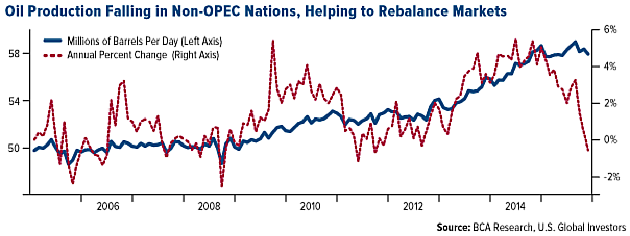

The price of a barrel of oil has almost doubled from its low of $28 at the start of the year, prompting speculation that a recovery is underway, which may result in the revival of companies in the exploration, production and services sectors that have foundered since prices collapsed in 2015.

According to news reports published today (Thursday, May 26), the pop above $50/bbl can be attributed to a drop in supply. The U.S. Energy Information Administration's "Summary of Weekly Petroleum Data for the Week Ending May 20, 2016" notes that "U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 4.2 million barrels from the previous week."

Since breaking the mark the price has sunk below the $50 level, but hovers in the vicinity, as it has for the past few weeks. Continue reading "Oil Climbs over $50: Can Investors Bank on a Recovery?"