Undoubtedly, this February will be remembered as painful for the dollar. Investors have long awaited the opportunity to short the greenback after a prolonged period of steep gains. When US growth came out surprisingly weak, FX traders pounced, taking the dollar on a brutal roller coaster ride.

Then we had Janet Yellen’s testimony, which suggested banks should be prepared for negative interest rates. Many considered that a hit below the belt as investors were betting on more rate hikes. So now, they’ve got to get ready for negative interest rates? No one was prepared for that remark, despite Yellen’s suggestion that it was only a remote possibility. Of course, now, the million dollar question is, how low can the dollar go?

Short Term Dollar Outlook

As with all corrections, the first catalyst is always about momentum. The question of whether that will lead to a wider correction is fundamental. But what about the imminent target? That’s driven by technical momentum. So what do the technicals say?

Chart courtesy of Netdania.com

As seen in the Dollar index chart above there are two key levels in this correction. The first is our resistance level at 100. The Dollar index has been attempting to break this level for a while now, though without success. When the Dollar index failed, it was really only a matter of time before the correction would come. And so as it did.

Then we have our support level, at 92. As one can see, this level has been critical because if it breaks it will signal a much broader dollar correction. Thus far, it has held.

Now, let’s look at what is happening between the 100 and 92 levels. As previously stated, the index has tried to break 100 for the second time (without success). Thus, there’s a very high likelihood that it will slide all the way to 92 to regain momentum. The technicals dictate that a loss of momentum tends to send the pair testing its nearest support level. In our case, of course, that’s at the 92 level. Therefore, the most imminent target for the Dollar index is 92, which is roughly 4% lower from where we are now.

Long Term: Dollar Outlook

To determine whether the 92 support will break and lead to a wider dollar correction we must first look at the fundamentals. The question is will the fundamentals hold steady? True, annualized Q4 US GDP growth slowed to 0.7%, and the Fed did sound more dovish. But one important factor that continues to look bright is credit. That will show us where the US economy is heading and that it is still on a growth trajectory.

In previous analyses of the US economy, I stressed that the key tool for identifying a temporary soft patch or a recession is credit. If credit grows, it usually translates into more spending, both by consumers and business. And that, of course, means more growth for business. Those are, of course, the two pillars of the US economy.

Hence, if credit to consumers and businesses is on the rise, it means growth will return sooner rather than later. As you may have guessed, that means the dollar correction could come to a halt after the expected 4% decline. But if credit fails to grow, then that means the fears for growth are real. Thus, the dollar correction will take us lower for longer.

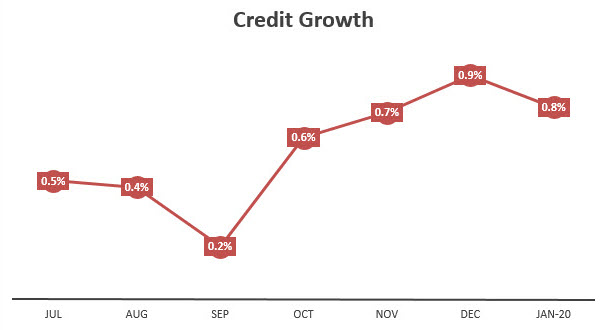

Take a look at the chart above, which was compiled by the Federal Reserve Bank. Since September, credit on a month-over-month basis has accelerated. And while the January figure seems to point that credit growth had slowed, notice that this represents data until January 20th. That means when the month ends we can expect to see credit growth accelerating, even in a “bleak” January.

In other words, the Fed’s rate hike did not impact US credit growth. Sooner rather than later that growth in credit will allow growth to accelerate once again.

And what does it mean for our dollar analysis? That long-term US fundamentals remain strong and hence the 92 level is less likely to break. Therefore, the dollar correction is likely to fade in a few weeks time.

The Bottom-line

For those that are looking to short the dollar, beware as you may soon hit a wall of buyers. And for those that intend to buy the dollar for the long term? It’s a classic buy on the dips scenario once again

Look for my post next week.

Best,

Lior Alkalay

INO.com Contributor - Forex

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

USA Economy

Dear Richard,

The holiday season is a time for us to count our blessings and be grateful for them. In that spirit, I am writing to thank you for your significant contribution to the success of all of the American people.

Your leadership and generous spirit deepens the belief that the optimism of the holiday season will extend throughout the New Year. Every day gives us more reason to be grateful, every new idea gives us more reason to be hopeful, and every challenge strengthens our resolve to make the future better.

Thank you again and again for your leadership and your friendship. Best wishes for a healthy and happy holiday season.

Peace and love,

Nancy

--------------------------------

Thank you Nancy Pelosi, as you already know, I am an Independent, but what I did was for all of the American People, with No Discrimination.

Out of over 300 Million People, I was the only Person that knew how to keep the United States from going into a Deep Recession.

