For some time now, I've been talking about the volatility of the markets and for the last three days, volatility has been front and center. So, what is an investor to make of this and what opportunities are there to make money?

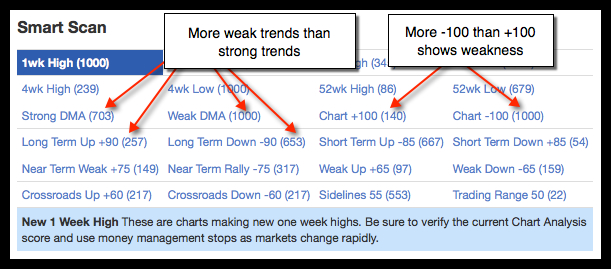

One way to take advantage of this difficult period is to look at our Smart Scan technology. In today's graphic, you can see that the market is beginning to tilt more and more to the bearish side of the ledger.

You can see by the Smart Scan numbers, the "Long Term Down" stocks now exceed the "Long Term Up" stocks by almost 400. When you look at "Chart +100", which means there's a strong uptrend, you see just 140 stocks trending upward. The number of stocks trending down in "Chart -100" is over 1000!

There are many stocks that are close to or have just reversed to the downside and you should be either on the sidelines in these stocks or shorting them.

With this being the last day of a tumultuous week, I expect the market to be a little exhausted and do not expect to see a big move either way today. Having just made that statement, I'm going to hedge myself and say as this is Friday, markets can and do sometimes go into turmoil.

This could be a perfect weekend for utilizing the "52-Week rules". In this case, I would favor the "52-Week rules" on the downside of the market. If you are not familiar with the rules for shorting the market, here they are again.

"The 52-Week New Lows on Friday" Rules

Rule #1: On a new 52-week low, when the market closes at or close to its low on a Friday, short and go home short for the weekend.

Rule #2: Exit the short position on the opening the following Tuesday.

Rule #3: If the market opens sharply higher on Monday, exit this position immediately.

These are the only three rules that you need to trade "The 52-Week New Lows on Friday" successfully. These rules work well in most markets, but especially in futures and Forex.

In this final quarter of 2014, I believe there are going to be many trading opportunities for the nimble investor who uses our Trade Triangle technology to their advantage.

Every success with MarketClub,

Adam Hewison

President, INO.com

Co-Creator, MarketClub

hi adam

for forex trading like u said if weekly triangle is green and as daily green triangle issued, go long and daily get red exit and re-enter if daily get green and if wekly get red trend is change. wel i tried alot and when weekly get green followed by daily green triangle with +100 score even it goes opposit. when i see weekly and daily is green suppose to be long and see lower time frames 1h, 4h, there price is going opposit for many days so i wonder wy daily green triangle is issued so early while the price on 1h, 4h is going opposit direction for many days.. so would u be kind enough to clarify the best way and when to enter when all 3 triangle are green.

thanks

james

Hi Adam,

Can you clarify why you wouldn't close the position late Monday instead of Tuesday morning. This would avoid a possible gap down (or up) which could negate gains. Also, do you simply put in a market order to to exit the position at the opening, or do you do it a different way?

To answer your question Stuart, normally you have follow through momentum on Tuesday morning. The type of order he would place is a market order to exit your position.

Cheers,

Jeremy