Our continuing research into the state of the real estate market suggests the Covid-19 virus event will likely put extreme pressure on many sectors within the US and global markets. This, Part III of a multi-part research article, will highlight many of the key economic data points that will soon be released and how these numbers may shock the markets. Additionally, as consumers and businesses prepare for an extended shutdown, it is important to understand the psychological process that takes place in the minds of people. PART I, PART II

Initially, people naturally hope for a quick and reasonable solution. As the process continues where an extended shutdown of the US economy persists, consumers and business managers change their expectations from optimism for a quick resumption of economic activity to “how do we survive this extended closure event”. This is when traders and investors really need to pay attention to what is happening in their local and national economies. One of the most important things to consider throughout an event like this is to watch how your local economy is operating and what is happening with local consumers. This will help you understand what is happening elsewhere.

Demand for certain items will continue almost as normal. We call this the Personal Consumer Essentials. These items are typically things like toilet paper, toothpaste, over the counter medications, underwear, food, and water. These are the types of purchases that must continue for average people to survive this type of event. Luxury items, vacations, extras, and other purchases may suffer throughout this process.

The first 30 days will likely be a transition period for many consumers. Remember, this is still the “hope” phase where consumers and business managers believe the entire thing will be over in 15 to 20 days and everything will go back to normal. We really need to start to watch how China is engaging in trying to restart their economy and how other nations are dealing with the virus contagion. Maybe the US will regain economic activity faster than other nations – maybe not. The key to all of this is when consumers and business managers feel confident enough to engage in opportunistic growth investments and purchases – not just survival purchases.

Let’s take a look at some of the key economic data that will be presented over the next 15+ days… But first, be sure to opt-in to our free-market trend signals before closing this page, so you don’t miss our next special report!

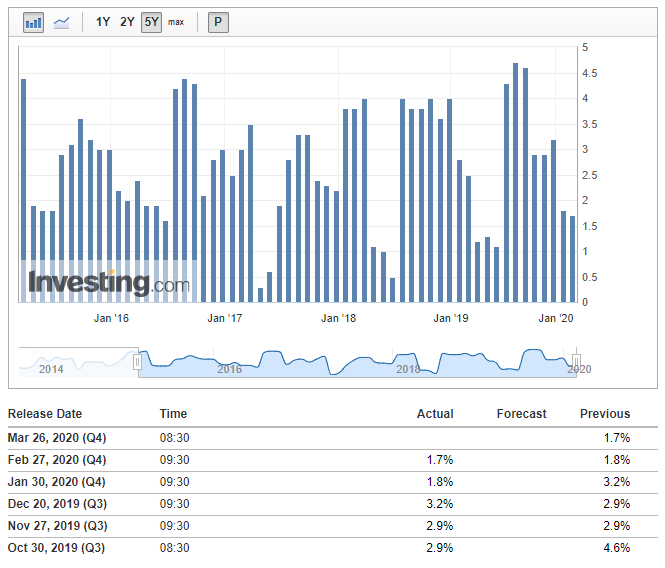

Consumer Spending

If consumer spending falls below 0.5% for an extended period of time, the largest part of the US GDP calculation will have essentially vanished (consumers). This will result in decreased economic activity, taxes, income and have far-reaching economic complications across the globe. It is our belief that the initial phase of the US shutdown sparked a decent wave of consumer spending for survival supplies. As we move further into this shutdown event, we believe Consumer Spending could easily fall below 0.5% for an extended period of time – possibly many months.

Source: investing.com

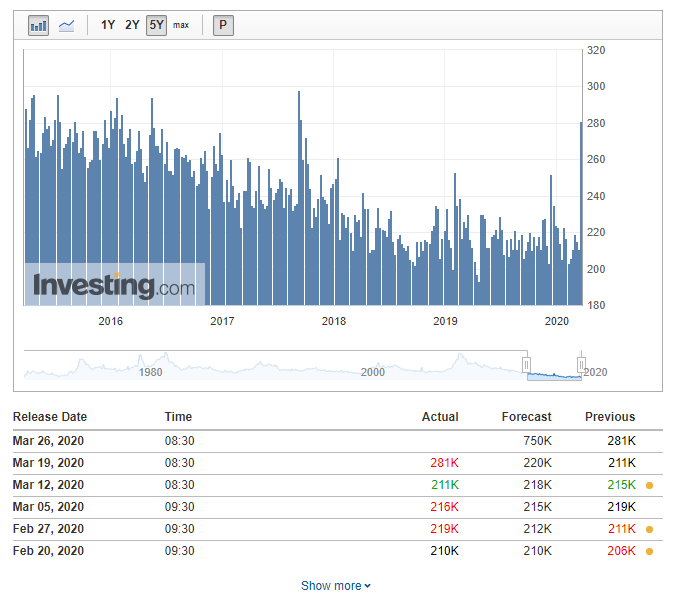

Jobless Claims

We expect Jobless claims to skyrocket. We are hearing from local sources that the true number of unemployed in the US as a result of this virus event could be well above 4+ million right now. It will take time for these people to process into the system – so this will be an interesting number to watch. This number could send a shock-wave throughout the investment community as an extended rise in the jobless claims values would suggest a very deep recession is setting up. No jobs, no income, no asset appreciation – it’s simple.