I will Quote JFK when he took the Oath of Office, "ask not what the Country will do for you, But ask, What can I do for the Country."

Also, my Motto is, "People with Ability, and the Ability to work together." We have witnessed this in Government, where People do not work together.

----------------

I am so Glad that I had the Age, Education from Denver University on what is known as the "Velocity of Money," Experience, and “Cognitive Memory with Abstract Thinking” on how to put the Pieces together to solve the problem to protect the United States from going into a Deep Depression.

I recall "The Great Depression, as if it were today." It lasted for over thirty years.

If All the People were Old enough too remember the Great Depression, they would understand, that by all means take Action to avoid such a Catastrophe. They would understand just how Serious the Economy was getting in 2008. I do thank the Federal Reserve,for keeping Currency available, which was not done during the "Great Depression," Also President Obama for following my instructions on how to prevent the United States from going into a "Great

Depression", like Europe is Suffering now, and will likely last for another Thirty Years, which is

a threat to the United States. If each country could solve their Corruption, and then follow my Instructions on how to Solve their Economy, their problem would be over.

Forbes in 2014, Published the Twenty Five most Powerful People in the World.

Vladimir Putin of Russian is Number One, because of his invasion of the Ukraine without any NATO interference.

President Obama of the United States, is the Number two most Powerful in the World, because the United States has the Best Economy over all of the other Country's in the World.

------------------

The Colorado unemployment is at 4.5%; North Dakota 2.0%; Nebraska 3.1%; Wyoming 4.1%

The Highest Unemployment is Georgia -

Sincerely,

Richard Brice

The Dollar is the Highest Currency, over all other's in the World.

Out of over three Hundred Million People, I was the only one that could save the Economy for the United States of America.

----------------

USA Economy

Dear Richard,

The holiday season is a time for us to count our blessings and be grateful for them. In that spirit, I am writing to thank you for your significant contribution to the success of all of the American people.

Your leadership and generous spirit deepens the belief that the optimism of the holiday season will extend throughout the New Year. Every day gives us more reason to be grateful, every new idea gives us more reason to be hopeful, and every challenge strengthens our resolve to make the future better.

Thank you again and again for your leadership and your friendship. Best wishes for a healthy and happy holiday season.

Peace and love,

Nancy

--------------------------------

Thank you Nancy Pelosi, as you already know, I am an Independent, but what I did was for all of the American People, with No Discrimination.

Out of over 300 Million People, I was the only Person that knew how to keep the United States from going into a Deep Recession.

I will Quote JFK when he took the Oath of Office, "ask not what the Country will do for you, But ask, What can I do for the Country."

Also, my Motto is, "People with Ability, and the Ability to work together." We have witnessed this in Government, where People do not work together.

----------------

I am so Glad that I had the Age, Education from Denver University on what is known as the "Velocity of Money," Experience, and “Cognitive Memory with Abstract Thinking” on how to put the Pieces together to solve the problem to protect the United States from going into a Deep Depression.

I recall "The Great Depression, as if it were today." It lasted for over thirty years.

If All the People were Old enough too remember the Great Depression, they would understand, that by all means take Action to avoid such a Catastrophe. They would understand just how Serious the Economy was getting in 2008. I do thank the Federal Reserve,for keeping Currency available, which was not done during the "Great Depression," Also President Obama for following my instructions on how to prevent the United States from going into a "Great

Depression", like Europe is Suffering now, and will likely last for another Thirty Years, which is

a threat to the United States. If each country could solve their Corruption, and then follow my Instructions on how to Solve their Economy, their problem would be over.

Forbes in 2014, Published the Twenty Five most Powerful People in the World.

Vladimir Putin of Russian is Number One, because of his invasion of the Ukraine without any NATO interference.

President Obama of the United States, is the Number two most Powerful in the World, because the United States has the Best Economy over all of the other Country's in the World.

------------------

The Colorado unemployment is at 4.5%; North Dakota 2.0%; Nebraska 3.1%; Wyoming 4.1%

The Highest Unemployment is Georgia -

Sincerely,

Richard Brice

To understand and predict Dollar Valuation in terms of Both, either intrinsic or Absolute value or with a view to it's Exchange rate with rest Currencies of the World.

Over and above Financial or economical data of U.S. it self, we must study and Analyse momentum and direction of Crude, Gold and overall situation of International Trade as well all other Global Economies, because all such issues are having much more influence even then most of U.S. Economy related Facts, Figures and Data, so any adverse effect on all these other co-related factors will create constant and continuous pressure on the Dollar to keep i's "Safe Haven" status, and i think, this process is already taken place since long.

As per my study, even presuming safe or steady situation of U.S. Economy, just due to above described factors, we have already obtained initial weakness in Dollar and not only that, but within short or even less shorter period, such pressure on Dollar will become un bearable or un-sustainable, followed with drastic fall in Dollar in both terms, as stated above.