GameStop Corp. (SPX: GME) has been victimized of late by the market’s bearish sentiment for video game retailers. Analysts claim the gaming industry is making an abrupt transition into streaming. In order for this statement to be true, a rather large assumption must be made -- that consumer preferences within the gaming industry are perfectly aligned. This has led investors to largely overlook GameStop’s bottom line growth thus far in FY 2015, in addition to the company’s strong forward earnings projections.

Chart courtesy of FinViz.com

As short interest approaches 50%, GameStop’s stock price has suffered through the turn of the New Year. The stock declined by 19% in less than 2 months after trading at $44.70/sh on November 20th, 2014. With a current price of $36.35/sh, GME is trading 22% below its 52-week high.

Negative speculation has driven down GameStop’s stock price to incredibly attractive levels. The market’s bearishness lacks substance, as evidenced by GME’s bottom line growth, and therefore I expect the street’s sentiment to adjust to more appropriate levels in the coming months. GameStop’s stock price is due to benefit handsomely when investors soak in the reality of the gaming industry. Video game retailers will always have a niche. People simply can’t afford the exorbitant prices of the newest video game consoles, making non-streaming consoles an attractive alternative due to their relative cheapness. As price goes down, demand goes up. The market has seemed to ignore this law of demand as it relates to the gaming industry, leading to the misplaced treatment of GME’s stock price over the short-term. However, we can expect those views to adjust at some point this year, allowing GME’s price to flourish as it should.

Attractive Fundamental Value Combined with Strong Earnings Growth

Chart courtesy of YCharts.com

Trading at a P/E ratio of 11.3, GME is fundamentally valued near its annual low-point. This means that an investor who buys the stock today will have paid less for each dollar of earnings than the majority of investors who’ve bought the stock over the past year. For a company undergoing bottom line expansion, this is a very bullish sign that a stock’s medium-term returns are due to exceed the overall market.

When FY 2015 full-year earnings are announced in March, GameStop’s EPS is expected to have grown by 16% YOY. FY 2016 EPS is projected to expand by 17% YOY, giving the stock a forward P/E of 8.9. According to FinViz, GameStop’s earnings are expected to grow 17% annually through the next 5 years. The stock has a miniscule PEG ratio of 0.8, which is typically more than enough reason for investors to expect excess returns on the horizon.

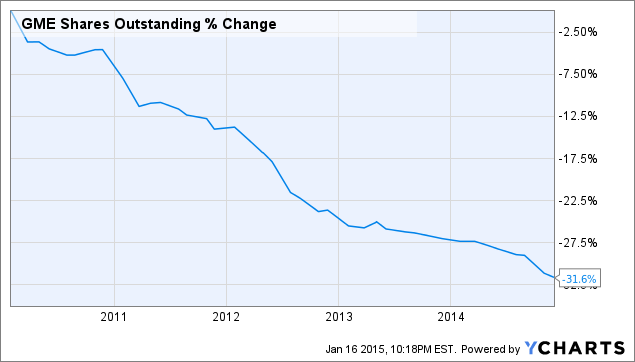

Chart courtesy of YCharts.com

Furthermore, the company has bought back an exorbitant amount of its stock through its share repurchase program. In just the last 5 years, GameStop has repurchased 32% of its shares outstanding at a fairly consistent rate (see chart above). Last year, the company bought back 6% of its stock. As this trend continues, GameStop will have a buffer to support the strong EPS growth that it’s expected to achieve, thus providing more than enough reason for a future resurgence in GME’s stock price.

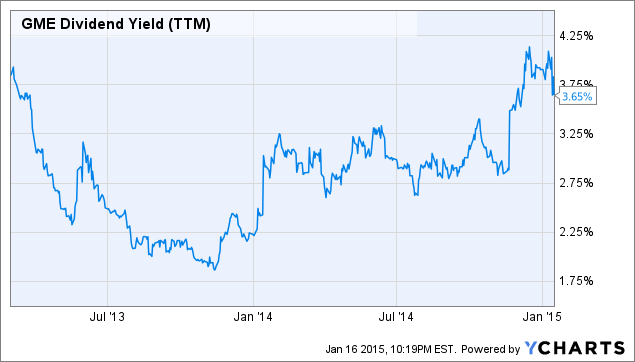

Chart courtesy of YCharts.com

GameStop has also been returning a large amount of cash to its shareholders through its quarterly dividend distribution program. At its current price, the $1.32/sh dividend payment tacks on an additional 3.6% annual return to an investment in the company. The dividend yield is nearly at an all-time high (see chart above), which is yet another reason for investors to be bullish about GME’s performance throughout this year.

Conclusion

The “Blockbuster thesis” concerning GameStop has been around since 2007. Blockbuster crashed within 3 years, whereas GameStop is still expanding its bottom line 7 years later, while continuing to return its mound of cash to its shareholders. Clearly, the market’s expectations are off. As the company continues to perform, I believe investors will begin to acknowledge reality. The result will be a sharp increase in GameStop’s stock price in 2015.

I recommend purchasing the stock at its current price, and adding to your position if there are any significant dips in the stock price. Additionally, I advise setting up a Dividend Reinvestment Program (DRIP) in order to expand your investment’s returns. If you have the patience to withstand this stock’s volatility, I believe this investment strategy will maximize your returns. It’s overwhelmingly clear that GME is due for a significant pricing reversal, and the stock’s performance in the coming months will bear proof of that expectation’s validity.

William Cikos

INO.com Contributor - Equities

Disclosure: This contributor has no positions in any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.