Source: investing.com

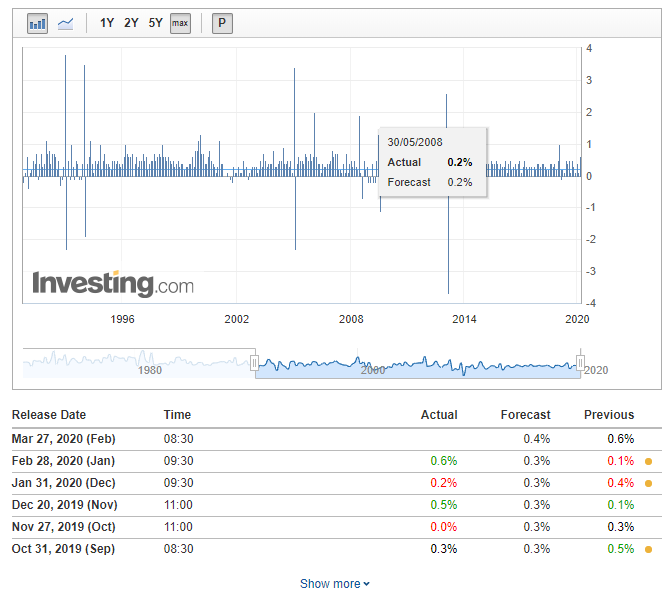

Personal Income

Personal Income has fallen into severely negative territory only a few times over the past 30+ years. We believe income levels will play an important role in understanding the true scope of this potential economic event and how to plan for a potential Real Estate collapse in the future. If you are following our logic in posting these data points, you’ll quickly understand that Consumer Spending is related to a psychological consumer belief (either opportunistic or survival). This psychological belief is related to having a job and a solid source of income.

In the past, we’ve often referred to the global economy as a “living being” operating in a localized environment – like a plant. Typically, if the environment is healthy and abundant, the plant adopts a “growth phase” where it attempts to flower and expand into the environment. If the environment is unhealthy, the plant changes into a “survival phase” where it attempts to shed unneeded shoots and stems while trying to simply survive the unhealthy environment. The plant can’t get up and walk to a better environment – it is forced to operate in either of these modes because it has no other choices.

Within a global event like the Covid-19 virus event, we are like these plants that I’m describing. We can’t pack up and move to a better environment – we just have to deal with the phases and processes that are taking place within our environment – hoping to survive enough to be able to grow when the environment gets more healthy.

If personal income collapses, consumers will shift into a survival mode much quicker. This is similar to the environment turning completely toxic over just a few days.

Source: investing.com

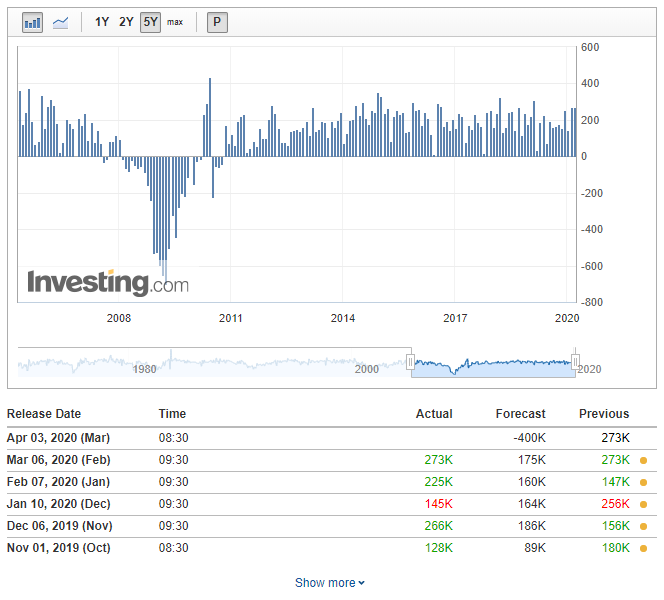

Non-Farm Payroll

Non-Farm Payroll data will also help us understand how toxic the economic environment has become in the US. We purposely included the 2008-09 data on this chart to show you how the payroll data turned negative in late 2007 and early 2008 – well before the collapse really started to happen. With the Covid-19 event taking place, we believe the process will be much quicker and violent. If the nation-wide shutdown continues for more than 60+ days and/or the spread of the virus is not under some type of containment within the next 60 to 90+ days, the damage to the jobs market could be extensive. That translates into the Real Estate market as very bearish.

