Introduction

McKesson Corporation (NYSE:MCK) has been on an acquisition spree as of late and announced layoffs of 1,600 workers or about 4% of its U.S. workforce. These collective efforts are aimed to stem any losses in revenue from a hit to its customer base while continuing to drive value for shareholders. McKesson has agreed to acquire two privately held medical firms that focus in oncology for a total of $1.2 billion. McKesson has also agreed to acquire Ontario-based Rexall Health for $2.2 billion in Canada. Layoffs are underway as well after the company determined “reductions in our workforce would be necessary to align our cost structure with our business model.” McKesson is being proactive and aligning its cost structure to in a fiscally responsible manner in order to remain competitive and add value to shareholders. After the recent political induced healthcare sell-off, many healthcare stocks look attractive at these levels, specifically McKesson. Once the political cycle is complete in 2016, these stocks will likely benefit from the mere absence of political headwinds. McKesson has hit a 52-week low and remains near that level and boasts a P/E of 16 and a PEG of 1.46. McKesson appears very attractive considering its EPS growth, dividend payout, acquisitive mindset and share buyback program.

McKesson Acquires Vantage Oncology and Biologics

Manhattan Beach, CA-based Vantage Oncology, LLC is a national provider of radiation oncology, medical oncology and integrated cancer care services. Cary, NC-based Biologics, Inc., is the largest independent oncology-focused specialty pharmacy in the U.S. These two acquisitions of Vantage Oncology and Biologics totaled $1.2 billion. These acquisitions enhance McKesson Specialty Health’s services to patients, providers, payers and manufacturers. The combined impact of these transactions is expected to be approximately 11 cents accretive to adjusted earnings per diluted share in Fiscal 2017. Collectively, these acquisitions will increase McKesson’s specialty pharmaceutical distribution scale, oncology-focused pharmacy offerings, solutions for manufacturers and payers, and scope of community-based oncology and practice management services available to providers and patients. Vantage will broaden the company’s scale in radiation oncology management services, adding more than 50 cancer centers across 13 states.

McKesson Acquires Rexall Health

McKesson has agreed to acquire Mississauga; Ontario-based Rexall Health from Katz Group for $2.2 billion. Rexall Health operates approximately 470 retail pharmacies and is one of Canada’s largest privately-owned enterprises. This acquisition further strengthens McKesson’s position in Canada’s pharmaceutical supply chain and marrying two companies that have worked together for over 20 years delivering care in Canada. This will bring McKesson Canada’s combined pool of talent to 13,000 employees, serving customers and patients throughout the country. Rexall Health will help McKesson leverage its existing portfolio of assets to drive growth, particularly in two of Canada’s fastest growing regions, Ontario and Western Canada. McKesson expects the acquisition to drive meaningful accretion, on a constant currency basis, to Fiscal 2018 adjusted earnings per diluted share.

Growing Revenues Augmented by Dividends and Share Buybacks

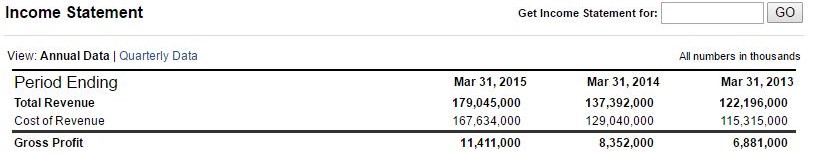

On an annualized basis MCK has grown its revenues greater than 46% over a three year period from Q4 2013 through Q4 2015. During this 3-year time frame, MCK grew revenues from $122.196 billion in 2013 to $179.045 billion in 2015. From 2014 to 2015, revenue grew by a 30% clip while operating profit grew at a greater than 20% clip. Gross profit has increased by over 65% over this same time period (Figure 1).

Figure 1 – Annual revenue and profit over the past three fiscal years per Yahoo Finance

In addition to growing revenues and profits, MCK offers a backdrop of dividend payouts along with a share repurchase program. MCK has increased its quarterly dividend payout by nearly 360% over the past ten years from $0.06 to $0.28 per quarter. This translates into a 0.75% yield based on its current price. MCK currently has a new share repurchase program that was approved and earmarked $2 billion to buy back and retire shares. This would allow the company to remove over 13 million shares from the open market or 5.5% of outstanding shares. This newly approved share repurchase program is very aggressive and a great way to return capital to shareholders while the price is suppressed. Taken together, capital is being deployed in a variety of ways via acquisitions, dividends and share repurchases to reward shareholders.

Summary

MCK is well positioned for future growth and success in the growing healthcare space. MCK has been highly acquisitive, growing dividends over time and buying back its shares to drive shareholder value. Its major acquisitions and partnerships via UDG Healthcare plc, Sainsbury's pharmacies, Vantage Oncology, Biologics, Rexall Health and Albertsons position MCK to continue its strong performance and competitiveness in the marketplace. The company does not shy away from deploying capital to acquire other assets to drive growth into the future. In addition to their acquisitive mindset, MCK also offers the backdrop of dividends and an aggressive share repurchases to add value to shareholders. McKesson presents a compelling buying opportunity as the stock has fallen to a 52-week low. On a technical basis, MCK appears to be undervalued based on its growth and future earnings as measured by its PEG ratio.

Noah Kiedrowski

INO.com Contributor - Biotech

Disclosure: The author currently holds shares of MCK and is long MCK. The author has no business relationship with any companies mentioned in this article. He is not a professional financial advisor or tax professional. This article reflects his own opinions. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned. Kiedrowski is an individual investor who analyzes investment strategies and disseminates analyses. Kiedrowski encourages all investors to conduct their own research and due diligence prior to investing. Please feel free to comment and provide feedback, the author values all responses.

Yes, another fantastic business model at the expense of the American worker.