Certain stock sectors are great tools for measuring the health and state of the economy. Transportation is arguably the sector that says the most about it. When transportation companies are posting profits, that means more goods are being shipped and the economy is growing. And when those same companies are missing earnings, it means that fewer goods are being shipped and the economy is either stagnating or contracting.

So far this year, the Dow Jones Transportation Average doesn't reflect a strong and robust economy. It's fallen around 10% year-to-date and most transportation stocks have been bouncing around their 52-week lows for the past six months or so. However, that downward trend could be on the verge of entering a major reversal.

US GDP growth estimates for the first quarter were an apathetic 0.02% while economic data that was reported was disappointing. However, most economists believe that adverse winter weather conditions were the primary contributor to the weakness. Recent figures like the upside surprise in the jobs number could be an indicator that the economy is alive and well.

For value investors, it's the perfect environment for finding strong companies with beaten-down stocks. One company, in particular, will not only benefit from the rising tide in transportation stocks that should lift all boats, but has also been posting positive earnings estimate revisions which indicates an improving macroeconomic outlook.

This railcar manufacturer is a textbook value stock with plenty of upside potential

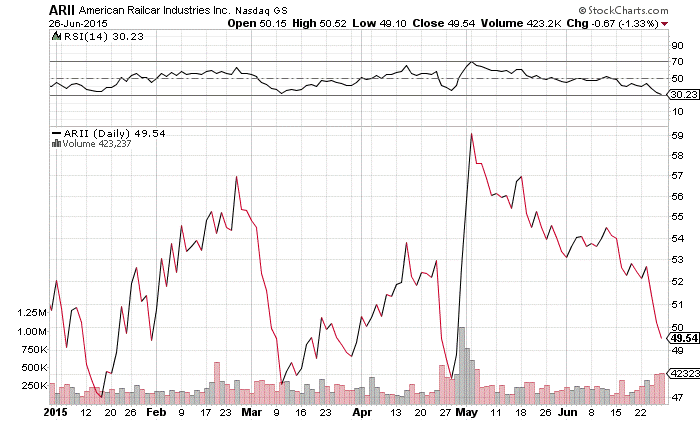

Chart courtesy of StockCharts.com

American Railcar Industries (ARII) is a $1 billion railroad car manufacturer and leasing company with operations across North America. The company has been raising expectations over the past month with upward earnings estimate revisions. Total annual earnings estimates soared from $4.91 per share to $5.46 per share – an 11% increase.

Despite the revisions, the stock hasn't responded yet.

It's been bouncing off of its 52-week low all year long and looks oversold at the moment by its RSI reading of 30.23. Considering the enormous potential this company has, the stock looks tremendously undervalued.

American Railcar's stock is fundamentally strong as well. The company has long-term growth expectations of around 97%. That's almost triple the industry average of 33% and more than six times the growth expectations of the S&P 500. The stock trades cheaply too – just 9.4 times earnings. Almost half of the industry average's P/E of 17.1 times earnings.

The company's sale-to-assets ratio of 0.70 is similarly impressive. That means it makes $0.70 for every dollar earned – well above the industry average of $0.21 per dollar. It's price-to-sales ratio beats the industry average as well at 1.46 compared to 1.93. It's easy to see why the stock was upgraded to buy back in April by Standpoint Research.

The company beat first-quarter earnings reporting $1.64 per share compared to the analysts estimate of $1.29 – a 26% upside surprise. Quarterly earnings growth year-over-year was 69% while quarterly revenue came in at $263.8 million.

Given the new revision for full year earnings, the stock should be worth at least $58 per share – a potential pop of 17%. In addition to the growth opportunity in the stock, it also pays a relatively high dividend with a yield of 3.2%.

So why is the stock not soaring higher right now?

It's a combination of forces acting within the energy trade and the lack of positive economic data to support higher growth until very recently.

The rail industry as a whole is headed higher though. Rail makers currently have orders for 140,000 units while the top three manufacturers can only handle around 50,000 units. That means their order backlog is filled through 2017 giving rail manufactures plenty of growth opportunities in the next couple of years.

Check back to see my next post!

Best,

Daniel Cross

INO.com Contributor - Equities

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

seems an interesting share to buy ; particularly because of growth potential