Capturing over 100% of the option's premium income and closing trades prior to expiration is the ideal scenario for options trades. The manner in how one constructs this options trade is the key to these attributes. A diagonal spread leverages a minimal amount of capital, defines risk, and maximizes return on investment while enabling traders to capture greater than 100% of the option premium while accelerating the trade's closure before expiration. Diagonal spreads are ideal when engaging in options trading for many reasons, namely its risk mitigation properties. This type of trade is excellent to layer into a long-term successful overall options strategy which includes risk-defining trades, staggering expiration dates, trading across a wide array of uncorrelated tickers, maximizing the number of trades, appropriate position allocation, and always being an option seller to continuously bring premium income into the portfolio.

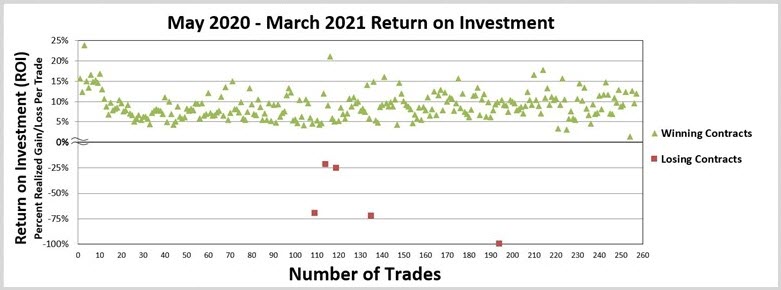

Using a combination of diagonal call spreads, diagonal put spreads, call spreads, put spreads, and iron condors over the past 11 months, a total of 248 options trades were placed and closed. During this timeframe, 243 trades were winning trades for a 98% option win rate with an average income per trade of $168, an average return on investment (ROI) per trade of 7.9%, and overall premium capture of 85%. An options-based portfolio can offer the optimal balance between risk and reward while providing a margin of downside and upside protection with high probability win rates. Risk management is essential when engaging in options trading to drive portfolio performance, and diagonal spreads are a key component to this overall strategy (Figures 1, 2, and 3).

Figure 1 – Comprehensive options-based performance metrics

Figure 2 – Comprehensive options-based performance metrics

Figure 3 – Comprehensive ROI options-based performance metrics

Diagonal Spreads

When you take in a premium after you sell an option and it expires worthless, you capture 100% of the premium. So how is it possible to capture more premium than what you sold the option contact for? The answer is a diagonal put spread. This type of trade leverages a minimal amount of capital, defines risk, and maximizes ROI while enabling traders to capture greater than 100% of the option premium.

A diagonal credit spread strategy involves selling an option and buying an option while collecting a credit in the process. When selling an option, a premium is collected and simultaneously using some of that premium income to buy a further dated option leg at a further out of the money strike. The net result will be a credit on the two-leg pair trade with defined risk since the purchase of the further out of the money option serves as protection.

Capturing Over 100% Premium Income

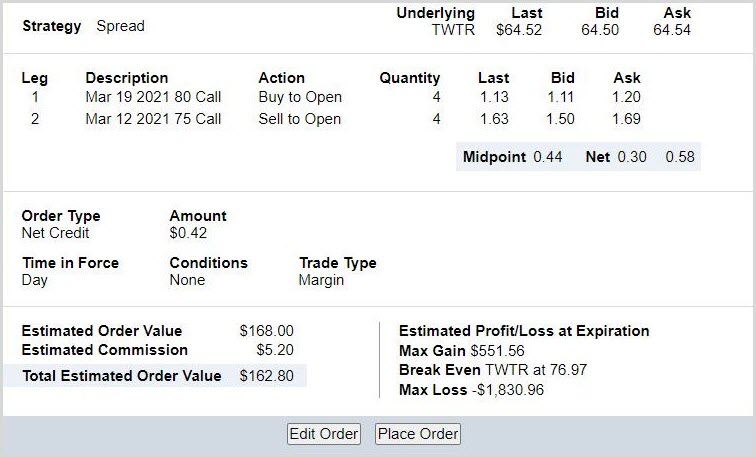

The diagonal spread trade set-up has two legs. The initial leg is a sell-to-open at an out-of-the-money strike to receive a premium. The second leg is a buy-to-open at a further dated and further out of the money strike to serve as a protection leg (Figure 4).

As expiration nears in a diagonal spread, you can buy-to-close the initial out of the money strike for a small debit. The further dated put protection leg has a week remaining in the contract; thus, time premium remains, and you can sell-to-close for a credit. The credit taken to close out the protection leg will exceed the debit required to close the initial strike leg. The result will be greater than 100% premium capture since you will net more premium than initially received upfront when selling the pair trade (Figure 4).

Figure 4 – This diagonal call spread trade is an example demonstrating a 105% premium capture and 9.3% ROI on the TWTR trade

Overall Options-Based Strategy

Options are a leveraged vehicle; thus, minimal amounts of capital can be deployed to generate outsized gains with predictable outcomes. A combination of spreads, diagonal spreads, and iron condors is used as the foundational strategy as an ideal way to balance risk and reward in options trading. Any risk-defined spread strategy involves selling an option and buying an option while collecting a credit in the process. When selling a diagonal spread option, a premium is collected and simultaneously using some of that premium income to buy a further dated and further out of the money protection option leg. The net result will be a credit with defined risk since the option's purchase serves as protection.

Conclusion

A combination of spreads, diagonal spreads, and iron condors underpin this options-based strategy. Diagonal spreads are an ideal way to balance risk and reward in options trading. Diagonal spreads offer superior risk mitigation in the event the underlying security moves against you during the option lifecycle while easily achieving greater than 100% premium capture throughout the process.

An overall options-based approach provides a margin of safety while circumventing the impacts of drastic market moves as well as containing portfolio volatility. Despite market volatility, consistent monthly income is generated while outpacing the S&P 500 with 50% of the portfolio in cash.

An options-based portfolio provides the agility required to mitigate uncertainty and volatility expansion while circumventing market declines. Using the 10 rules as a foundation will drive consistent options results.

Thanks for reading,

The INO.com Team

Disclosure: The author holds shares in AAPL, AMZN, DIA, GOOGL, JPM, MSFT, QQQ, SPY and USO. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.