Introduction

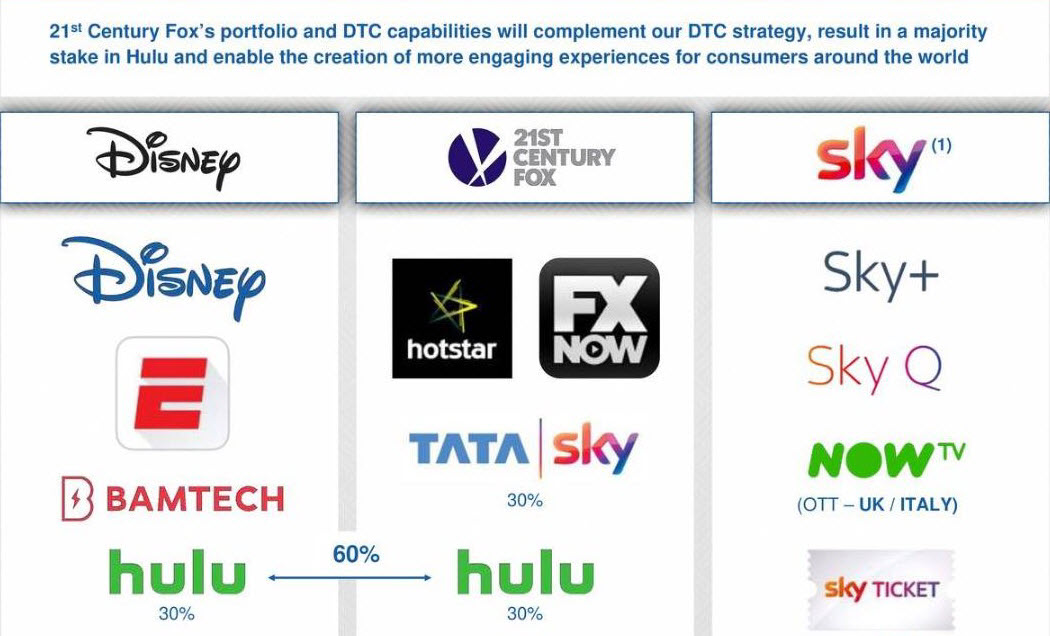

FY2018 is off to an excellent start for The Walt Disney Company (NYSE:DIS) with a confluence of growth catalysts via streaming, studio strength, Fox acquisition and tax reform legislation. Disney has been establishing a firm footing in the streaming space via Hulu (30% stake and will likely be expanded to a majority 60% stake after the Fox acquisition), BAMTech, Sling, ESPN streaming service and a Disney branded service coming in 2019. The studio segment is off to a great start with record-breaking movie releases such as Thor: Ragnarok and Star Wars: The Last Jedi surpassing $850 and $900 million in worldwide box office receipts, respectively. Disney is evolving to address the deteriorating Media Networks business segment with major streaming initiatives. Disney has one of its biggest movie slates for FY2018 with Blank Panther, The Avengers: Infinity War and Solo: A Star Wars Story around the corner. Disney also announced that it is acquiring 21st Century Fox’s assets to further drive growth for $52 billion. This acquisition brings in noteworthy studio assets such as more Marvel properties (X-Men, Fantastic 4 and Suicide Squad) and Avatar along with TV content, regional sports and a 60% majority stake in Hulu. Disney currently pays a 33% effective tax rate and now with tax reform signed into law; this rate will be dramatically reduced a third to 21%. Disney can deploy more cash into growth initiatives and return value to shareholders via increased dividends and share buybacks with the increased cash flow. Disney offers a compelling long-term investment opportunity considering the growth, Fox acquisition, pipeline, Media Networks remediation plan, diversity of its portfolio, tax reform, share repurchase program and dividend growth.

