In March, I published a piece on taking speculative positions given the complete market meltdown. It was as good a time as any to put on some speculation plays because this COVID-19 black swan event presented a once in a lifetime opportunity. This COVID-19 induced sell-off has been the worst since the Great Depression in terms of breadth and velocity of the sell-off. This health crisis has crushed stocks and decimated entire industries such as airlines, casinos, travel, leisure, and retail with others in the crosshairs. Now many positions have been sold at realized profits between 20%-100% gains as the market bounced back from its lows in late March.

The broader indices have shed approximately a third of their market capitalization into April. Some individual stocks directly related to the COVID-19 pandemic have lost 50%, 60%, 70% and even 80% of their market capitalization. Investors had been presented with a unique opportunity to start speculating on some of these names as sharp rebound candidates. Throughout the market sell-off, I began to speculate on a variety of names with small amounts of capital. Let's not confuse speculation for investment; thus, these trades were purely speculative for a sharp potential recovery. These names have been battered to levels not seen since the Financial Crisis. Names such as Expedia (EXPE), Wynn Resorts (WYNN), Capri Holdings (CPRI), MGM Resorts (MGM), Yelp (YELP), Yum Brands (YUM), Chipotle (CMG), Ulta Beauty (ULTA), Royal Caribbean (RCL), Boeing (BA) and Twitter (TWTR) are some speculative names that have sold off ~40%-85%.

Evaporated Market Capitalization

The COVID-19 pandemic has destroyed entire industries and many individual stocks. Anything related to travel, leisure, retail, industrials, and discretionary spending has been cut by 50% or more. Companies are being tested like no other time in history, where the entire economy is at a standstill until the COVID-19 coast is clear. Amid this economic wreckage, speculation can potentially yield huge gains once this pandemic passes, and companies can get back on their feet. Markets can misbehave and become irrational, resulting in the temporary mispricing of stocks. Expedia (EXPE), Wynn Resorts (WYNN), Capri Holdings (CPRI), MGM Resorts (MGM), American Insurance Group (AIG), Square (SQ), Lowes (LOW), Yelp (YELP), Yum Brands (YUM), Chipotle (CMG), Ulta Beauty (ULTA), Royal Caribbean (RCL), Boeing (BA), Hasbro (HAS) and Twitter (TWTR) are some speculative names that have sold off ~40%-85% and sharply rebounded doubles in many cases (Figure 1).

Figure 1 – A slew of speculative stocks that have lost 40%-80% of their market capitalizations and since sharply rebounded to doubling their share price in many cases. Expedia (EXPE), Wynn Resorts (WYNN), Capri Holdings (CPRI), MGM Resorts (MGM), American Insurance Group (AIG), Square (SQ), Lowes (LOW), Yelp (YELP), Yum Brands (YUM), Chipotle (CMG), Ulta Beauty (ULTA), Royal Caribbean (RCL), Boeing (BA), Hasbro (HAS) and Twitter (TWTR) are speculative names that have rebounded ~50%-100% of their lows to capture realized gains

Opening Speculative Positions

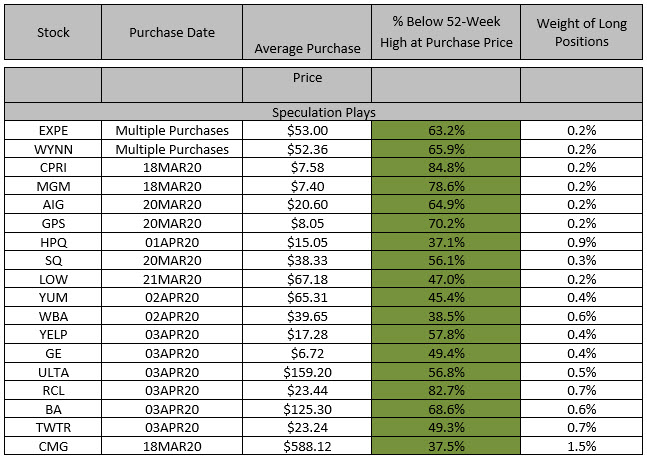

I've opportunistically opened speculative positions that presented the potential to explode higher when the market inevitably rebounds. These stock positions have been purchased well off their highs, and I've averaged down throughout this sell-off using small amounts of capital (Table 1). These speculative positions encompassed a small portion of my portfolio in an effort to aim for huge gains when the market recovers. As the market recovered in April, many of my speculative positions were sold for realized gains (Tables 1 and 2).

Tables 1 and 2 – Initiating speculative positions throughout the market sell-off for securities that have lost more than 50% of their value and the corresponding realized gains.

When the market has sharp drops, it tends to have quick and drastic rebounds to the upside that can yield quick double-digit gains

Conclusion

It was a great time to add speculative positions to your portfolio in companies that have lost the vast majority of their value in the heart of the COVID-19 sell-off. These stocks have the potential to explode higher when the market inevitably rebounds or elevates on a quick rally. Expedia (EXPE), Wynn Resorts (WYNN), Capri Holdings (CPRI), MGM Resorts (MGM), American Insurance Group (AIG), Square (SQ), Lowes (LOW), Yelp (YELP), Yum Brands (YUM), Chipotle (CMG), Ulta Beauty (ULTA), Royal Caribbean (RCL), Boeing (BA), Hasbro (HAS) and Twitter (TWTR) were recent examples of taking small positions and then turning these into double-digit realized gains in a matter of trading days or weeks.

After this epic sell-off, some stocks are worth speculating on as these are too cheap to ignore. When you sell during a panic, you may miss the market's best days as rapid sell-offs often lead to quick bounces. COVID-19 has sent shock waves through the markets, causing market capitalizations to be wiped out across a slew of stocks. The COVID-19 induced sell-off has presented an excellent opportunity to add speculative positions that have sold off ~50%-85%. This can serve a great speculative opportunity for any portfolio, as this type of decline comes along once in a lifetime.

Thanks for reading,

The INO.com Team

Disclosure: The author holds shares in AAL, AAPL, AMC, AMZN, AXP, CMG, DIA, DIS, FB, GOOGL, GS, HQY, IBM, JPM, KSS, MA, MSFT, QQQ, SBUX, SLB, SPY, TRIP, UPS, USO and X. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.