OPEC concluded its meeting on June 22nd with a vaguely-worded communique about its oil deal:

“Accordingly, the Conference hereby decided that countries will strive to adhere to the overall conformity level of OPEC-12, down to 100%, as of 1 July 2018 for the remaining duration of the above-mentioned resolution and for the JMMC to monitor and report back to the President of the Conference.”

At the press conference afterward, OPEC president HE Suhail Mohamed Al Mazrouei, UAE Minister of Energy and Industry, struggled to explain exactly what it meant. When asked how many barrels would be added, he remarked that “you can do the math” between current output and the 100 percent conformity level, although he later said it was about one million barrels per day.

However, at the press conference of the 4th OPEC and non-OPEC Ministerial Meeting on June 23rd, oil ministers Khalid al-Falih of Saudi Arabia and Alexander Novak of Russia, responded to questions, explaining the new deal and how it would be implemented.

But Iran’s oil minister later said that OPEC’s oil output agreement did not specify a production increase, which probably explains why the agreement was left vague. It also explains Mr. Al-Falih’s unusual remark at the press conference:

“As far as I’m concerned, as the minister of Saudi Arabia, it’s important to respect the decisions of the group and to try to stay within it. But my bigger guiding principle is to be respectful for the market needs.”

The U.S. State Department issued a statement following the OPEC meeting that oil companies would not be permitted to import any Iranian oil after November 4th. This has raised the prospects that Iranian exports could be drastically reduced. However, there is no indication that China, India, and Russia could or would not increase their purchases of Iranian oil, especially if offered at a discount to world prices.

In the latest report this week, Saudi Arabia has already increased its output to almost 10.8 million barrels per day (mmbd) in June and will increase it to 11.0 mmbd in July.

Before these developments, the DOE had forecast that OPEC crude production would average about 31.9 mmbd in the second half of 2018. The OPEC group said it would add 1.0 mmbd to 32.9 mmbd; however, what happens to Iranian exports in the last two months of 2018 remains a question, and the spare capacity to replace two mmbd of Iranian exports does not exist. However, the U.S. could release oil from its Strategic Petroleum Reserve of up to 4 million barrels per day.

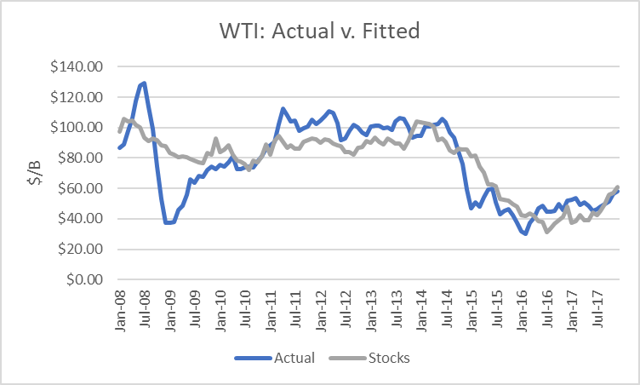

Nonetheless, I used the DOE’s forecast of global OECD inventories as a base case to assess how current futures prices compare to model-predicted prices. I previously have run a regression between WTI crude oil prices and OECD stocks from 2008 through 2017. The correlation is -79%.

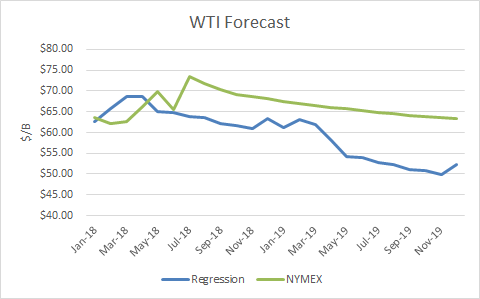

When I inserted EIA’s global OECD forecast for 2018 and 2019, I get the forward price curve as depicted below. I compared the price forecast from the regression to NYMEX WTI prices (June 28th close). It shows that nearby futures prices ($73.45) currently have about a $10/b risk premium.

Conclusions

The oil market movement since the OPEC meeting seems to be ignoring the Saudi promise to raise OPEC production by 1 million barrels per day. Instead, it is pricing in a premium for the withdrawal of Iranian exports starting in November. I expect Iran to instead increase its exports to China, India, and Russia to maintain production. In the meantime, the additional oil being produced by Saudi Arabia and friends will add to stockpiles.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

As far as Technical s are concerned for WTI, $ 76.5 and $ 74.5 are long term and $ 67.25 to $ 71.44 is near term resistance, any Bull run can be expected only if oil break above upper barriers.

Is oil and gas going up?

I BELIEVE THAT OIL WILL CONTINUE TO GROW IN PRICE. SLOWLY THROUGH 2018.

MAINLY BECAUSE OF THE 2 TRILLION $ ARAMICO IPO NEXT YEAR.

I tend to believe oil will go down by end of 2018

so is oil going up or down

thank you sir for this article. Agree with the post but can't understand when mkt will discount Saudi production hike ?