost 400. When you look at "Chart +100", which means there's a strong uptrend, you see just 140 stocks trending upward. The number of stocks trending down in "Chart -100" is over 1000!

There are many stocks that are close to or have just reversed to the downside and you should be either on the sidelines in these stocks or shorting them.

With this being the last day of a tumultuous week, I expect the market to be a little exhausted and do not expect to see a big move either way today. Having just made that statement, I'm going to hedge myself and say as this is Friday, markets can and do sometimes go into turmoil.

This could be a perfect weekend for utilizing the "52-Week rules". In this case, I would favor the "52-Week rules" on the downside of the market. If you are not familiar with the rules for shorting the market, here they are again. Continue reading "One Way To Take Advantage Of This Difficult Period"

Hello traders everywhere! Adam Hewison here, President of INO.com and Co-creator of MarketClub, with your

Hello traders everywhere! Adam Hewison here, President of INO.com and Co-creator of MarketClub, with your