Transformative Fox Acquisition

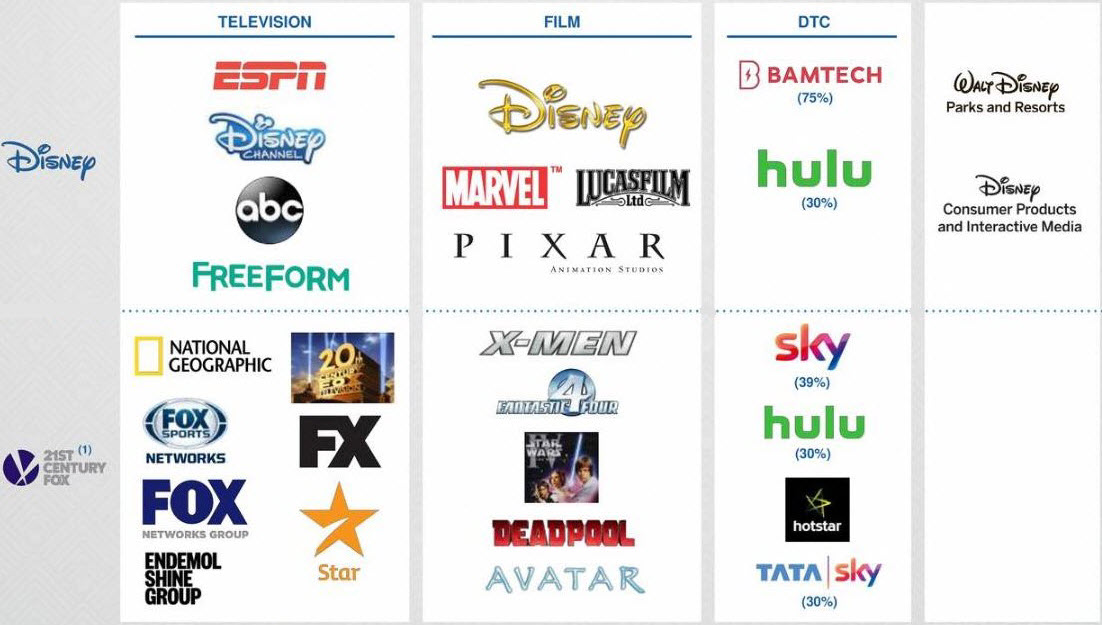

Disney shelled out $52 billion to acquire many of Fox’s assets to drive future growth in regional sports, movies, TV programming and foreign market penetration. This is a transformative acquisition as Disney will take control of the movie studio and significant TV production assets and gain exposure to international markets through Fox’s networks via a 39% ownership of Sky (Figures 1, 2 and 3). In addition to the movie studio, TV production and international assets such as Star and Sky, Disney will also add entertainment networks such as FX and National Geographic. Bob Iger stated that the deal should close in 12-18 months and highlighted the chance to expand Fox's Avatar franchise particularly considering new theme park lands. In addition to expanding the Marvel Universe via X-Men, Fantastic Four, and Deadpool, Disney will obtain Fox's distribution rights to the first Star Wars film. The deal will be accretive to EPS for the second fiscal year after closing, says Disney CFO Christine McCarthy, and Disney expects roughly $2B in cost synergies by 2021. Taking a majority stake in Hulu will further accelerate Disney’s streaming capabilities and compete directly with Netflix (NFLX). Taking majority control of Hulu is going to be beneficial and result in "flowing more content in Hulu's direction," and managing Hulu "becomes a little more clear, a little more effective." Turning to sports, combining Fox’s sports content with Disney’s ESPN will be synergistic and a "perfect complement" to ESPN's offerings, which are national in nature and will benefit from regional focus, Iger says.

Since the deal includes the Twentieth Century Fox Film and Television studios, along with cable and international TV businesses. Iger expects the deal to receive a "significant amount of regulatory scrutiny" both in the U.S. and internationally, but that it will be important to remember the "aim of this combination is to create a more high-quality product for consumers around the world" and to deliver it in more compelling ways. President Trump supports the combination of the film, television and international businesses from Twenty-First Century Fox, according to a White House statement. At the request of both boards, Iger has agreed to continue as chairman and CEO of Disney through the end of the calendar year 2021.

Figure 1 – Television, film and direct-to-consumer combination of Disney and Fox with noteworthy asset acquisitions

Figure 2 – Sporting assets that the Fox acquisition brings to the table to complement ESPN and ABC Sports that Disney operates

Figure 3 – Direct to consumer capabilities with the Disney and Fox combination and controlling interest in Hulu

Disney’s New Growth Pivot - Streaming

ESPN has remained at the forefront of investors’ minds, serving as the cause of this streaming initiative as profits and revenue from the Media Networks division have stalled out over the past few years. Simply put, Disney is going all-in on a Disney branded streaming service come 2019. Although ESPN makes up a disproportionate amount of the company’s revenue and income, all of its other franchises are posting robust growth hence Disney will be relying less on its ESPN franchise over the coming years. Disney’s perpetual stock slump and the roller coaster ride over the last two years has almost entirely been attributable to the decrease in ESPN subscribers and subsequent revenue slowdown at its Media Networks division.

Bob Iger revealed plans to roll out the ESPN Plus streaming service in the spring of 2018 and suggested the company might pursue early uptake of 2019's Disney-branded streaming service by pricing it "substantially" cheaper than Netflix. The company is making the right steps with its plans to target evolving media consumers with the two streaming services, JPMorgan's Alexia Quadrani says. The next two fiscal years look suitable for the film slate as well, she notes, with a pair of Star Wars canon films yet ahead, and another trilogy on the way along with stand-alone films like Solo.

The Walt Disney Company (NYSE:DIS) said it intends to remove all of its movies from Netflix and instead plans to launch its streaming service starting in the U.S. and then expanding internationally. Disney opted to exercise an option to migrate its content off the Netflix platform. Movies to be removed include Disney and Pixar titles, according to Iger. Netflix said that Disney movies would be available through the end of 2018 on its platform while Marvel TV shows will remain. The new platform will be the home for all Disney movies going forward, starting with the 2019 theatrical slate which includes "Toy Story 4," "Frozen 2," and the upcoming live-action "The Lion King." It will also be making a "significant investment" in exclusive movies and television series for the new platform.

Like analysis from Noah Kiedrowski?

