We began Q1 with high hopes of keeping our winning streak alive, just as we had finished out the year on a very positive note with some strong gains in Q4 of 2009.

We began Q1 with high hopes of keeping our winning streak alive, just as we had finished out the year on a very positive note with some strong gains in Q4 of 2009.

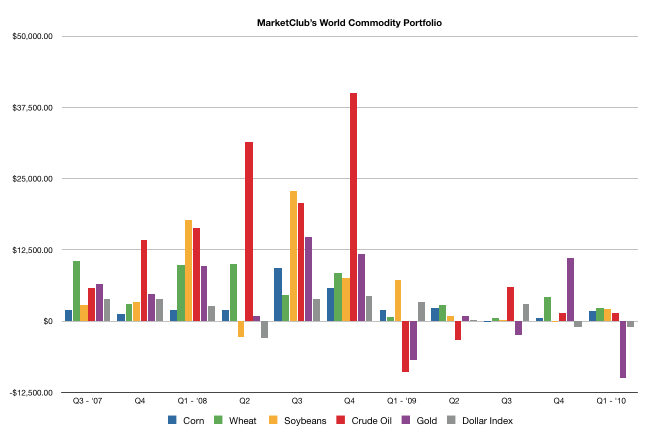

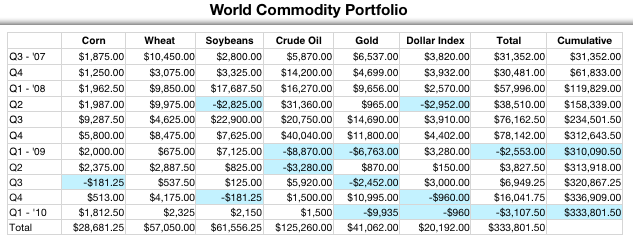

Q1 proved to be a challenging quarter for the "World Cup Portfolio." Out of the six markets we track, we had winning positions in four markets (that's the good news) and losing positions in the other two.

However, the big disappointment in Q1 was the gold market which produced our biggest quarterly loss of any market since we began tracking the "World Cup Portfolio."

The main reason for this loss was the choppy, trend-less action in the gold market. In the eleven quarters we have been tracking gold, we have made money in eight of those quarters. This is not the time to abandon trading gold, rather it is a time to continue with our game plan and "Trade Triangle" approach that has been so successful for this portfolio. Furthermore we have never had back-to-back losing quarters in gold.

On the brighter side, the grain markets proved to be resilient and just the ticket as corn, wheat, and soybeans all put in positive performances. The only other market to put in a negative performance in Q1 was crude oil.

All these gains were not enough to turn the tide and prevent our only second losing quarter in eleven quarters. While the loss was 6% based on margins of $50,000 (margin is needed to trade the "World Cup Portfolio") it was still a loss and we hate losses.

As we have said before, diversification is the key, followed by a sound market-proven game plan. This is the one way to positively approach the markets with the odds stacked in your favor.

Q2 promises to be better and we expect to turn in a positive performance. This is based on the fact that the "World Cup Portfolio" has never lost money two quarters in a row.

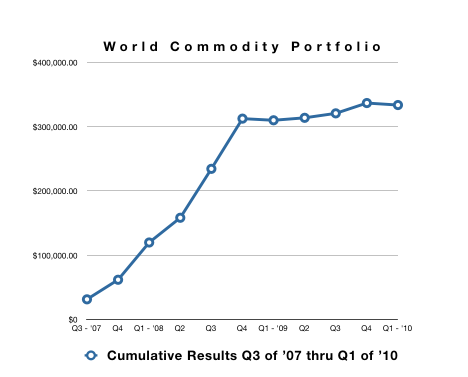

Even with this quarter's loss, the "World Cup Portfolio" has produced, on average a 60% return per quarter. This number however was greatly skewed with the huge run up in crude oil in Q4 of '08. That being said, it just emphasizes the point that you have to be in it to win it.

The results we show in the "World Cup Portfolio" are hypothetical and should not be taken as trades that were actually made in the marketplace. The results however, do show and resemble how you would have come out using MarketClub's "Trade Triangle" approach.

If you'd like to know more about this approach visit our website at MarketClub.com or call us at 1-800-538-7424.

Here's to a profitable Q2.

