Thank you for your interest in this exclusive analysis and INO.com's Daily Analysis & Commentary. Please see the report below and don't hesitate to contact us at

su*****@in*.com

if you have any questions. You can also view this Traders Blog for daily analysis, trading polls, and complimentary tools.

Looking back on 2013, I have to say it was a very good year, one that will long be remembered by many investors and traders. Now the question is, what kind of year is 2014 going to be? The goal of this special report is to make sure that you are not caught on the wrong side of the market and have to give back all of last year's profits. By knowing these 4 important factors, you can survive and thrive this year!

Looking back on 2013, I have to say it was a very good year, one that will long be remembered by many investors and traders. Now the question is, what kind of year is 2014 going to be? The goal of this special report is to make sure that you are not caught on the wrong side of the market and have to give back all of last year's profits. By knowing these 4 important factors, you can survive and thrive this year!

I am going to be looking at the big picture and the S&P 500 index in this report. The S&P 500, or the Standard & Poor's 500, is a stock market index based on the market capitalization of 500 large companies having common stock listed on the NYSE or NASDAQ. By following the 500 largest companies, it gives us a good sense of direction for the overall economic climate. The stock market tends to look out 6 to 9 months ahead, so when the index is moving higher, it's thinking that things will continue to get better with the economy, conversely when it's going down, it's just the opposite.

It's important to understand what drives and effects this index as it is an indicator of general market health. In my opinion, there are 4 main factors you must understand to trade in 2014: technicals, economic cycles, fundamentals and perception.

1 - Market Technicals

Unlike the fundamentals, the technicals pretty much rely on one thing, price action. You want to be long when the prices are going up and out when prices are going down. Technicians believe that the sum total of all knowledge (fundamentals, perception and cycles) are all in a stock's closing price for that particular day. By measuring price against previous days, technicians believe they can determine the trend of the market.

The one standout technical feature I see on the S&P 500 chart is the long-term trend line which comes in from the lows seen in 2009. There is also another shorter trend line that begins in September of 2011. Should these lines be breached on the downside, it would not augur well for the S&P 500.

Daily Close-Only S&P 500 Chart

Looking at the daily close-only chart of the S&P 500, I can see the recovery from the lows at 1,741.78 to the first major Fibonacci resistance level around 1,795. The next major Fibonacci resistance comes in at 1,807, which would be a 61.8% correction from the highs seen in January. The RSI indicator is back to the mid-point line at 50, which should offer resistance for this index. The combination of the Fibonacci resistance and the RSI resistance indicates that the S&P 500 could be running into some serious supply lines.

Legend & Technical Picture (Black Numbers)

1) All-time closing high for the S&P 500 at 1,850.59 on January 15, 2014

2) Fibonacci retracement level.

3) RSI below its 50 line, which will now act as resistance

Weekly Close-Only S&P 500 Chart

Looking at the weekly close-only chart of the S&P 500, I can see a "parallel channel" starting back in 2009. The fact that the S&P 500 index is at the top of this channel could present problems for further upside activity. I have also drawn in the Fibonacci retracement levels. A 50% retracement from the lows of 1,122 would drop this index back to a 1,481 support level. Further downside pressure could push this index all the way back to the 1,400 support level, which would represent a 61.8% Fibonacci retracement.

Legend & Technical Picture (Black Numbers)

1) Parallel channel for the S&P 500

2) Fibonacci retracement levels

Monthly Close-Only S&P 500 Chart

Looking at the monthly close-only chart of the S&P 500, you can see the importance of the trend lines that are support for this index. Should these lines of support give way, it would indicate further downside pressure. One of the key lines to look at, in my opinion, is the RSI indicator. A break below that trend line could be the first inkling of problems for the index.