Get Our Free Political Plays Newsletter

This free, bi-weekly newsletter from Noah Kiedrowski will give you actionable stock plays based on political action. Spot and profit from the political plays that matter.

ESPN's upcoming streaming service will be called ESPN Plus which will launch in the spring of 2018 with a fully redesigned app and offer scores and highlights along with authenticated streaming of channels for cable subscribers, and the ability for all to subscribe to live events. As for the general Disney-content direct-to-consumer offering, it's coming in the latter part of 2019, Iger says, and will include content from Disney's four major brands (Disney, Pixar, Star Wars/Lucasfilm and Marvel). It will have 4-5 independent feature films per year as well; he says, as well as original series. Already in development is a Star Wars live-action series, as well as other series based on its Monsters film and High School Musical series. All-in-all, bringing all of Fox’s studio and TV assets into the streaming fold will only add to the formidable challenger that Disney is becoming to Netflix.

Completing Marvel Universe

The Fox acquisition complements Disney’s Marvel Universe now that Fantastic 4, The X-Men and Deadpool come into the portfolio. The Fantastic 4, X-Men and Deadpool were Marvel assets that were divested and sold to Fox while Disney purchased all remaining Marvel properties. Disney effectively owns all the Marvel assets with the exception of box office gross for the Spider-Man films as the studio rights belong to Sony and the character rights belong to Disney. Spider-Man: Homecoming was written by Disney as Sony failed to reboot the Spider-Man franchise successfully with past attempts. This was a win-win for both studios as Disney benefited from merchandizing sales and Sony witnessed a windfall at the box office, scoring $880 million worldwide in 2017. Acquiring these Marvel assets provides Disney with scale and numerous options to complement record success at the box office for its Marvel Universe movies. Marvel Universe has released 17 films in total (Disney’s acquisition was in 2009), and on average, each film brings in $795 million in worldwide gross. The Incredible Hulk (2008) and Iron Man (2008) were technically before Disney’s ownership while Captain America: The First Avenger (2011), Thor (2011) and Iron Man 2 were projects already on-going at Marvel before the full Disney influence on future projects. Excluding these five legacy Marvel projects, the Disney inspired Marvel Universe films gross an average of $935 million per film. Given Disney’s success on the big screen, bringing in Fantastic 4, The X-Men and Deadpool to the portfolio will likely provide Disney with even more options and new franchises to integrate with its current Marvel talent.

Conclusion

FY2018 is off to an excellent start for Disney growth catalysts in the works via streaming, studio strength, Fox acquisition, and tax reform legislation. The Walt Disney Company (NYSE:DIS) has been establishing a firm footing in the streaming space via Hulu (30% stake now converting into a majority 60% stake after the Fox acquisition), BAMTech, Sling, ESPN streaming service and a Disney branded service coming in 2019. The studio segment is off to a great start with record-breaking movie releases such as Thor: Ragnarok and Star Wars: The Last Jedi surpassing $850 and $900 million in worldwide box office receipts, respectively. Disney is evolving to address the deteriorating Media Networks business segment with major streaming initiatives. Disney has one of its biggest movie slates for FY2018 with Blank Panther, The Avengers: Infinity War and Solo: A Star Wars Story around the corner. Disney also announced that it is acquiring 21st Century Fox’s assets to further drive growth for $52 billion. This acquisition brings in noteworthy studio assets such as more Marvel properties (X-Men, Fantastic 4 and Suicide Squad) and Avatar along with TV content and regional sports. Disney offers a compelling long-term investment opportunity considering the growth, Fox acquisition, pipeline, Media Networks remediation plan, diversity of its portfolio, tax reform, share repurchase program and dividend growth.

Noah Kiedrowski

INO.com Contributor - Biotech

Disclosure: The author holds shares of Disney and is long Disney. The author has no business relationship with any companies mentioned in this article. He is not a professional financial advisor or tax professional. This article reflects his own opinions. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned. Kiedrowski is an individual investor who analyzes investment strategies and disseminates analyses. Kiedrowski encourages all investors to conduct their own research and due diligence prior to investing. Please feel free to comment and provide feedback, the author values all responses. The author is the founder of stockoptionsdad.com a venue created to share investing ideas and strategies with an emphasis on options trading.

Mr Kiedrowski, Suicide Squad is a DC comics, therefore a Time Warner property.

And I don't understand how business laws in America works. The Justice department is kicking against AT&T's vertical integration with Time Warner that should raise no monopoly issues yet Mr Trump gives a nod to the horizontal integration between Disney and Fox that clearly raises a case of monopoly. This was the same person who expressed his opposition to the deal between AT&T and Time Warner months before he was elected president.

Hi okeke

Looks like I mistakenly mentioned Suicide Squad twice in the article where this should've been Deadpool. Outside of these two incorrect mentions, I consistently stated Deadpool, thanks for bringing that to my attention. In terms of the antitrust issues, Disney is aware of this and stated that publicly however they are structuring this deal to avoid any news assets and other red flags that may result in this deal being blocked. This is a horizontal integration with international reach for Disney so the international assets shouldn't be a problem and as far as the domestic assets are concerned, we'll see but their share at the box office is only ~20% as it stands right now.