All the best,

Adam Hewison

President of INO.com

Co-founder of marketclub.com

YO PABLO YOURE WRONG ! FUNDAMENTAL INFORMATION DOES DRIVE THE MARKETS AS IT DID TODAY! THE FUNDAMENTAL INFORMATION THAT GREECE JUST GOT BAILED OUT! HAHAH AND FOR YOU RICHARD WHO WROTE THE! ESSAY ABOVE TRYING! TO SOUND LIKE SOMEONE WHO KNOWS WHAT THE HELL HE IS TALKING ABOUT -- YOU KNOW WHAT HAPPENED TO GOLD TODAY WHEN THE USA DOLLAR HIT A NICE STRONG 84 TODAY ? GOLD HIT A NEW HIGH ! HAHAHAHAHAHAHAHAHAHAHAHAHAH PROFESSOR RICHARD AND PROFESSOR PABLO SOUNDED LIKE THEY THOUGHT THEY KNEW WHAT THEY WERE TALKING ABOUT ! WE ALL KNOW WHAT HAPPENS TO GOLD WHEN THE DOLLAR RISES RIGHT ? IT HITS A NEW HIGH LIKE IT DID ON 5/11/10 OF 1232 HAHAHAHAHAHAHAHAHAH LOL

4-29-10 1157 pm gold now at $ 1172 per ounce

I think gold is relative cheaper, comparing to other assets class: stock, bond, etc.

So as long as stock continue to go up, gold should go up too. Yes gold will have a pull back, when stock market pull back. At this time I think gold is less risk than DOW.

well... ha... you all sound so smart .... we will see... adam said no new high or low price for gold this year.. he didnt say anything about maybe in the last quarter... he said this year.... well we will see how right adam and his friends that ' have so much good information ,well thought out information and balanced comment ha what a joke... we will see who is right before the year is over... the ones who provide fluff on this site with their bs commentary why gold will not make a new high this year or the crazy commentary that fundamentals like china india buying huge amounts of gold and because of the worlds debt crisis that news has nothing to do with gold propelling to a new high this year ... people like adam are clever , he is already putting his advertisements on sites like tickerspy.com hoping that people subscribe to his service and will listen to his trade triangle technology hoping that enough people will join and his technology will cause people to sell or buy on his triangle bs.... if you people want a service on someone who can provide you with the last amount of stocks -10-and an average of 900 % gain with just ten stocks in ten years i refer you to john doody publisher of gold stock analyst who is way more knowledgable about gold than adam could ever hope to be... yes he charges more a year then this site but with only 10 stocks that keeps you from guessing which stocks to pick out of the many stocks in adams site even if it shows the strongest sector which there are many stocks .. john limits it to 10 stocks ,,, lists target prices for each stock and when it is time to buy according to the price of gold comparing it to the price of the stocks worth.....we will see gold at a new high this year and all these people that sound so smart will say nothing because if they did they will sound like fools....

lou, please "pull your head in". The attacking tone of your comments are unhelpful and annoying.

The information on this blog is quite useful to me.

why do my comments not appear?

Very Good to have such information

Using only technical or fundamental analysis gives a 2D picture of markets. Combining both gives a 3D picture. Adding action of related markets and equities of the companies that produce the analyzed commodity to the mix adds further perspective.

Since Gold is the market that this thread started on I have the following humble observations:

1. Technically gold is in a secular bull market. It remains well above key moving averages and we are somewhere in the middle of that bull if it conforms to past cycles that typically average about 17 years. Gold is volatile and 10 to 20% corrections are common. Furthermore such bull markets typically end with a price spike (Blow-off top) where the price action becomes parabolic leading to extremely overbought conditions and a subsequent price fall initiating a new secular bear market.

Presently the most advisable trading strategy is to buy the dips and sell the rips. (I find that MACD and % Williams provide excellent signals)

2. Fundamentally gold production has been declining during the past decade. Underinvestment during the 1990’s due to low prices and typical 10 year lead times to bring on new mine production mean that we probably will not see substantial increases in production for several years. Central banks, the largest holders of gold have turned from sellers to buyers. Again, the long side is advisable until supply increases due to increased production or central bank sales.

3. Although less reliable, related markets also paint a positive scenario. Oil prices, which are positively correlated to gold, are in a bull market. Major currencies which are negatively correlated to gold (Euro, US$) are weak compared to those of emerging markets and major commodity producers such as Canada and Australia.

4. Gold equities which are even more volatile than gold and have an uncanny ability to lead the gold price are the only fly in the ointment. Although gold prices rose to a new high in Dec 2009, the HUI (Amex gold bugs index) did not confirm that new high and provided an early warning sign of the impending correction. When the HUI starts to outperform again, it will give an early signal to get long again.

Bottom line no single method works as well as a combination of all and when all arrows point in the same direction the odds of success improve tremendously. I am probably missing some aspects that can further increase the odds in our favor. Good luck!

