MarketClub's model portfolio section showcases three portfolios using MarketClub's strategies that you can follow and see how well they are doing. We provide you with all the entry and exit points for each market in each portfolio so there is nothing to second guess.

World Cup Portfolio

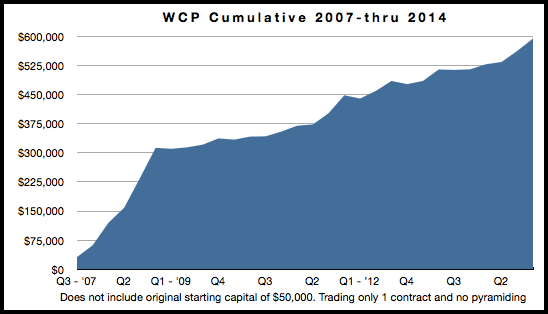

The final results are in and once again the World Cup portfolio (WCP) knocked it out of the park with triple digit returns. This is the third time in 7 years that this portfolio has chalked up some of the best returns in the investment world. We have continually published the daily signals and the results for this portfolio since 2007, so this year's results are no fluke.

The big winner in 2014 was, of course, being short crude oil. This strategy produced spectacular results and was responsible for almost half of our profits for the entire portfolio. With gains of $38,130, representing a 76% return on total invested capital, this commodity was a standout, just trading one contract of crude oil. Next up was gold, which was responsible for producing a return of $7,793, equaling a 15.5% return on invested capital.

Total capital needed to trade the World Cup portfolio is $50,000. (Remember, we are not brokers nor do we manage money.)

Every single market showed a profit in 2014, however, not every single market showed a profit in every quarter. This is why it is so important to be diversified as it lowers your risk profile while raising you profit profile.

Here is the quarterly market breakdown per share:

| Market | 2014 Q1 | 2014 Q2 | 2014 Q3 | 2014 Q4 |

| Corn | -21.00 | +49.50 | +42.00 | -27.00 |

| Wheat | +76.50 | -5.50 | +4.25 | +33.75 |

| Soybeans | +102.00 | -61.50 | +208.75 | -113.50 |

| Crude Oil | +6.17 | +0.02 | +4.80 | +27.14 |

| Gold | +12.245 | +76.645 | +52.65 | -63.605 |

| Dollar Index | -0.075 | -0.921 | +5.653 | +2.453 |

The overall return on a $50,000 investment (minimum needed to successfully trade the World Cup portfolio) was $67,908, which represents a return of 135.8% in 2014.

The third quarter was a big winner for the WCP, as every market turned in positive returns. Soybeans were the standout performer in Q3 producing gains of $10,437.50 on trading just one contract.

If you are interested in the World Cup portfolio, I suggest that you first follow it and paper trade it for a minimum of 3 months. That way you can see first hand if it is right for you, and if it fits your trading personality. You will also get to see exactly how you might incorporate this strategy into your overall investment strategy.

If you have any questions about the World Cup portfolio, please leave them below this posting. We will be happy to answer all of them as soon as possible.

Every success with MarketClub and the World Cup portfolio,

Adam Hewison

President, INO.com

Co-Creator, MarketClub

Do we need to b actual members in order to get signals & also follow the WCP?

Thx,

KE

Hi Karmel,

Yes you do. To see the signals you have to be a member of MarketClub.

You can use this link to join - https://club.ino.com/join/starttrial/?WCP012014

Best,

Jeremy

Congratulations INO team for the great performance.

Is there a way to follow this portfolio with a smaller account (lets say 15-25k range)?

Thanks!

Dan

I see the quarterly results. What is your deepest draw down? Would you have to have a margin account? How soon does a person see the buy or sell signal that is presented by MarketClub?

We see and agree that natural gas can spike up on historic fashion . .50 or more in day can go to the the 9 level

Now good buying point . Natural gas below five yr storage . Demand LNG on the ceiling. We see oil ready to to up to in V formation well above 62

Nice work, Adam.

Perhaps you could provide a publicly accessible link to the past results? Even if it's just a summary, I would appreciate the information.

Hi Jason,

Here's a link to a post with past results - https://www.ino.com/blog/world-cup-portfolio-quarterly-and-annual-results/

Best,

Jeremy

We see natural gas futures igniting much higher move from 5.95 to 16

Natural gas futures historic historic move higher we see a move from 5 to above 7.75

i want to know about base metal & specially natural gas it give me lot of pain by decreasing