Hello MarketClub members everywhere. The question today is, are you one board the gold train?

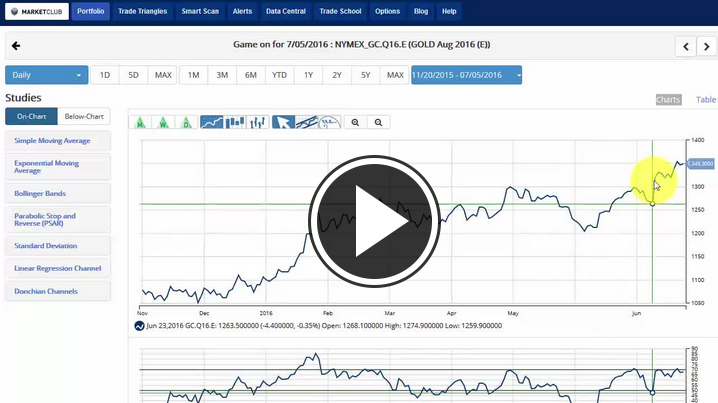

According to the Trade Triangle technology the gold train left the station on January 5th of this year at $1081.55. Since that time the gold market has steadily moved higher reaching its highest levels this past weekend as America celebrated its birthday.

The next question is, how many stops is the train going to make before it gets to its ultimate destination?

That's a tricky one to answer. However, I strongly believe that gold (NYMEX:GC.Q16.E) is going to continue higher for the better part of the year.

In today's video I will be looking at some specific target zones I have for this precious metal. In addition to looking at the gold market, I'll analyze the volatile nature of the major indices last week. I'm going to see if we can make some sense of the dramatic reversal both on the downside and upside.

Crude oil (NYMEX:CL.Q16.E) is under pressure this morning falling about 3%. I'll discuss the next support area for this market and share with you what I see in the future for this market.

Stay focused and disciplined.

Every success with MarketClub,

Adam Hewison

President, INO.com

Co-Creator, MarketClub

no, i'm not. i'm aboard the SILVER train. i'm 100% invested in real silver

bullion in my own hands. silver will outperform gold at least 5 to 1

and return to the tradition, historical ratio of 15 to 1. silver is the

most undervalued asset on earth, and gold second.

I disagree with assessment on gold. I believe the first run is done and it will correct to 1145. The next run will take gold to 1600. The RSI and STO are screaming a top. Oil just did a complete correction and the dollar is on its way to 104 to 105. Everyone sees a recession in next 12 months and so do I. However still a ways to go.

My bets on the dollar vs. gold. Good luck to all.

The DOW and S&P are going to come close to their May 2015 highs within the next couple of weeks, DOW 18,312 and S&P 2,130. That will be the true resistance! A failure to break those May 2015 highs beyond the 7/27 Fed meeting will send the stock market into a major decline and a possible crash in the months leading up to the presidential election.

I predict the system will use every power they have to postpone a real crash until after the US election this November.

Adam,

Do you have a "redo" on gold using the trade triangles in your saddle bag?

(Please forgive my repost - I posted in an earlier blog and not sure if you'll see it)

Adam - I have a couple of questions regarding the 52 week high rule. -

Do we ALWAYS close positions on Tues AM (unless Monday is down) -

This week is a great example GLD, GDX, ABX all strong good ride over the weekend -

Would I really sell them on a Tuesday morning strong open?

How about if Tuesday is the first day of the trading week? - Still Tuesday, or Wed instead?

Hi FrankB,

If you're trading the 52-week rule you will always close the position at the open on Tuesday. It's a very short-term trade.

If you're trading over a holiday weekend you would sell on Wed. morning.

Best,

Jeremy

hi adam hewison, the cot is looking very bearish for pm. is there a time when you ignore the cot?