Interesting Friday. Gold gave a signal for long trade and Dollar gave signal for long trade. Which one to take?

sorry lou,

but I might agree with you about chartists and their limitations, they seem to still be consistently right. I agree with Adam that gold will not see new highs this year, or at least not till the last quarter. As I have stated before, in Aust the miners are gearing up to mine marginal yeilding ground,they claim need prices above Aus$2000 to be viable,if the miners didnt know what they were talking about they would be out of business pretty quickly. I am buying bulk gold now but I am not in a hurry, theres no need, GOLD WONT SEE NEW HIGHS THIS YEAR unless its late in the 4th Quarter

ken........gold up 16 dollars today thats what ! resistance -1160-is about to be broken and fundamentals of whats driving up gold like debt laden greece is going to request a rescue package from the european union- this rescue package request news has lifted the euro off its 1 year lows and it caused greek bonds to rally,various stock indices to rise,the us dollar to retreat ! { yesssss good for gold hahahah }and commodities to stage a comeback ! regardless of what adam sees in charts there are certain fundamentals in the market like ive noted above and more with the worlds debt crisis that CANNOT BE SEEN in using charts like adam uses to predict that gold will not be making a new high this year ! there is way to much debt , many cities in the usa are billions of dollars in debt - ny state alone is 51 billion dollars in debt ! thats just ny state and in europe its even worse ! this is what adams charts do not show - the current fundamentals of the world and it relationship to gold ... need i really go on ?

Lou,

Fundamental information doesn't drive markets - manipulation and sentiment do (but it's mostly manipulation, because after all a market must be made) - fundamentals just provide a list of reasons from which excuses for price movement can be cherry-picked. The newsfeeds are rife with fine examples every single day.

But whatever one believes about the driving forces of fundamentals, manipulation or sentiment the distillation of these factors results in a price point and volume at a specific time. Similar to a mathematical equation.

The chart records the history of price action and volume - and just to re-emphasise, that means it records the results of ever-changing fundamental information, how the prevailing sentiment reacted to it at the time, and how each of these was manipulated by those vapid little monstrosities intent on clawing every cent out of your account *ahem*.

That history then shows points at which price action changes as a result of one or more of these factors; based upon the occasional patterns or levels formed by these points the technical analyst tries to identify future points from which a statistically likely outcome can be extrapolated. Note 'statistically'.

I could go further but this is enough to get the points across (and I don't want to bore people more than I already have). And the points are: compared to your adherence to fundamental information alone, we can ascertain that Adam (or any technical analyst for that matter) is basing his analysis on more data than you; but this doesn't necessarily mean that Adam's prognostications are more correct than yours - the market can ignore/manipulate statistical concensus just as easily as it does fundamentals - but at least Adam can more readily identify a 'sea change' because he is using finer tools; and finally Adam isn't even disagreeing with you over the longterm either, he's trying to explain what might happen in the meantime and for how long, an opinion which will adapt as more data is added.

Ultimately the real difference between technical and fundamental analysis (regardless of what I said about charts containing more information) is that technical analysis trades an opinion until proven wrong, then trades a new opinion until that is proven wrong, and so on, a fundamental analyst holds to a view and waits (sometimes interminably) to be proven right, an event which may never occur until after they have been financially broken.

Of course, this is all just my opinion, you can only ever trade or invest according to your interpretation of the environment, vive la différence... .

And apologies to all others as this post is directed at other posts rather than the content that kicked them off.

Regards.

Pablo,

Thank you for an extremely well thought out and balanced comment.

All the best,

Adam

Lou, I do have a little chuckle to myself when people suggest that it is good news for the euro that one of its members have requested bailing out, in order to prevent a sovereign default. It is referred to as "emergency aid" for a reason. Friday was a completely predictable profit taking session on the masses of euro shorts that had been placed over the previous week and the Euro had already risen considerably before the Greek request. In fact, if you were paying attention at the time, the European response to the statement was virtually non existent. The yanks then opened and they had their turn to profit take and throw a load more money into the equity bubble. I do not believe for one second that people jumped into the air with joy and all bought euros,lol.

Next week, when it is clear that the actual cost of this bailout is about twice the size that was initially predicted, that the euro members are not actually in agreement about who should loan what, when, to whom and how; when the realisation hits home that it is actually going to take weeks/months and not hours/days to initiate the package (by which time Greece will have already defaulted); when Greece realise that they can't actually afford to repay the loans, despite the austerity measures; when the other indebted members of the euro (particular attention to Ireland, Spain, Portugal and Italy) say that they can't afford the necessary contribution demanded by Germany (whose public already disagree with any support at all) due to their own fiscal issues; when the likes of the other indebted countries I mentioned earlier decide that instead of battling on, that they too want to be bailed out and the question then turns to how much and who can pay it? ; The fact that the whole credibility of the euro zone has been shot to pieces by this aid package needing to be instigated at all.

