Just before the COVID-19 pandemic struck the S&P 500, Nasdaq, and Dow, Ray Dalio was recklessly dismissive of cash positions, stating "cash is trash." Even Goldman Sachs proclaimed that the economy was recession-proof via "Great Moderation," characterized by low volatility, sustainable growth, and muted inflation. Not only were these assessments incorrect but they were ill-advised in what was an already frothy market with stretched valuations. I'm sure Ray Dalio quickly realized that his "cash is trash" mentality, and public statements were imprudent. The COVID-19 pandemic has been a truly back swan event that no one saw coming. This health crisis has crushed stocks and decimated entire industries such as airlines, casinos, travel, leisure, and retail with others in the crosshairs.

The S&P 500, Nasdaq, and Dow Jones have shed approximately a third of their market capitalization, with the sell-offs coming in at 33%, 29%, and 36%, respectively, through March 20, 2020. Some individual stocks have lost over 70% of their market capitalization. Other stocks have been hit due to the market-wide meltdown, and many opportunities have been presented as a result.

Investors have been presented with a unique opportunity to start buying stocks and take long positions in high-quality companies. Throughout this market sell-off, I have begun to take long positions in individual stocks, particularly in the technology sector and broad market ETFs that mirror the S&P 500, Nasdaq, and Dow Jones. It's important to put this black swan into perspective and see through this on a long term basis while viewing this as an opportunity that only comes along in decades.

Most Extreme and Rare Sell-Off Ever

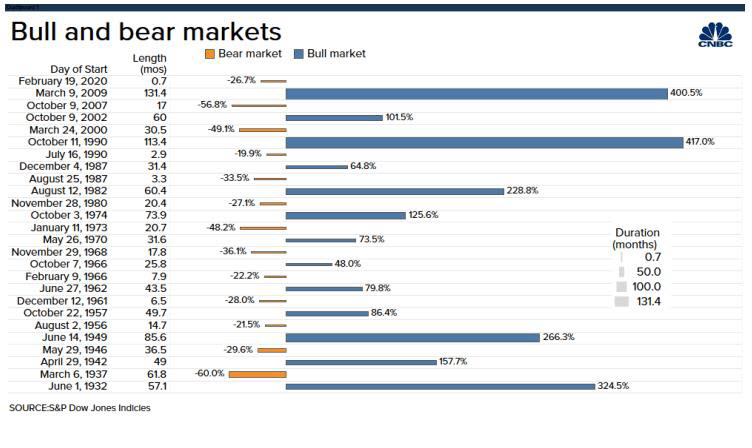

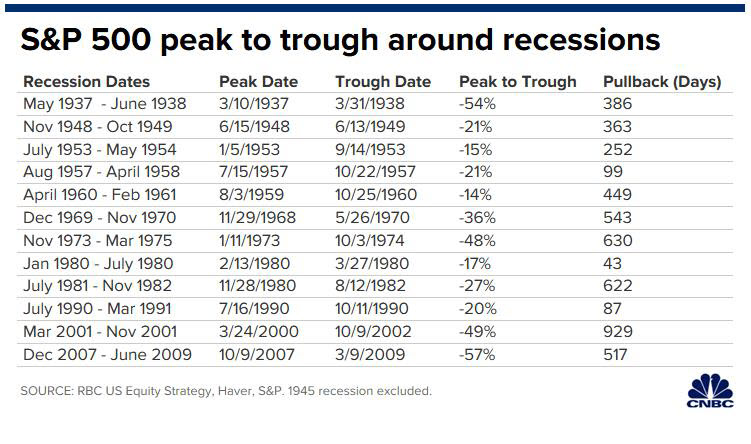

The abrupt and drastic economic shutdown and velocity of the U.S. market's ~30% drop within a month bring parallels to the 1930s. This sell-off has been extreme and rare in its breadth, nearly evaporating entire market capitalizations of specific companies. The pace at which stocks have dropped from their peak just last month from all-time highs is the fastest in history. The major averages just posted their worst week since the financial crisis (Figures 1 and 2). The Dow is tracking for its worst month since 1931, the S&P since 1940. As of March 20, the S&P 500, Nasdaq and Dow Jones have sold off 33%, 29%, and 36%, respectively.

Figure 1 – Dramatic market sell-off in one month leading to the sharp market declines accompanied with a 36% market correction

Figure 2 – Major market sell-offs and their corresponding peak-to-trough declines

See Through This Black Swan Event

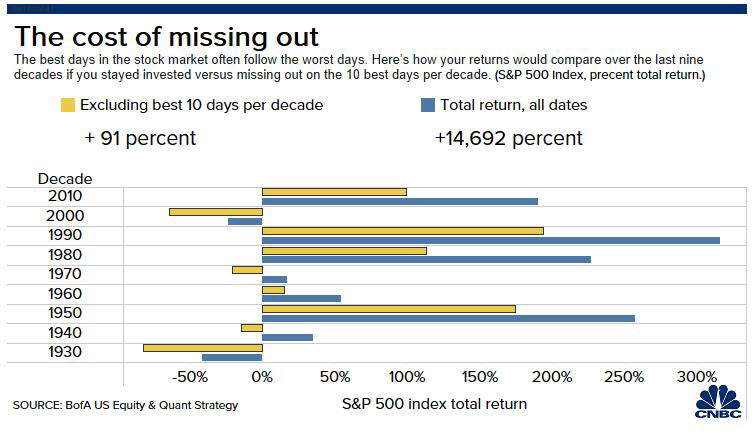

Investors should look at this as a unique opportunity to invest in stocks and stay the course over the long term. Per Bank of America, looking at data going back to 1930, if an investor missed the S&P 500′s 10 best days in each decade, total returns would be just 91%, compared to the 14,962% return for investors who held steady throughout the ups and downs (Figure 3).

