Gold

Chart courtesy of Tradingview.com

As seen in the above 4-hour chart, Gold has finished shaping a short term reversal pattern we've seen before, called a Head And Shoulders pattern. This pattern was confirmed on the RSI where the model is even more bearish as consequent lower highs were shaped.

The vertical neckline, highlighted in black, has been broken today below $1197 and this is a good sell signal. The target is the distance from the top of the head to the neckline, subtracted below the neckline. So the market aims for $1159 (highlighted in the red dashed horizontal line), which is $35 down from the current price at $1194.

Risk is above the neckline beyond $1200, which is >$6 of potential loss. The risk/reward ratio is almost 1:6.

Watch closely for the next support located at $1177 where a March 31st low and March 19th high were recorded. Once the market fails, you should be nimble to square shorts with gains booked.

If the bears fail and the price manages to close above $1200, the first level of resistance is located at the top of the head at $1224. The next levels can be found at $1252 (January 29th low) and $1307 (year high).

Silver

Chart courtesy of Tradingview.com

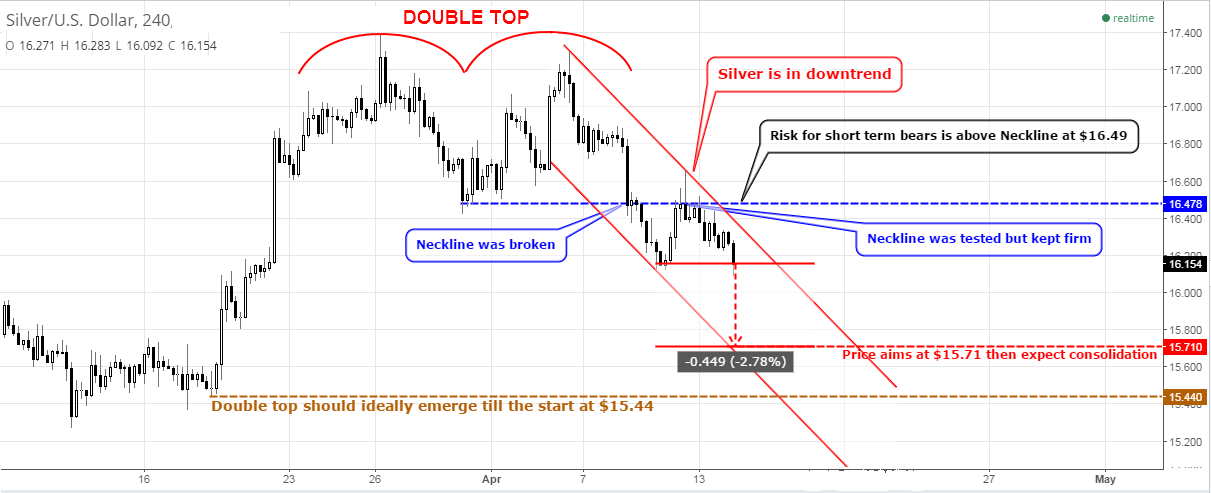

Silver couldn't lift its head up after a large reversal Double Top pattern (highlighted in two red semicircles) emerged at the $17.30-17.40 level. The bears were successful in breaking below the pattern's neckline at $16.47 (highlighted in blue) and the price has sunk down to a local low at $16.12, the downside of the trend was shaped.

Right after that, the market pulled back to the broken neckline and tested it twice, but failed. The price then chose the path of least resistance and quietly landed in the local reaction low area at $16.15.

As the upside was already tested, there are two possible downward scenarios that can be played. The first downside target is located at the bottom of the current short term downtrend at $15.71, which is down 45₵ from the current level. And if we take a risk to the $16.49 level beyond the neckline, then it could cost us >34₵. The risk/reward ratio is not so good, but still positive.

Another downward target is at $15.44, where the start of the previous short term uptrend is located and then was reversed by the Double Top. The distance to this target is 71₵ and if we compare it to the risk of 34₵ which was referred to above, then the risk/reward ratio is more than 1:2.

Above the neckline, the price could go to the Double Top's high at $17.40.

Limit your risks with stop loss orders.

Intelligent trades!

Aibek Burabayev

INO.com Contributor, Metals

Disclosure: This contributor has no positions in any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

This time of year is tricky to trade the gold market for three reasons.(short term weekly trades are different though)

1. It's tax time/sell time and that tends to put downward pressure on gold, sliver, ect.

2. As you approach the summer people tend to be in a better mood and they tend to invest accordingly.

Pro dollar/pro market thinking

3. Historically gold tends to go down from april to the summer time.

Another thing is industry buyers tend to come in to by gold and silver in the fall season. This affects actual physical demand.

If you are just trading by charts/numbers and not paying attention to how the mining industry and business buying works. Well then you can easily be blind sided at times.

There are also wild cards like a nation saying they want their gold back from the U.S. storage or something.

Good point about the fall jewelry demand bump.

Here's a guy who has talked about just such a phenomena:

http://www.mercenarygeologist.com/

The other thing that would support a short gold trade (in your favor Aibek) is the continued devotion to QE and the bond buying the ECB will be doing in the coming year. This can't be good for gold prices priced in dollars.

I'm looking at the DXY and all the commodities and the delay in the FED rate increase and thinking that this is a bad trade...

I'd say the opposite is true here. That we're about to enter the reversion period with regards to USD and everything else not USD.

Dear old friend Anonymole!

First of all thank you very much that you keep with my posts and challenge my ideas as it's invaluable interaction and experience for me.

I prepared for you my reply in the chart hope you will find it useful at the link https://www.tradingview.com/x/RdT2hsg1/

As seen in the chart, yesterday, the Dollar completed sub-sub-sub wave C, it was deep (261% of wave A) scary and fast correction which usually makes most traders to doubt the trend.

But today the uptrend resumed (highlighted in blue callout) and new (I guess extended) wave 3 started with sub-sub-sub wave 1 and 2 already done.

So all of this gives a clue that maybe it's not so short "short" play.

Let's live and see.

Sincerely yours,

Aibek Burabayev ([email protected] or AibekB on tradingview.com)

Aibek,

I love TradingView myself -- excellent tool!

That's some interesting speculation you've got going there. And I myself had been thinking that with the way things were going, world wide currencies and such, that the dollar could head back into the 110-120 area. I'm not feeling that any longer. It seems that dozens of commodities have formed solid bases in the last couple of months and that it's time for them to head back up. Interesting times, interesting times.

TradingView, yes, the platform is awesome, talented guys from non-trading area built new era of user experience for traders.

Back to the point.

Conspirologists would say that it is good to bring the price of commodities down to exchange them for fiat money. Maybe this feeling is knocking to your mind.

Different dimensions we live and do believe.

Thank you again, I try for you, best!

Aibek