Well, they are just some of the many many issues/questions that will start to be raised next week and guess what will happen to the greenback when these questions are raised? then guess what will happen to Gold.......that's right. They are just some of the things that will help the greenback and hinder the euro, but don't forget our asian friends, we usually get at least one "story" a week that sees people running for the exit doors from the risk trade and back to the $. Did I mention the indicies? The S&P and Dow are fast approaching important Fib retrace levels, so keep your eye out for pullbacks. FOMC rate decision this week, no chance of a rate hike, but will the language change now there are some more concrete signs of recovery from jobs and housing, alongside manufacturing, industrial production, retail sales etc etc etc? probably not, but the inference will be there and that's enough for the market. There are whispers of new measures to reduce stimulus being discussed and this never goes down well with equity bubbles. US GDP next friday and April payrolls are up soon and I hear whispers of a consensus number around 200k.

Honestly, there are so many reasons for the Euro to go down and the $ to remain strong that it would take me hours to list, but the point is, these are not good times for the Euro, but great times for the $ and we all know what happens to Gold when the $ rises, don't we?

Richard,

Thanks for a very thought provoking comment.

All the best,

Adam

One thing about free advice, Example , all the idiots that kept calling for the Market correction for a yr, They lost any followers a shit load of wealth because the crash had not appeared or any large correction thus far...if you didn't get in the market back in last yr , you got screwed out of some serious money, Thanks Market guru / analyst/ doomers...idiots

The GLD & UUP have been working only for day traders

or short-term swing traders -- too much work for me.

Whereas, the UMW has returned 41% on investment

over the last three months -- cha-ching.

The trend is my friend.

The market has not corrected more than 9% since March 09.

With a new 3-Week Low I go neutral.

Then, with a new 3-day high go long again.

If and/or when a new 3-Month Low is achieved,

I will consider going short the market (I will use the TWM).

Watch the charts my dear Watson, the new 3-day, 3-week & 3-month

highs & lows tell the true story.

Happy Trading.

Gold is just a part of the total package. If you have reasonable stops updated weekly(before Wed open and after Friday close) and a you can lock in some of your profit with a buy back in a specific level with the desired direction. Look at resistance levels and make "reasonable" determinations for profit targets as well as hard targets such as taking out half when at the 50% profit level and putting a trailing stop from there. Remember this is "almost free advice" and free advice is worth what it cost you. Do not let your "advise" cost you more than the information itself. You are the person that decides where to put your money. If you can not do that then just pay the fees and hand it over to some broker to lose your money for you. Note: this was free advise.

Bruce:

What do you know about gold that Adam doesn't know? Please enlighten us.

Bruce:

I'd like to expand on Ken's request, that you please also share your market outlook on gold with us. Adam has created this forum to share our ideas with others. I'd be very interested in reading your comments on this subject. Thanks.

my comment on this subject is based on years of real life education in economy and something that we used to call the free market and the manipulated currency market analysis.

Days of black box trading is coming to an end, of course not for ever but at least for a while. Pay a very close attention to the Fundamentals!

Again if you are like Ken who want someone to enlighten you, then I suggest the same as I did to dear Ken, that is a personal responsibility!

cheers

Here you again, blowing your horn about Gold.

You know nothing about gold, you black box player!

Good luck!

Adam -

For clarification purposes - The original investment was $50,000 divided equally between the 6 markets. Were the profits re-invested each quarter and spread equally between the 6 markets or were they taken out?

Dave,

Thank you for your feedback.

No, profits where not reinvested. We trade just one contract per market or $50,000 to fund the entire portfolio. That way we deleverage the portfolio to reduce risk.

Had profits been reinvested the returns would be substantially higher.

All the best,

Adam

I would have to give you credit that pretty good number of your videos are very informative and are helpful at times. The way I have used some of your videos is to confirm what my own analysis is. Like when gold was about 1100, my analysis said I should get into it and

at the same time your video recommended the same so I was more confident in getting into it. And when it was at 1150 I was scared that I might loose the profits but was confused whether to get out and you recommended an exit so my fear was more confident and I booked the profit. So I do not really use your stuff to blindly trade but to really see if there are similar thoughts at more professional level and if thoughts match I get into trade.

Thanks for all the information and keep posting your videos/recommendations.

Pete