Figure 3 – Trying to time the market and potentially missing some of the best days can be detrimental to one's portfolio

The S&P 500 is currently at 2,300 or ~32% below its peak back on February 19. The index trades at ~14 times earnings for 2019. If next year recovers to the 2018-19 level again of $165 per share, the market is still at 14 times forward earnings, which is a discount to historic P/E multiples. The market traded at a P/E of 14.5 during the market meltdown in Q4 2018. Previous bottoms have seen lower P/Es in history with a P/E of 11 on March 9, 2009, the bottom during the financial crisis.

Getting started is easy! Test our tools with a 30-Day Trial.

It's noteworthy to point out the Dow Jones' five worst single-day point drops, and the four best single-day point gains have all been in March. At a certain point, there will be an inflection point, and one of those big rallies will mark the turn in this market. If you sell now, you will be left on the sidelines, hurting your long-term returns per the data.

Per Bank of America, "the probability of losing money plummets to 0% over a 20-year time horizon." Time and again, bear markets have proven to be good buying opportunities; however, it can just take several years for the gains to be realized.

"Investors with longer-term investment horizons should remain invested in stocks," Goldman said, while Bank of America noted that "time is money for equities." The firm added that "for equity investors, the best recipe for loss avoidance is time: as time horizons lengthen, the probability of losing money in stocks has decreased."

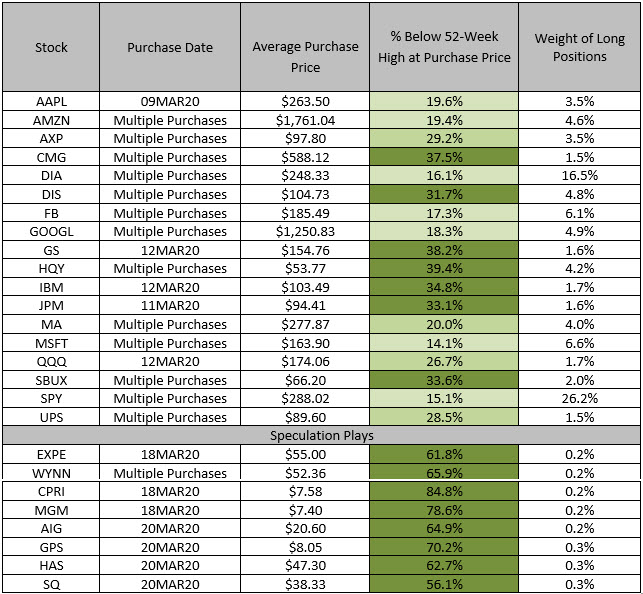

Initiating Long and Speculative Positions

The S&P 500, Dow Jones, and Nasdaq are now off 33%, 36%, and 29%, respectively, from their highs. Throughout this stretch of market weakness, I started to buy long positions in names that present compelling value and growth beyond the COVID-19 health crisis. These names are well-positioned to explode higher when the market inevitably rebounds. Many of these positions have been purchased well off their highs, and I've averaged down throughout this sell-off. Some positions were initiated too early in hindsight; however, I've scaled into these names over time with multiple purchases in small increments (Table 1). I've also started to scale into speculative names that have sold off by ~60% or more with small dollar amounts, as I feel these are too cheap to ignore.

Table 1 – Initiating long positions in small increments throughout the market sell-off to lock-in double-digit discounts from 52-week highs

Conclusion

After this epic sell-off, stocks are too cheap to ignore, and starting to buy at these levels is prudent. There's a wide array of high-quality names that are selling at deep discounts; some are off ~40% from their 52-week highs. When you sell during a panic, you may miss the market's best days as rapid sell-offs often lead to quick bounces. COVID-19 has sent shock waves through the markets, causing double-digit declines across all major indices. Selling here has proven to put investors at risk for missing out on some of the best days ahead for the market. COVID-19 induced sell-off has presented an excellent opportunity to take long positions on high-quality names such as Apple (AAPL), Amazon (AMZN), Chipotle (CMG), Disney (DIS), Microsoft (MSFT), Google (GOOGL), Facebook (FB), Mastercard (MA) and Starbucks (SBUX) to name a few as well as the broader indices such as SPY (S&P 500 ETF), Nasdaq (QQQ) and DIA (Dow Jones ETF). Selling far out cash covered puts and put spreads on high-quality stocks that have corrected ~30%-plus may be a great strategy to mitigate further downside and define your risk.

Thanks for reading,

The INO.com Team

Disclosure: The author holds shares in AAPL, AMZN, DIA, GOOGL, JPM, MSFT, QQQ, SPY and USO. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.

First of all, predictors with an approach or thinking alike "cash is trash." are dangerous, as specially, when they are stating such advice without considering even any primary Technical analytical point of views. All such “so called” experts or Pundits have damaged investors harshly, so either their intention at the time of such announcement is doubtful or their level of knowledge itself is questionable.

Second thing, when so many uncertainty still remains, how can current situation identify as a "Black swan Event"? At this stage, can anyone is in a position to declare stable strength or weakness confidently? Does anyone sure that Stock will not available at even cheaper rates, or Stocks are at the Bottom or just near to Bottom?

Finally, I would like to say that at current juncture, one should avoid investing and wait for some more reliable signals to start buying, irrespective of criteria like short term or long term. (Current Levels - Last closing – Dow 21636.78 and S&P 500 2541.45)

Coronavirus was NOT a black swan event. It has been predicted and studied and prophesied for years. We chose to ignore the warnings. But it is not a black swan, as it was predicted.