Source: investing.com

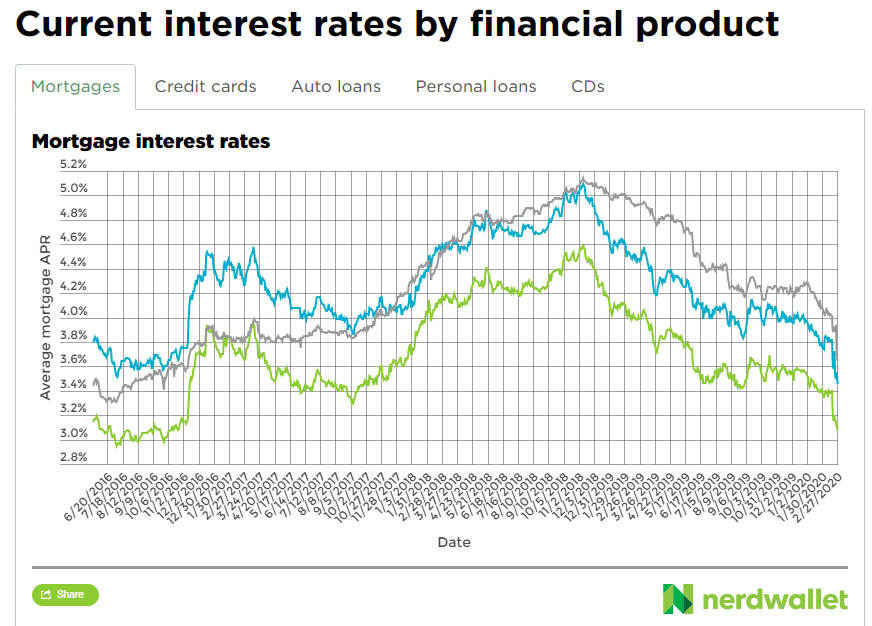

Mortgage Rates

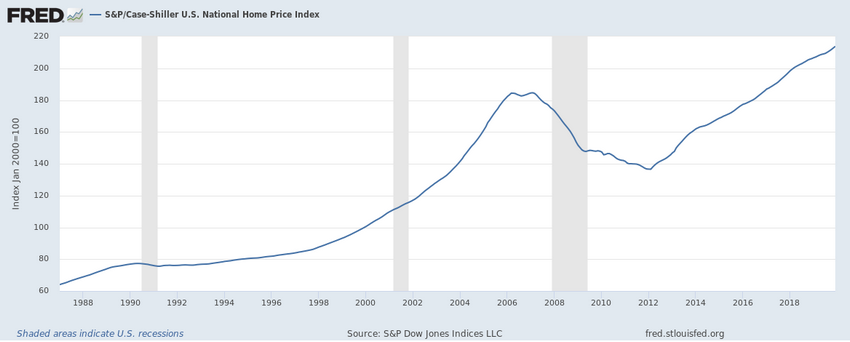

Even though the Fed has dropped interest rates, consumers may not be willing to engage in purchasing real estate while this Covid-19 virus event continues. Home prices are extremely high compared to historical values. The Case-Shiller home index (below) suggests a move down to the 140~150 level would not be unreasonable – even with interest rates near ZERO again.

Source: nerdwallet.com

Case-Shiller National Home Index

If we are correct and an immediate and rather deep price decline takes place in the US housing market, it will set up a “race to real value” in terms of the market attempting to find what we call the “equilibrium” within the supply/demand curve.

A decrease in the Case-Shiller National Home Price Index to levels near 150~160 would represent a nation-wide price collapse of about 25~35% in the housing market. Certain segments of the housing market may fall by even more extreme levels whereas other segments may fall by smaller amounts.

We believe the economic reaction related to the Covid-19 virus event will result in a “shock wave” type of collapse as the March 2020 (Q1) data is released in April and May 2020. We believe the revised expectations and continued battle to contain the virus will continue to place extreme pricing pressure on certain asset values. Commercial and Residential real estate is some of the largest price assets anyone could purchase and they’ve experienced a solid 8+ year price advance. It does not seem illogical that a 20% to 30% decline could take place as a result of this Covid-19 virus event.

When you consider the real process of combating this virus event and the destruction that will take place across the US and the global economy over the next 6 to 12+ months, it is very likely that both commercial and residential real estate will fall from current lofty levels to price levels that are closer to the equilibrium of the supply/demand curve.

We also believe that foreclosures will continue to stack up – even if the banks are told not to process foreclosures for a 12 month period of time. This does not stop the flow of consumers unable to continue their mortgage obligations – it just stops the banks from engaging in near foreclosure activity for a period of time. The hope is that the markets may settle a bit before banks open the flood gates and start processing these faulty mortgages again.

In the next, last, portion of this real estate research article, we’ll try to share some predictive analysis that may help you understand where the US stock market may find support and where the US real estate market may find a bottom.

You don’t have to be smart to make money in the stock market, you just need to think differently. That means: we do not equate an “up” market with a “good” market and vi versa – all markets present opportunities to make money!

We believe you can always take what the market gives you, and make a CONSISTENT money.

Learn more by visiting The Technical Traders!

Chris Vermeulen

Technical Traders Ltd.

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation for their opinion.

Insiggewend!