Legend & Technical Picture (Black Numbers)

1. Long-term support trend line

2. Intermediate-term support trend line

3. Next major time cycle of this index

4. Long-term RSI support trend line

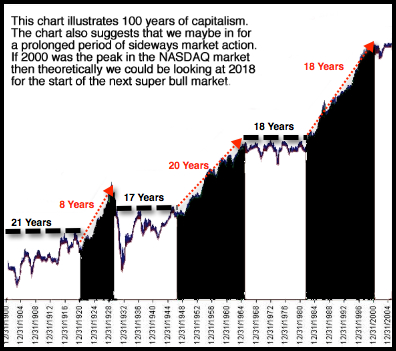

2 - Market Cycles - 100 Years Of Capitalism

Let's look at over a century of capitalism and see the economic market cycles in a capitalistic economy. Based on the graph, you can see the potential for this market to have a pullback from the highs that were seen in January of 2014. The graph shown utilizes NASDAQ data. You may remember that the NASDAQ topped out at 5,132.52 on March 10, 2000 with the dot-com collapse. It has not made new highs since it peaked in 2000.

The graph shown utilizes NASDAQ data. You may remember that the NASDAQ topped out at 5,132.52 on March 10, 2000 with the dot-com collapse. It has not made new highs since it peaked in 2000.

If the economic cycles are correct and the same pattern continues and we assume that the highs for the last economic cycle were in 2000, then we could see more sideways action similar to the previous 17 and 18 year periods. Once we are over that time frame, history suggests that it would be an excellent time for long-term investors to load up and stay the course.

We are now entering a period after a five year expansion in a longer-term secular bear market, which means the chances of the S&P 500 delivering returns anywhere close to 2013 are slim to none. Historically, it just has never happened after a five year expansion, but when it comes to the market, you never say never.

3 - Market Fundamentals

The fundamentals that power the S&P 500 index are important and can be as simple as an investor looking for stocks that are going to improve over time or as complex as a company's balance sheets, profit margins, rate of growth and dividend payouts. Another big factor that effects market valuations is the policies of the Federal Reserve Board.

The Fed’s decision to move into a quantitative easing stance in 2009 had an enormous positive effect on the stock market, which has been the number one beneficiary of this policy. "Helicopter Ben” has left office, but his grand experiment lives on and it is up to the new Fed chairperson, Janet Yellen, to clean up this mess.

The Fed bet $4 trillion to push the S&P 500 from a low of 666.79 in 2009 to a high of 1,850.59 on January 15, 2014. $4 trillion dollars is beyond a boatload of money, that is how much debt we have piled on the books since 2009. With the Fed now committed to tapering and gradually ending its quantitative easing policy, it will be interesting to see if the markets themselves can stand without the "Fed fix." Many traders are concerned that the market has become so addicted to the "Fed fix" and easy money policies, that the markets may have a difficult time going cold turkey.

To make matters more interesting, we have a looming debt ceiling problem that needs to be resolved by the end of February. Not to resolve this issue means the United States would run out of money which would start the market talking about a potential sovereign debt default.

The fundamentals that effect the markets can sometimes be overwhelming and complex, but they are never boring.

4 - Market Perception

Perception is a large unknown and extremely powerful in the marketplace. Perception can and does change the direction of markets. Markets that were once loved by investors, can be scorned a few weeks later, and this is particularly true with momentum stocks. While perception is not as clear-cut as the technicals, it is an important element and should not be overlooked.

Coming into 2014 from one of the market's best performances in history, the feeling was totally different. Nothing much had changed technically or fundamentally except perception in investors' minds. Perception is a very fickle animal and can change quickly like the weather.

Another example of this phenomenon was the recent non-Farm payroll report that was announced on February 7th. By all accounts it was a dismal fundamental number, yet the S&P 500 was up 1.3% for the day. Once again, perception trumped the fundamentals.

2014 And Beyond

As we are barely into 2014, it's turning out to be an interesting year to say the least. Fundamentals, technicals, economic cycles and perception for the S&P 500 seem to suggest that 2014 will be a rough year. These four factors should be evaluated and re-evaluted throughout the year to ensure you are on the right side of the 2014 move.

I am confident in saying that no matter which direction the market takes in 2014, traders who are diligent and do their homework will do extremely well.

Best wishes and happy trading,

Adam Hewison

President, INO.com

Co-Creator, MarketClub