Analysis originally distributed on April 19, 2018 By: Michael Vodicka of Cannabis Stock Trades

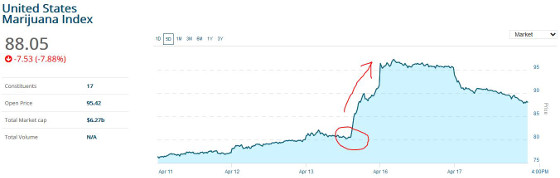

US cannabis stocks just had their best day of the year after a game-changing shift in US cannabis policy hit the Street. If I’m correct, the stage is now set for a huge rally that could send cannabis stocks deep into a new all-time high.

On April 13, the US cannabis index jumped more than 15%, the largest one-day gain of the year, on news of a huge shift in US cannabis policy.

In news that completely shocked the cannabis industry and stocks, President Trump promised to support legislation to protect state cannabis rights.

Here’s a clip from a Bloomberg article with more details: Continue reading "Game-Changing Reversal In US Cannabis Policy"